Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) distributions under the Non-habitual tax resident (NHR) regime - 09.12.2021

•

0 likes•685 views

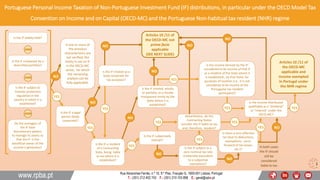

The Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) distributions, in particular under the OECD Model Tax Convention on Income and on Capital (OECD-MC) and the Portuguese Non-habitual tax resident (NHR) regime, is a complex topic, namely due to the diversity of legal and tax status among IFs. RPBA’s Infographic provides a step-by-step questionnaire for an accurate and full analysis of the matter.

Report

Share

Report

Share

Download to read offline

Recommended

NHR case-studies Infographics 31.10.2019

NHR case-studies Infographics 31.10.2019Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese non-habitual tax resident regime is granted to individuals who become resident for tax purposes in Portugal. This regime may grant an exemption on certain foreign source income as well as a 20% tax rate on employment and self-employment income deriving from high value added activities during 10 years. It targets non-resident individuals who are likely to establish residence in Portugal. View a few standard case studies on this RPBA’s infographic.RPBA Newsletter: Cross Border Succession - Updated: 21.09.2018

RPBA Newsletter: Cross Border Succession - Updated: 21.09.2018Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

In the last few challenging months we have received inquiries or demands relating to Clients concerned with their succession planning.

Please note that wills are considered an important and urgent act that Portuguese notaries, according to our experience, are still performing in spite of all Covid 19 restriction measures.

We would like to highlight the key topics on this subject:

Tax

- Inheritance and gifts are subject to Stamp Tax in Portugal. However, inheritance and gifts between close family (spouses, living partners, children, grandchildren, parents and grandparents) are exempt and assets outside Portugal are not even territoriality liable to Stamp Tax. Only in the case of gifts of Portuguese real estate between close family is there a 0,8% tax on its taxable value. Even when tax is due on the Portuguese assets (between siblings, cousins, uncle and nephew, etc.) it is so at a low rate – 10% in the case of an inheritance / 10% plus 0,8% in the case of a gift of Portuguese real estate is concerned.

Legal

- By default Portuguese inheritance law applies to Portuguese residents, irrespective of the place where they decease. However, it is possible to voluntarily opt-out from this rule and choose the law of ones’ nationality to govern one’s succession.

RPBA’s Information Note below may be of interest to you concerning the choice of law governing succession in case of death. It provides you a quick overview of the applicable rules as well as your options as a resident of Portugal. Although this is not a tax issue there may be tax implications of the law chosen to govern your succession. For instance, in a case where a person that has recently left his State of nationality and became a Portuguese resident dies, choosing the law of his/her nationality to govern his/her succession may be an indication of subjective attachment to that prior State, which may be viewed as relevant for inheritance tax purposes in some jurisdictions.

We have the know-how to assist and support our private clients on this matter. Partition of assets during one’s lifetime, wills, life insurance with or without death coverage, family foundations and trusts are the main instruments that can be used.

In case you would like to discuss the details of your specific specific situation please contact your usual RPBA lawyer or: ana.isabel@rpba.ptRPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Real estate, as an immovable factor, tends to be overtaxed in most countries and Portugal is no exception. Tax structuring and optimizing is crucial to minimize total acquisition costs and maximize investment returns.

RPBA’s updated presentation deals with this challenging topic incorporating the latest developments, including tax incentives on rehabilitation, the OECD Multilateral Instrument rules on “real estate rich” companies and also the brand new SIGI company (the Portuguese equivalent of the REIT – Real Estate Investment Trust).RPBA Infographic: NHR case-studies - Updated: 09.11.2022

RPBA Infographic: NHR case-studies - Updated: 09.11.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese non-habitual tax resident (NHR) regime is granted to individuals who become resident for tax purposes in Portugal. This regime may grant an exemption on certain foreign source income as well as a 20% tax rate on employment and self-employment income deriving from high value-added activities during 10 years. Entrants into the NHR regime that became Portuguese tax residents after April 1st 2020 are subject to a flat tax rate of 10% on foreign-sourced pensions (instead of the previous exemption), as well as on other payments, such as pre-retirement benefits and "lump-sum" payments from pension funds and similar retirement schemes. It targets non-resident individuals who are likely to establish residence in Portugal. View a few standard case studies on this RPBA’s infographic.RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...

RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese tax regime for non-habitual residents is motivating high net worth individuals, pensioners and high value added professionals to relocate to Portugal, either on a permanent or on a temporary and expatriate basis. The regime is granted to individuals who become resident for tax purposes in Portugal without having been so in the five preceding years. Non-habitual resident individuals may enjoy such status for a ten-year period, after which they will be taxed under the standard regime. This regime may grant an exemption or reduced rate on foreign source income as well as a limited taxation on Portuguese domestic source income deriving from high value added activities. Our presentation does not contemplate changes envisaged by the proposed Budget Law for 2023 (an update will be made when such Law is approved).RPBA - Frequently Asked Questions & Reasons to Move to Portugal - Updated: 11...

