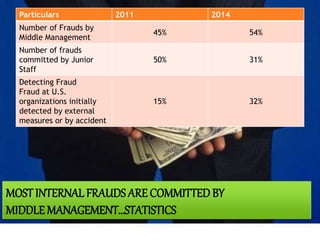

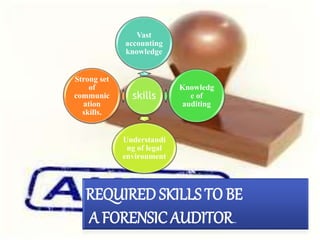

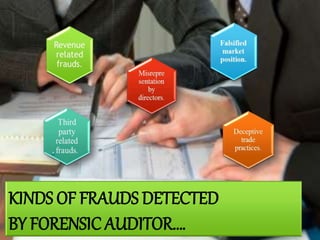

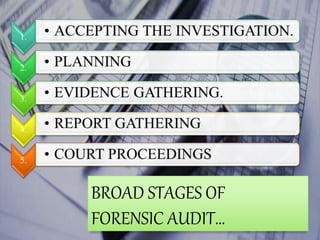

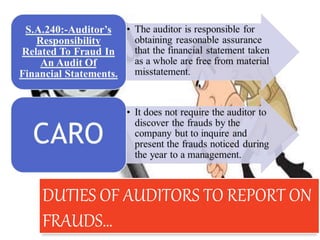

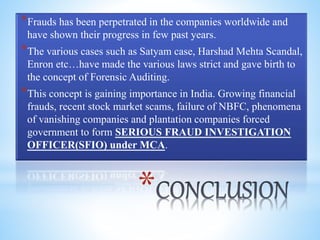

The document discusses corporate fraud and the rise of forensic audits in India. It notes that fraud, including cyber fraud, is a major concern for companies and regulators. Forensic audits involve comprehensive investigations using accounting and investigative techniques to establish the accuracy of transactions and detect any fraud. Forensic auditors need skills like accounting knowledge, auditing experience, and strong communication. Common frauds detected include asset misappropriation and financial statement fraud. Forensic audit techniques include benchmarking, ratio analysis, and system analysis. Auditors have duties to report any detected fraud. Forensic auditing is gaining importance in India due to several corporate scams.