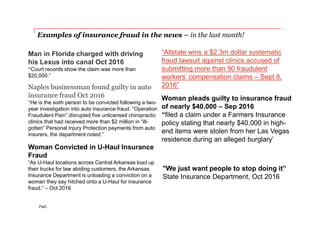

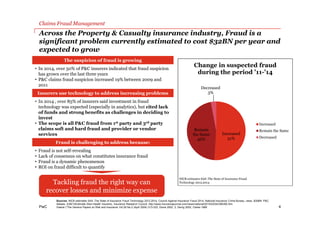

1. The presentation discusses insurance fraud management and how companies can improve their fraud detection approaches. It provides examples of insurance fraud cases and statistics on the growing costs of fraud.

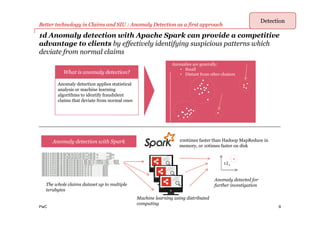

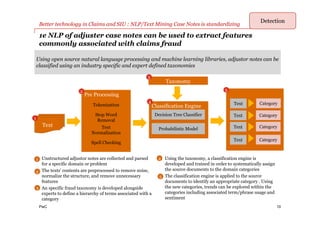

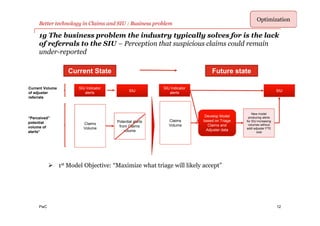

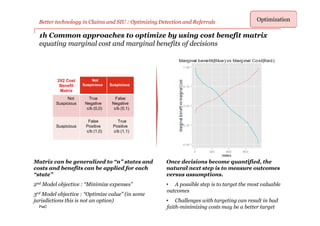

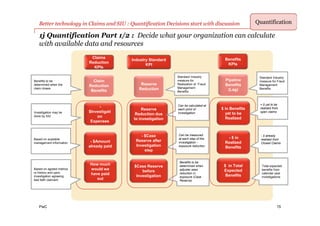

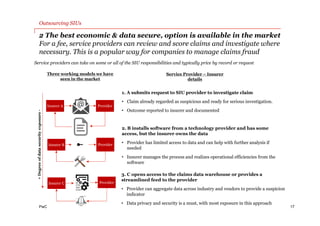

2. It outlines how companies currently manage fraud through special investigations units (SIUs) but notes challenges with justifying the costs. The presentation proposes three opportunities to create greater value: improving claims and SIU technology, outsourcing SIUs, and developing new analytical approaches.

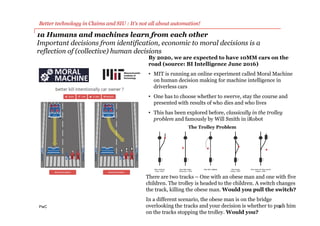

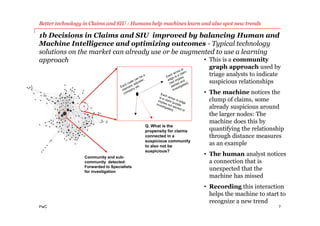

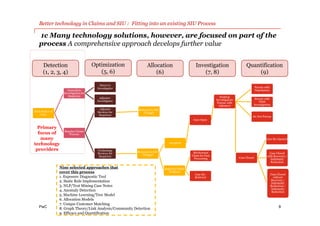

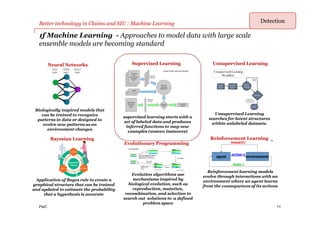

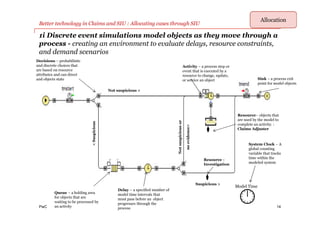

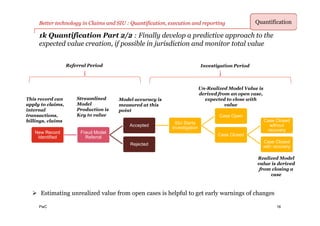

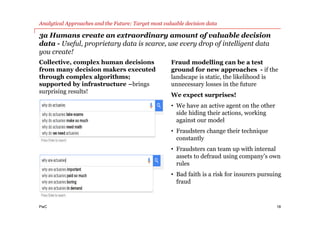

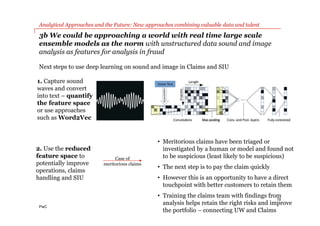

3. It demonstrates how machine learning and other advanced analytics can be used in various stages of the fraud management process from detection to investigation to quantification. Combining human and machine intelligence through continuous learning is presented as a way to improve fraud management outcomes.