RPBA - Frequently Asked Questions & Reasons to Move to Portugal - Updated: 11...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

There are a few things you should know If you are considering moving to Portugal.

This updated presentation answers the most frequently asked questions on the Portuguese Non-Habitual Tax Resident regime. Our presentation does not contemplate changes envisaged by the proposed Budget Law for 2023 (an update will be made when such Law is approved).

RPBA - O Regime Fiscal dos Residentes Não Habituais - Um guia detalhado sobre...

RPBA - O Regime Fiscal dos Residentes Não Habituais - Um guia detalhado sobre...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

O regime fiscal português para residentes não habituais está a motivar indivíduos com significativo património líquido, pensionistas e profissionais de elevado valor acrescentado a mudarem-se para Portugal, de forma permanente ou temporária, como expatriados. O regime é concedido a pessoas que se tornam residentes para efeitos fiscais em Portugal, sem o terem sido nos cinco anos anteriores. Os residentes não habituais podem usufruir desse estatuto por um período de dez anos, após o qual serão tributados pelo regime regra. Este regime permite isentar ou tributar a uma taxa reduzida o rendimento de fonte estrangeira, bem como tributar de forma limitada o rendimento de fonte portuguesa decorrente de actividades de elevado valor acrescentado. A RPBA possui um profundo conhecimento e experiência sobre este regime.RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese tax regime for non-habitual residents (NHR) is motivating high net worth individuals, pensioners and high value added professionals like digital nomads to relocate to Portugal, either on a permanent or on a temporary and expatriate basis. The regime is granted to individuals who become resident for tax purposes in Portugal without having been so in the five years preceding its acquisition. Non-habitual resident individuals may enjoy such status for a ten-year period, after which they will be taxed under the standard regime. This regime may grant an exemption on foreign source income as well as a limited taxation on Portuguese domestic source income deriving from high value added activities. Entrants into the NHR regime that became Portuguese tax residents after April 1st 2020 are subject to a flat tax rate of 10% on foreign-sourced pensions (instead of the previous exemption), as well as on other payments, such as pre-retirement benefits and "lump-sum" payments from pension funds and similar retirement schemes. With effect as from January 1st, 2022, Sweden - following the precedent of Finland - terminated its tax treaty with Portugal. RPBA has revised, updated and developed its newsletter, explaining this regime in great detail.Recommended

NHR case-studies Infographics 31.10.2019

NHR case-studies Infographics 31.10.2019Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese non-habitual tax resident regime is granted to individuals who become resident for tax purposes in Portugal. This regime may grant an exemption on certain foreign source income as well as a 20% tax rate on employment and self-employment income deriving from high value added activities during 10 years. It targets non-resident individuals who are likely to establish residence in Portugal. View a few standard case studies on this RPBA’s infographic.RPBA Newsletter: Cross Border Succession - Updated: 21.09.2018

RPBA Newsletter: Cross Border Succession - Updated: 21.09.2018Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

In the last few challenging months we have received inquiries or demands relating to Clients concerned with their succession planning.

Please note that wills are considered an important and urgent act that Portuguese notaries, according to our experience, are still performing in spite of all Covid 19 restriction measures.

We would like to highlight the key topics on this subject:

Tax

- Inheritance and gifts are subject to Stamp Tax in Portugal. However, inheritance and gifts between close family (spouses, living partners, children, grandchildren, parents and grandparents) are exempt and assets outside Portugal are not even territoriality liable to Stamp Tax. Only in the case of gifts of Portuguese real estate between close family is there a 0,8% tax on its taxable value. Even when tax is due on the Portuguese assets (between siblings, cousins, uncle and nephew, etc.) it is so at a low rate – 10% in the case of an inheritance / 10% plus 0,8% in the case of a gift of Portuguese real estate is concerned.

Legal

- By default Portuguese inheritance law applies to Portuguese residents, irrespective of the place where they decease. However, it is possible to voluntarily opt-out from this rule and choose the law of ones’ nationality to govern one’s succession.

RPBA’s Information Note below may be of interest to you concerning the choice of law governing succession in case of death. It provides you a quick overview of the applicable rules as well as your options as a resident of Portugal. Although this is not a tax issue there may be tax implications of the law chosen to govern your succession. For instance, in a case where a person that has recently left his State of nationality and became a Portuguese resident dies, choosing the law of his/her nationality to govern his/her succession may be an indication of subjective attachment to that prior State, which may be viewed as relevant for inheritance tax purposes in some jurisdictions.

We have the know-how to assist and support our private clients on this matter. Partition of assets during one’s lifetime, wills, life insurance with or without death coverage, family foundations and trusts are the main instruments that can be used.

In case you would like to discuss the details of your specific specific situation please contact your usual RPBA lawyer or: ana.isabel@rpba.ptRPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Real estate, as an immovable factor, tends to be overtaxed in most countries and Portugal is no exception. Tax structuring and optimizing is crucial to minimize total acquisition costs and maximize investment returns.

