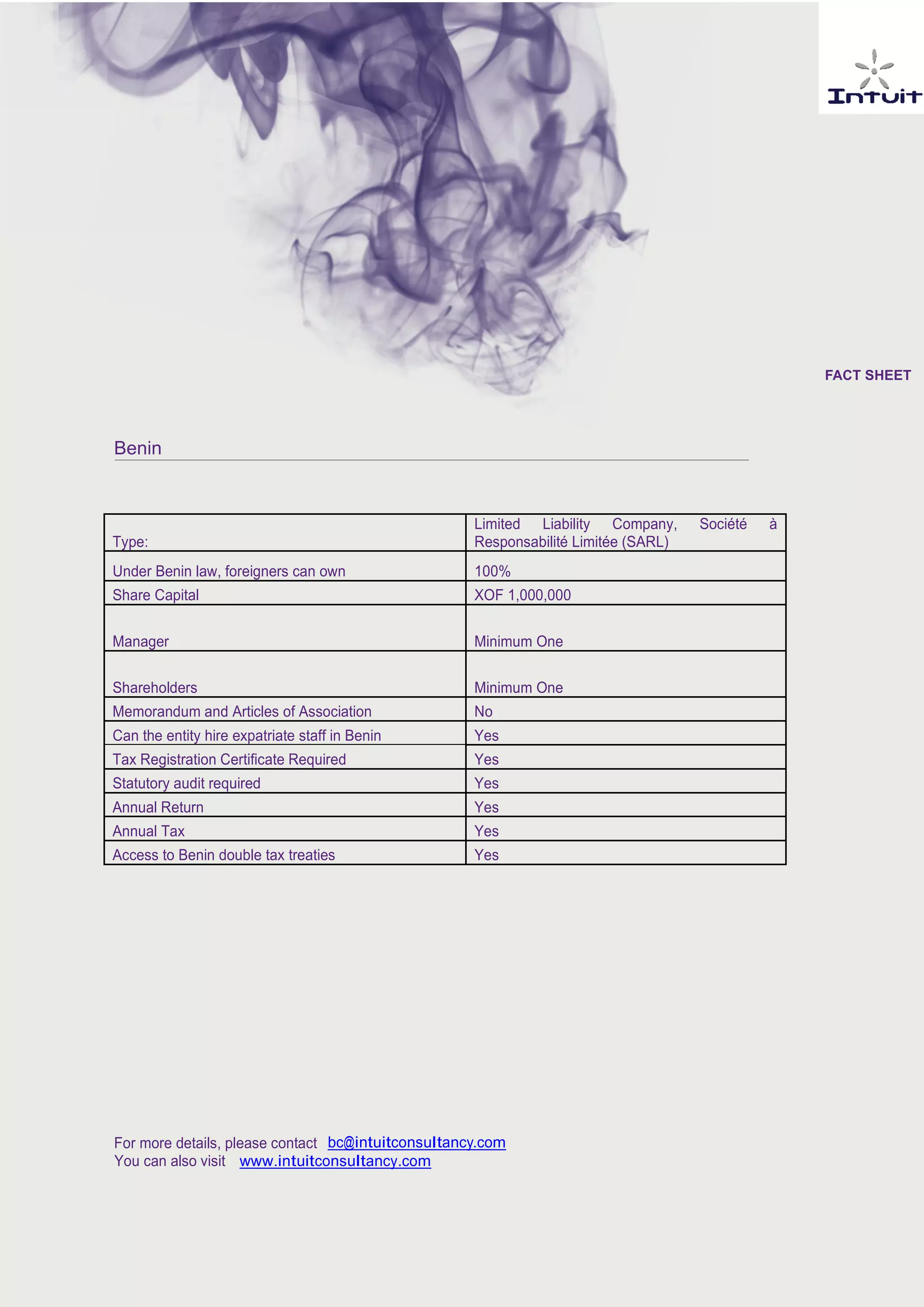

Benin is a country located in West Africa with its capital in Porto-Novo and seat of government in Cotonou. The Government of Benin encourages foreign investment through initiatives like the Presidential Investment Council established in 2006. There are free trade zones in Cotonou benefiting landlocked neighbors. To incorporate a company in Benin, an incorporation package must be presented to the Chamber of Commerce and Industry's Corporate Formalities Center including choosing a unique company name. The limited liability company, SARL, is a common structure where foreigners can own 100% and requires a minimum of one manager and shareholder with a share capital of 1,000,000 XOF.