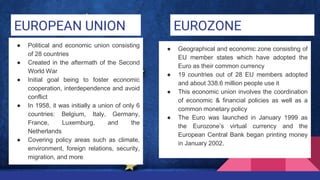

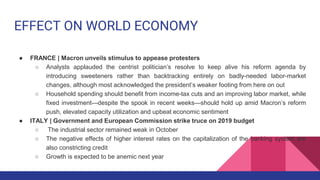

The document provides an overview of the formation and history of the eurozone, including key dates and events. It describes the criteria for countries to adopt the euro as their currency. The eurozone currently consists of 19 EU member states that have adopted the euro. The euro was launched in 1999 and the European Central Bank began printing money in 2002. The eurozone has expanded over time as additional countries adopted the euro. The eurozone economy has slowed in recent quarters but growth is still expected in 2019, albeit at a more moderate pace than in 2018.