RPBA’s updated presentation deals with this challenging topic incorporating the latest developments, including tax incentives on rehabilitation, the OECD Multilateral Instrument rules on “real estate rich” companies and also the brand new SIGI company (the Portuguese equivalent of the REIT – Real Estate Investment Trust).RPBA Infographic: NHR case-studies - Updated: 09.11.2022

RPBA Infographic: NHR case-studies - Updated: 09.11.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese non-habitual tax resident (NHR) regime is granted to individuals who become resident for tax purposes in Portugal. This regime may grant an exemption on certain foreign source income as well as a 20% tax rate on employment and self-employment income deriving from high value-added activities during 10 years. Entrants into the NHR regime that became Portuguese tax residents after April 1st 2020 are subject to a flat tax rate of 10% on foreign-sourced pensions (instead of the previous exemption), as well as on other payments, such as pre-retirement benefits and "lump-sum" payments from pension funds and similar retirement schemes. It targets non-resident individuals who are likely to establish residence in Portugal. View a few standard case studies on this RPBA’s infographic.RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...

RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese tax regime for non-habitual residents is motivating high net worth individuals, pensioners and high value added professionals to relocate to Portugal, either on a permanent or on a temporary and expatriate basis. The regime is granted to individuals who become resident for tax purposes in Portugal without having been so in the five preceding years. Non-habitual resident individuals may enjoy such status for a ten-year period, after which they will be taxed under the standard regime. This regime may grant an exemption or reduced rate on foreign source income as well as a limited taxation on Portuguese domestic source income deriving from high value added activities. Our presentation does not contemplate changes envisaged by the proposed Budget Law for 2023 (an update will be made when such Law is approved).RPBA - Frequently Asked Questions & Reasons to Move to Portugal - Updated: 11...

RPBA - Frequently Asked Questions & Reasons to Move to Portugal - Updated: 11...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

There are a few things you should know If you are considering moving to Portugal.

This updated presentation answers the most frequently asked questions on the Portuguese Non-Habitual Tax Resident regime. Our presentation does not contemplate changes envisaged by the proposed Budget Law for 2023 (an update will be made when such Law is approved).

RPBA - O Regime Fiscal dos Residentes Não Habituais - Um guia detalhado sobre...

RPBA - O Regime Fiscal dos Residentes Não Habituais - Um guia detalhado sobre...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

O regime fiscal português para residentes não habituais está a motivar indivíduos com significativo património líquido, pensionistas e profissionais de elevado valor acrescentado a mudarem-se para Portugal, de forma permanente ou temporária, como expatriados. O regime é concedido a pessoas que se tornam residentes para efeitos fiscais em Portugal, sem o terem sido nos cinco anos anteriores. Os residentes não habituais podem usufruir desse estatuto por um período de dez anos, após o qual serão tributados pelo regime regra. Este regime permite isentar ou tributar a uma taxa reduzida o rendimento de fonte estrangeira, bem como tributar de forma limitada o rendimento de fonte portuguesa decorrente de actividades de elevado valor acrescentado. A RPBA possui um profundo conhecimento e experiência sobre este regime.RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...

RPBA Newsletter - The Portuguese Non-Habitual Tax Resident Regime - Updated: ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese tax regime for non-habitual residents (NHR) is motivating high net worth individuals, pensioners and high value added professionals like digital nomads to relocate to Portugal, either on a permanent or on a temporary and expatriate basis. The regime is granted to individuals who become resident for tax purposes in Portugal without having been so in the five years preceding its acquisition. Non-habitual resident individuals may enjoy such status for a ten-year period, after which they will be taxed under the standard regime. This regime may grant an exemption on foreign source income as well as a limited taxation on Portuguese domestic source income deriving from high value added activities. Entrants into the NHR regime that became Portuguese tax residents after April 1st 2020 are subject to a flat tax rate of 10% on foreign-sourced pensions (instead of the previous exemption), as well as on other payments, such as pre-retirement benefits and "lump-sum" payments from pension funds and similar retirement schemes. With effect as from January 1st, 2022, Sweden - following the precedent of Finland - terminated its tax treaty with Portugal. RPBA has revised, updated and developed its newsletter, explaining this regime in great detail.RPBA Presentation - Madeira Free Zone - Updated: 18.10.2022

RPBA Presentation - Madeira Free Zone - Updated: 18.10.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The interaction between the extensive Portuguese Corporate Income Tax Reform of 2014 with the regime of the International Business Center of Madeira or Madeira Free Zone provides many interesting tax planning opportunities, namely an effective general Corporate Income Tax rate of 5% or a specific effective rate of 0,75% for certain Intellectual Property income. RPBA has fully updated its extensive presentation on this subject.RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021

RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese Golden Visa is a special residence permit for investors which enables non-EU individuals to become resident in Portugal and move freely within the Schengen Zone. Please take a look at RPBA's detailed and updated presentation.Multilateral instrument (mli) treaty abuse [articles 6-11]![Multilateral instrument (mli) treaty abuse [articles 6-11]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Multilateral instrument (mli) treaty abuse [articles 6-11]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

The Multilateral Instrument (MLI) is the latest development in International taxation which would modify the existing bilateral treaties (DTAAs) and implement measures to prevent Base Erosion Profit Shifting (BEPS) strategies. In this Webinar we shall analyse the provisions of Part III of the MLI relating to 'Treaty Abuse'. Articles 6 to 11 are covered under this Part and provide important concepts like Principle Purpose Test (PPT), Limitation on Benefits (LOB) and anti-abuse measures addressing 'Triangular PE' and other treaty-related measures.

