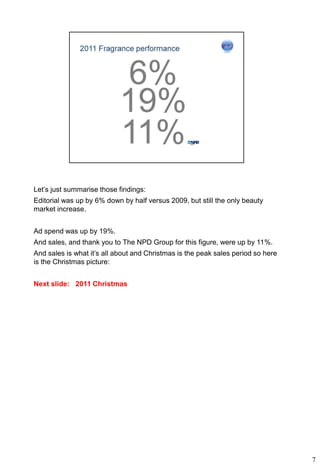

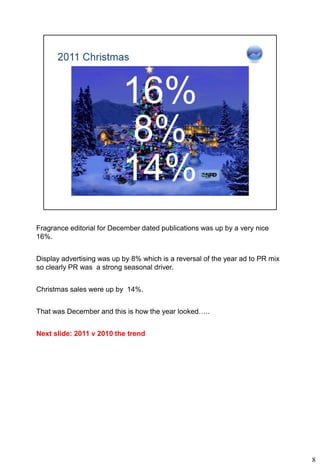

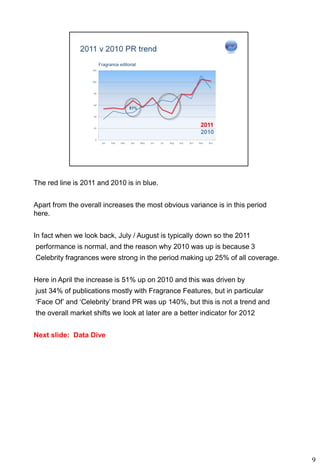

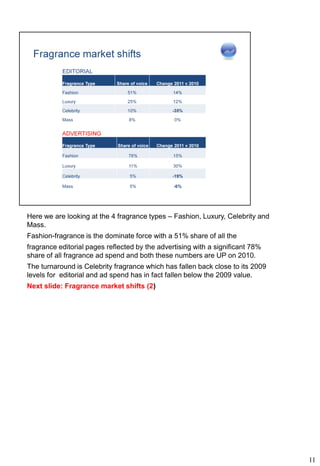

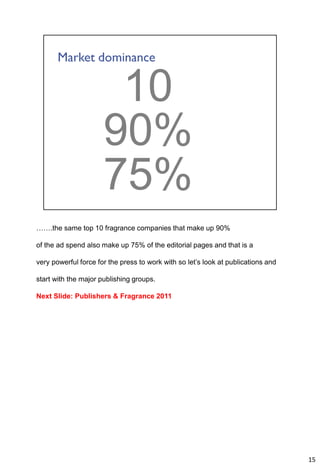

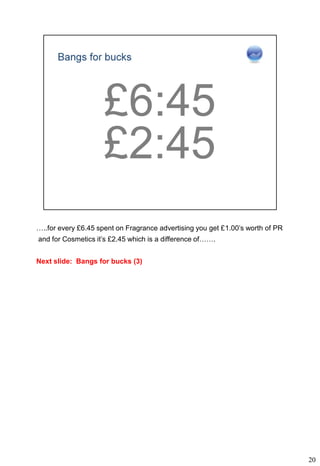

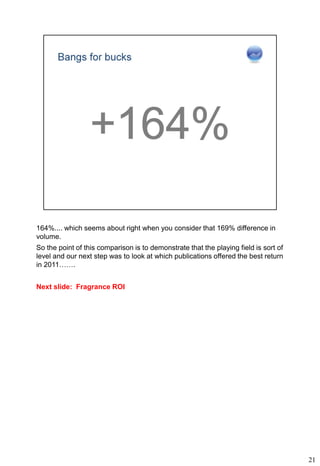

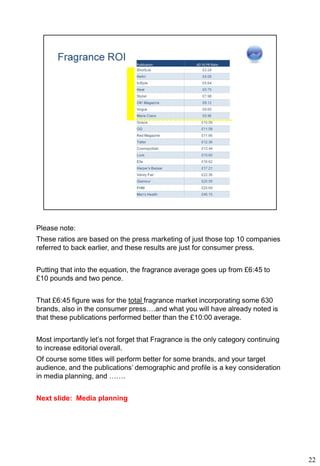

The document summarizes key findings about the fragrance industry's marketing in print media from 2011 to 2012. It found that fragrance advertising spend increased 18% in 2011 and editorial coverage was up 6%, making fragrance the only beauty category to increase editorial. At Christmas time specifically, fragrance editorial was up 16%, display advertising up 8%, and sales up 14%. Overall, the data indicates fashion and luxury fragrance brands performed well while celebrity brands declined. Most publishers saw changes in fragrance coverage, with Hearst experiencing a large editorial decrease. The analysis suggests allocating a small portion of ad budgets to improve public relations ratios and continue 2011's marketing successes in 2012.