Pajak Berganda dalam Pajak Internasional

Ini adalah sebuah resume dari buku International Tax Policy And Double Tax Treaties oleh Kevin Holmes. I do not own the copyrights, it's only for educational purposes.

DTAA - Double Taxation Avoidance Agreement

Double taxation avoidance agreement a general understanding about double taxation and tax procedures with different concept.

Brexit & its consequences

In this presentation the economy, finance and European polities data is available.

Making Products from CO2 and Olivine (accelerated weathering)

A lecture held at the Dutch CCS Symposium.

Subject: Using accelerated weathering for producing valuable materials from CO2 and Olivine

Transforming population and migration statistics: International student emplo...

Transforming population and migration statistics: International student emplo...Office for National Statistics

This case study aims to build on research into international student migration, specifically to understand the activity and impact they have during their stay. The slides summarise what research is already published on the activity of international students. It illustrates what exploratory research, using linked administrative data sources, can tell us about the interactions international students have with the HMRC PAYE system. The findings from this case study provide important insights which are key to the successful development of a population and migration statistics system based on administrative data sources.Brexit

With Britons voting to take their country out of the European Union will reduce the politico-economic bloc to 27 members from 28. No corner of the global financial structure will remain unscathed. Market horses like currencies, commodities and equities are the first to find their courses altered, even as economic jockeys riding them - monetary policies, bank rates and macro-economic markers - will find it hard to adapt to the altered course.

Tax Havens: Heaven to Evade Taxes

The Presentation was focussed on the use of low or nil tax jurisdictions typically known to be as Tax Havens by Big Corporate to meticulously route their revenue and using instruments like Double Dutch Sandwich to evade taxes.

Il Piano Nazionale di Ripresa e Resilienza

Il Piano Nazionale di Ripresa e Resilienza,

che cos'è e quali sono gli obiettivi!

Double taxation

double taxation , double taxation relief , types of DTAAs , Methods of Relief , some practical issues , conclusion.

RPBA Infographic: International Tax Transparency (Controlled Foreign Entities...

RPBA Infographic: International Tax Transparency (Controlled Foreign Entities...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese rules on international tax transparency (usually known as CFC rules, the abbreviation for Controlled Foreign Companies) are complex.

RPBA has prepared an infographic to help understand this subject and conclude on the transparent or opaque nature of non-Portuguese resident entities, with consequences at the level of the Portuguese Corporate Income Tax (“IRC”) or Personal Income Tax (“IRS”).More Related Content

What's hot

RPBA Presentation - Madeira Free Zone - Updated: 18.10.2022

RPBA Presentation - Madeira Free Zone - Updated: 18.10.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The interaction between the extensive Portuguese Corporate Income Tax Reform of 2014 with the regime of the International Business Center of Madeira or Madeira Free Zone provides many interesting tax planning opportunities, namely an effective general Corporate Income Tax rate of 5% or a specific effective rate of 0,75% for certain Intellectual Property income. RPBA has fully updated its extensive presentation on this subject.RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021

RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese Golden Visa is a special residence permit for investors which enables non-EU individuals to become resident in Portugal and move freely within the Schengen Zone. Please take a look at RPBA's detailed and updated presentation.Multilateral instrument (mli) treaty abuse [articles 6-11]![Multilateral instrument (mli) treaty abuse [articles 6-11]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Multilateral instrument (mli) treaty abuse [articles 6-11]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

The Multilateral Instrument (MLI) is the latest development in International taxation which would modify the existing bilateral treaties (DTAAs) and implement measures to prevent Base Erosion Profit Shifting (BEPS) strategies. In this Webinar we shall analyse the provisions of Part III of the MLI relating to 'Treaty Abuse'. Articles 6 to 11 are covered under this Part and provide important concepts like Principle Purpose Test (PPT), Limitation on Benefits (LOB) and anti-abuse measures addressing 'Triangular PE' and other treaty-related measures.

Pajak Berganda dalam Pajak Internasional

Ini adalah sebuah resume dari buku International Tax Policy And Double Tax Treaties oleh Kevin Holmes. I do not own the copyrights, it's only for educational purposes.

DTAA - Double Taxation Avoidance Agreement

Double taxation avoidance agreement a general understanding about double taxation and tax procedures with different concept.

Brexit & its consequences

In this presentation the economy, finance and European polities data is available.

Making Products from CO2 and Olivine (accelerated weathering)

A lecture held at the Dutch CCS Symposium.

Subject: Using accelerated weathering for producing valuable materials from CO2 and Olivine

Transforming population and migration statistics: International student emplo...

Transforming population and migration statistics: International student emplo...Office for National Statistics

This case study aims to build on research into international student migration, specifically to understand the activity and impact they have during their stay. The slides summarise what research is already published on the activity of international students. It illustrates what exploratory research, using linked administrative data sources, can tell us about the interactions international students have with the HMRC PAYE system. The findings from this case study provide important insights which are key to the successful development of a population and migration statistics system based on administrative data sources.Brexit

With Britons voting to take their country out of the European Union will reduce the politico-economic bloc to 27 members from 28. No corner of the global financial structure will remain unscathed. Market horses like currencies, commodities and equities are the first to find their courses altered, even as economic jockeys riding them - monetary policies, bank rates and macro-economic markers - will find it hard to adapt to the altered course.

Tax Havens: Heaven to Evade Taxes

The Presentation was focussed on the use of low or nil tax jurisdictions typically known to be as Tax Havens by Big Corporate to meticulously route their revenue and using instruments like Double Dutch Sandwich to evade taxes.

Il Piano Nazionale di Ripresa e Resilienza

Il Piano Nazionale di Ripresa e Resilienza,

che cos'è e quali sono gli obiettivi!

Double taxation

double taxation , double taxation relief , types of DTAAs , Methods of Relief , some practical issues , conclusion.

What's hot (20)

RPBA Presentation - Madeira Free Zone - Updated: 18.10.2022

RPBA Presentation - Madeira Free Zone - Updated: 18.10.2022

RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021

RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021

Multilateral instrument (mli) treaty abuse [articles 6-11]![Multilateral instrument (mli) treaty abuse [articles 6-11]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Multilateral instrument (mli) treaty abuse [articles 6-11]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Multilateral instrument (mli) treaty abuse [articles 6-11]

VAT and Tax Govt. Treasury Deposit Code - Bangladesh

VAT and Tax Govt. Treasury Deposit Code - Bangladesh

Making Products from CO2 and Olivine (accelerated weathering)

Making Products from CO2 and Olivine (accelerated weathering)

Transforming population and migration statistics: International student emplo...

Transforming population and migration statistics: International student emplo...

Similar to Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) distributions under the Non-habitual tax resident (NHR) regime - 09.12.2021

RPBA Infographic: International Tax Transparency (Controlled Foreign Entities...

RPBA Infographic: International Tax Transparency (Controlled Foreign Entities...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese rules on international tax transparency (usually known as CFC rules, the abbreviation for Controlled Foreign Companies) are complex.

RPBA has prepared an infographic to help understand this subject and conclude on the transparent or opaque nature of non-Portuguese resident entities, with consequences at the level of the Portuguese Corporate Income Tax (“IRC”) or Personal Income Tax (“IRS”).Non habitual residents tax regime en 03.2017

Our Law Firm information on Non-Habitual Residents Portuguese Tax Regime

Portugal: Non Habitual Resident and Madeira Free Zone Regimes – Opportunities...

Portugal: Non Habitual Resident and Madeira Free Zone Regimes – Opportunities...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Non Habitual Resident (“NHR”) and Madeira Free Zone (“MFZ”) regimes offer ample opportunities for those who wish to live in Portugal or manage their investments through Portugal. This presentation is designed with Dutch clients in mind and exemplifies some of the many possibilities that the said regimes enable to conduct life or business in a tax efficient manner.

RPBA has in-depth knowledge and experience with both regimes and can advise you on the best solutions to take full advantage of them.

Please do not hesitate to contact us if you consider moving your personal residence to Portugal or taking advantage of the MFZ to structure your business.

Portuguese non habitual tax regime

Status of non-habitual tax resident both for EU/EEA non-residents who plan

on establishing permanent residency in Portugal, and for temporary residents.

Cost of Doing Business in the Philippines 2019

A brief summary of expenses and fees associated with investing in the Philippines. This brief covers various agencies, but is not limited to SEC, DTI, BIR, SSS, Pag-Ibig, DOLE, as well as living expenses for expatriates.

Impact of taxation on cross border investment

Consequent to the implemented economic liberalisation in India during the 1990s, substantial international investment activity began within the Indian capital markets and through corporate vehicles with an increasingly vibrant fervour. In fact, today, Foreign Institutional Investors (FIIs) play a crucial role in the liquidity, growth and vitality seen in Indian capital markets. Simultaneously, along with increasing FII activity, as a result of the favourable economic and political climate, India also witnessed an increasing quantum of Foreign Domestic Investment (FDI).

The regulation of these investment channels and instruments was at the front and centre of economic policy debate, a part of which revolves around taxation. There is undoubtedly a proximate and intelligible nexus between taxation and the employment of these investment tools. A taxation regime that is favourable can work in effectively attracting more international investment which in turn would enhance market liquidity, activity, and growth.1 While FIIs and FDIs may appear to be similar investment channels, for the most part, they serve entirely different objectives, and operate in substantially different manners and are subject to different regulatory regimes in terms of exchange, economic and taxation policy.

In the coming sections of this paper, the authors have attempted to analyse several aspects of FII and FDI taxation in India. The first section delineates the differences in FIIs and FDIs, their market strategy, modus operandi, and objectives, while ascertaining what exactly these investment channels imply and the various investment vehicles that may be employed by foreign actors.

The subsequent section of the paper outlines the tax regime applicable to such FDIs and FIIs, depending on the organisational scheme and objective of the business vehicle so employed for the investment.

Given that FIIs and FDIs essentially involve a foreign element, the question of double taxation is one which necessarily requires to be addressed. To that end, in the third section of this paper, the authors have looked at Double Taxation Avoidance Agreements (DTAAs) (Tax Treaties) in the context of FIIs and FDIs.

Doing Business / Investing in Portugal (A quick guide)

Created by: ESPANHA E ASSOCIADOS

Portugal is a unique European country to live or invest, evidencing, among other things, a pleasant all year climate, friendly people, passionate food, safety and a beautiful Atlantic coast-line with endless landscape views. Being part of EU since 1986, Portugal has seen significant growth since then, being now an indisputable modern western country, well-served in terms of network connections, business friendly laws, competitive and qualified professionals and, at the same time, a cost of living well below the EU average, which represents a clear advantage when you are thinking about investing or living abroad.

Special Tax Regime for non-habitual residents in Portugal

Portugal created a special regime for new residents (also applicable to Portuguese out bounds living abroad for many years) designed to promote the transfer of residence of skillful professionals, entrepreneurs and investors, by offering attractive tax opportunities at the individual level.

This summary provides a brief overview and explains the main guidelines and potential implications of this new regime for foreigners and for Portuguese individuals settling in Portugal after an extended period of living abroad.

Guide "Make a French Start" : The French tax system

Guide "Make a French Start" : The French tax system

Mazars and Business France combined their expertise to help foreign investors and entrepreneurs who want to settle in France. Mazars has created practical guides that we hope will provide you with valuable insight to launch and grow your business in France.

Guide for a successful establishment in Spain from China

Practical guide for all those Chinese companies that would like to establish in Spain:

•Major Corporate Structures.

•Example of a Process Type.

•Regulation regarding Subsidiaries.

•Main Taxes.

•Double Taxation.

•Workplace.

•Helps to attract investments.

•Residence in Spain.

•Other aspects to consider.

•Obtaining NIE (Foreigner Identity Number).

Controversy on the applicability of MAT to foreign companies and FIIs - K. R....

Controversy on the applicability of MAT to foreign companies and FIIs - K. R. Girish - Article published in Business Advisor, dated April 25, 2015 http://www.magzter.com/IN/Shrinikethan/Business-Advisor/Business/

International tax newsletter september 2017 - Kreston International

ADDITIONAL DUTCH COUNTRY–BY-COUNTRY REPORTING RULES (“CBCR”)

AND TRANSFER PRICING (“TP”) DOCUMENTATION - EFFECTIVE 5 JUNE 2017.

Similar to Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) distributions under the Non-habitual tax resident (NHR) regime - 09.12.2021 (20)

RPBA Infographic: International Tax Transparency (Controlled Foreign Entities...

RPBA Infographic: International Tax Transparency (Controlled Foreign Entities...

Overview of DTAA Provisions_WIRC_14.05.16 - Harshal Bhuta

Overview of DTAA Provisions_WIRC_14.05.16 - Harshal Bhuta

Portugal: Non Habitual Resident and Madeira Free Zone Regimes – Opportunities...

Portugal: Non Habitual Resident and Madeira Free Zone Regimes – Opportunities...

Doing Business / Investing in Portugal (A quick guide)

Doing Business / Investing in Portugal (A quick guide)

Special Tax Regime for non-habitual residents in Portugal

Special Tax Regime for non-habitual residents in Portugal

Guide "Make a French Start" : The French tax system

Guide "Make a French Start" : The French tax system

Guide for a successful establishment in Spain from China

Guide for a successful establishment in Spain from China

Controversy on the applicability of MAT to foreign companies and FIIs - K. R....

Controversy on the applicability of MAT to foreign companies and FIIs - K. R....

International tax newsletter september 2017 - Kreston International

International tax newsletter september 2017 - Kreston International

Recently uploaded

一比一原版麻省理工学院毕业证(MIT毕业证)成绩单如何办理

毕业原版【微信:41543339】【麻省理工学院毕业证(MIT毕业证)】【微信:41543339】成绩单、外壳、offer、留信学历认证(永久存档真实可查)采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【我们承诺采用的是学校原版纸张(纸质、底色、纹路),我们拥有全套进口原装设备,特殊工艺都是采用不同机器制作,仿真度基本可以达到100%,所有工艺效果都可提前给客户展示,不满意可以根据客户要求进行调整,直到满意为止!】

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信41543339】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信41543339】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

留信网服务项目:

1、留学生专业人才库服务(留信分析)

2、国(境)学习人员提供就业推荐信服务

3、留学人员区块链存储服务

→ 【关于价格问题(保证一手价格)】

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:客户在留信官方认证查询网站查询到认证通过结果后付款,不成功不收费!

WINDING UP of COMPANY, Modes of Dissolution

Winding up, also known as liquidation, refers to the legal and financial process of dissolving a company. It involves ceasing operations, selling assets, settling debts, and ultimately removing the company from the official business registry.

Here's a breakdown of the key aspects of winding up:

Reasons for Winding Up:

Insolvency: This is the most common reason, where the company cannot pay its debts. Creditors may initiate a compulsory winding up to recover their dues.

Voluntary Closure: The owners may decide to close the company due to reasons like reaching business goals, facing losses, or merging with another company.

Deadlock: If shareholders or directors cannot agree on how to run the company, a court may order a winding up.

Types of Winding Up:

Voluntary Winding Up: This is initiated by the company's shareholders through a resolution passed by a majority vote. There are two main types:

Members' Voluntary Winding Up: The company is solvent (has enough assets to pay off its debts) and shareholders will receive any remaining assets after debts are settled.

Creditors' Voluntary Winding Up: The company is insolvent and creditors will be prioritized in receiving payment from the sale of assets.

Compulsory Winding Up: This is initiated by a court order, typically at the request of creditors, government agencies, or even by the company itself if it's insolvent.

Process of Winding Up:

Appointment of Liquidator: A qualified professional is appointed to oversee the winding-up process. They are responsible for selling assets, paying off debts, and distributing any remaining funds.

Cease Trading: The company stops its regular business operations.

Notification of Creditors: Creditors are informed about the winding up and invited to submit their claims.

Sale of Assets: The company's assets are sold to generate cash to pay off creditors.

Payment of Debts: Creditors are paid according to a set order of priority, with secured creditors receiving payment before unsecured creditors.

Distribution to Shareholders: If there are any remaining funds after all debts are settled, they are distributed to shareholders according to their ownership stake.

Dissolution: Once all claims are settled and distributions made, the company is officially dissolved and removed from the business register.

Impact of Winding Up:

Employees: Employees will likely lose their jobs during the winding-up process.

Creditors: Creditors may not recover their debts in full, especially if the company is insolvent.

Shareholders: Shareholders may not receive any payout if the company's debts exceed its assets.

Winding up is a complex legal and financial process that can have significant consequences for all parties involved. It's important to seek professional legal and financial advice when considering winding up a company.

Secure Your Brand: File a Trademark Today

A "File Trademark" is a legal term referring to the registration of a unique symbol, logo, or name used to identify and distinguish products or services. This process provides legal protection, granting exclusive rights to the trademark owner, and helps prevent unauthorized use by competitors.

Visit Now: https://www.tumblr.com/trademark-quick/751620857551634432/ensure-legal-protection-file-your-trademark-with?source=share

How to Obtain Permanent Residency in the Netherlands

You can rely on our assistance if you are ready to apply for permanent residency. Find out more at: https://immigration-netherlands.com/obtain-a-permanent-residence-permit-in-the-netherlands/.

VAWA - Violence Against Women Act Presentation

VAWA - Violence Against Women Act

Basics & Eligibility

Responsibilities of the office bearers while registering multi-state cooperat...

Responsibilities of the office bearers while registering multi-state cooperat...Finlaw Consultancy Pvt Ltd

Introduction-

The process of register multi-state cooperative society in India is governed by the Multi-State Co-operative Societies Act, 2002. This process requires the office bearers to undertake several crucial responsibilities to ensure compliance with legal and regulatory frameworks. The key office bearers typically include the President, Secretary, and Treasurer, along with other elected members of the managing committee. Their responsibilities encompass administrative, legal, and financial duties essential for the successful registration and operation of the society. Rokita Releases Soccer Stadium Legal Opinion

Indiana Attorney General Todd Rokita is weighing in on the proposed MLS soccer stadium project.

XYZ-v.-state-of-Maharashtra-Bombay-HC-Writ-Petition-6340-2023.pdf

असंगत न्यायालयी फैसलों के कारण भारत में महिलाओं को सुरक्षित गर्भपात के लिए एक भ्रामक और अनुचित कानूनी लड़ाई का सामना करना पड़ रहा है।

办理(waikato毕业证书)新西兰怀卡托大学毕业证双学位证书原版一模一样

原版纸张【微信:741003700 】【(waikato毕业证书)新西兰怀卡托大学毕业证】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Military Commissions details LtCol Thomas Jasper as Detailed Defense Counsel

Military Commissions Trial Judiciary, Guantanamo Bay, Cuba. Notice of the Chief Defense Counsel's detailing of LtCol Thomas F. Jasper, Jr. USMC, as Detailed Defense Counsel for Abd Al Hadi Al-Iraqi on 6 August 2014 in the case of United States v. Hadi al Iraqi (10026)

ALL EYES ON RAFAH BUT WHY Explain more.pdf

All eyes on Rafah: But why?. The Rafah border crossing, a crucial point between Egypt and the Gaza Strip, often finds itself at the center of global attention. As we explore the significance of Rafah, we’ll uncover why all eyes are on Rafah and the complexities surrounding this pivotal region.

INTRODUCTION

What makes Rafah so significant that it captures global attention? The phrase ‘All eyes are on Rafah’ resonates not just with those in the region but with people worldwide who recognize its strategic, humanitarian, and political importance. In this guide, we will delve into the factors that make Rafah a focal point for international interest, examining its historical context, humanitarian challenges, and political dimensions.

定制(nus毕业证书)新加坡国立大学毕业证学位证书实拍图原版一模一样

原版纸张【微信:741003700 】【(nus毕业证书)新加坡国立大学毕业证学位证书】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

怎么购买(massey毕业证书)新西兰梅西大学毕业证学位证书注册证明信原版一模一样

原版纸张【微信:741003700 】【(massey毕业证书)新西兰梅西大学毕业证学位证书】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

The Reserve Bank of India Act, 1934.pptx

This presentation is regarding the reserve bank of india act

Recently uploaded (20)

How to Obtain Permanent Residency in the Netherlands

How to Obtain Permanent Residency in the Netherlands

Debt Mapping Camp bebas riba to know how much our debt

Debt Mapping Camp bebas riba to know how much our debt

Responsibilities of the office bearers while registering multi-state cooperat...

Responsibilities of the office bearers while registering multi-state cooperat...

ADR in criminal proceeding in Bangladesh with global perspective.

ADR in criminal proceeding in Bangladesh with global perspective.

XYZ-v.-state-of-Maharashtra-Bombay-HC-Writ-Petition-6340-2023.pdf

XYZ-v.-state-of-Maharashtra-Bombay-HC-Writ-Petition-6340-2023.pdf

Military Commissions details LtCol Thomas Jasper as Detailed Defense Counsel

Military Commissions details LtCol Thomas Jasper as Detailed Defense Counsel

Notes-on-Prescription-Obligations-and-Contracts.doc

Notes-on-Prescription-Obligations-and-Contracts.doc

Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) distributions under the Non-habitual tax resident (NHR) regime - 09.12.2021

- 1. Is the IF widely-held? Is the IF composed by a diversified portfolio? Is the IF subject to investor protection regulation in the country in which it is established? Do the managers of the IF have discretionary powers to manage its assets so that the IF is the beneficial owner of the income it generates? If one or more of the previous characteristics are not verified, the entity is not an IF in the OECD-MC sense, for which the remaining analysis can be fully applicable. NO YES NO YES YES NO Rua Abranches Ferrão, n.º 10, 9.º Piso, Fracção G, 1600-001 Lisboa, Portugal T.: (351) 212 402 743 F.: (351) 210 103 898 E.: geral@rpba.pt NO YES Is the IF a legal person (body corporate)? YES NO Is the IF treated as a body corporate for tax purposes? Is the IF treated, wholly or partially, as a fiscally transparent entity by the State where it is established? Is the IF subjectively exempt? Is the IF a resident of a Contracting State, being liable to tax where it is established? NO YES Nevertheless, do the Contracting States consider the IF liable to tax and, therefore, resident? Is there a zero-effective tax (due to deductions, exemptions, carry- forward of tax losses, etc.)? Is the income derived by the IF considered to be income of that IF as a resident of the State where it is established , by that State, for purposes of taxation (i.e., it is not considered to be income of the Portuguese tax resident participant)? NO Is the income distributed qualifiable as a “dividend” or “interest” under the OECD-MC? Is the IF subject to a zero nominal tax rate (materially equivalent to a subjective exemption)? YES NO NO YES In both cases the IF should still be considered liable to tax YES YES NO Articles 10 /11 of the OECD-MC applicable and income exempted in Portugal under the NHR regime YES Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) distributions, in particular under the OECD Model Tax Convention on Income and on Capital (OECD-MC) and the Portuguese Non-habitual tax resident (NHR) regime 1 AND AND Articles 10 /11 of the OECD-MC not prima facie applicable (SEE NEXT SLIDE) AND

- 2. Rua Abranches Ferrão, n.º 10, 9.º Piso, Fracção G, 1600-001 Lisboa, Portugal T.: (351) 212 402 743 F.: (351) 210 103 898 E.: geral@rpba.pt Articles 10 / 11 of the OECD-MC not prima facie applicable Given the structure through which the income is generated (e.g., a fixed place of business), can it still be considered as originating from the State where the IF is established (Source State)? Does the “Other income” provision of the real Double Taxation Convention (DTC) at stake follow article 21 of the OECD-MC? Does the “Other income” provision of the DTC allow the State where the IF is established (Source State) to tax this income, alongside the Residence State of the Portuguese tax resident participant? YES YES YES NO NO Income exempted in Portugal under the NHR regime Income taxable in Portugal at a 28% tax rate NO DISCLAIMER: This infographic is updated until December 9th, 2021. Although great care has been taken when drafting this infographic, Ricardo da Palma Borges & Associados (RPBA) - Sociedade de Advogados, S.P., R.L. does not accept any responsibility whatsoever for any consequences arising from the use of the information contained herein. Such information is provided solely for general purposes and cannot be regarded as legal or other advice. You are strongly recommended to take professional legal advice appropriate for your case before taking any decisions. 2 Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) distributions, in particular under the OECD Model Tax Convention on Income and on Capital (OECD-MC) and the Portuguese Non-habitual tax resident (NHR) regime