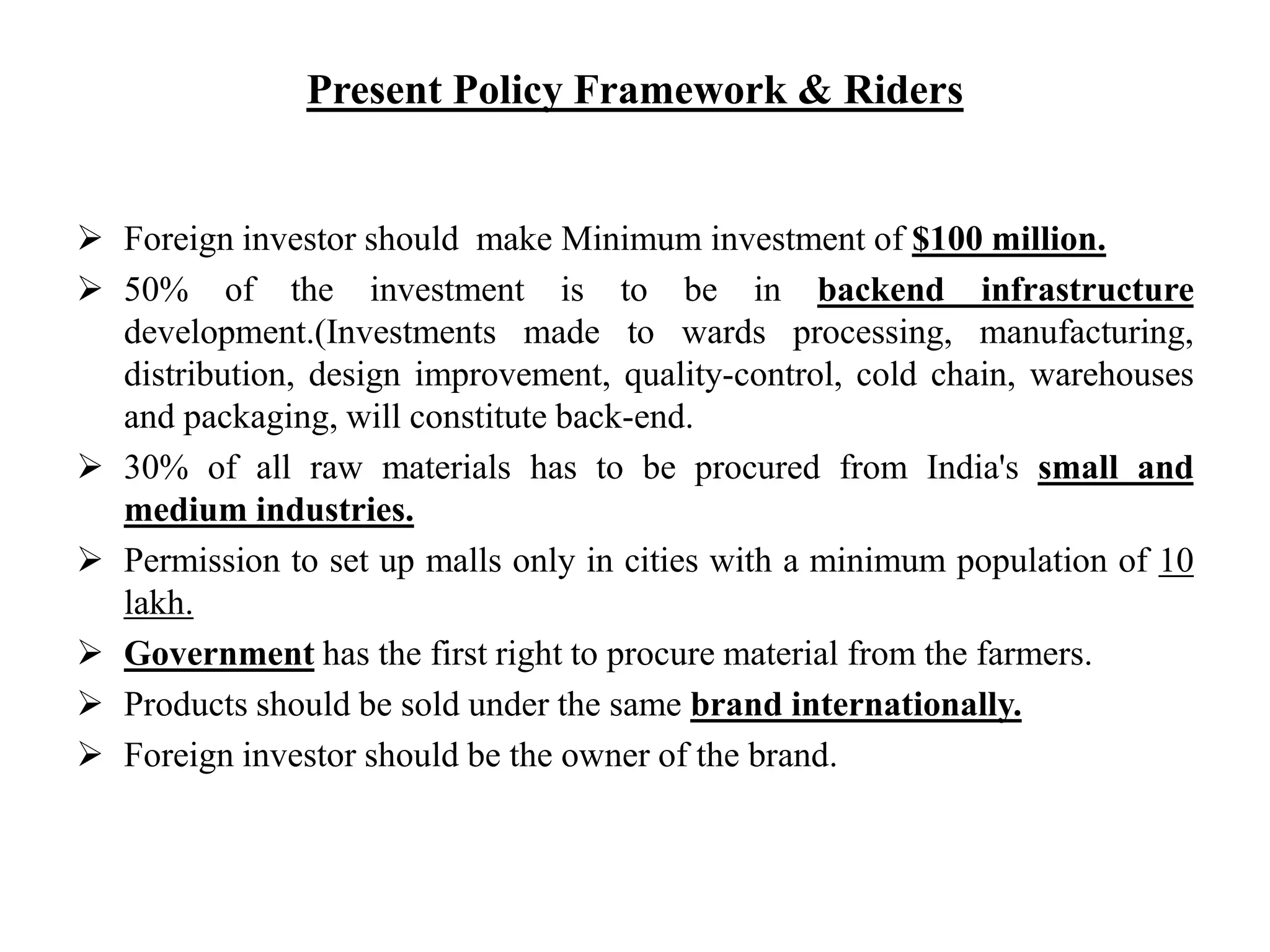

This document discusses foreign direct investment (FDI) in India, specifically in the retail sector. It begins by defining FDI and describing its structure and trends in India. It then analyzes the impact of allowing FDI in multi-brand retail, noting both threats such as increased consolidation and unemployment, as well as advantages like more competition, choice, and infrastructure development. It acknowledges valid concerns on both sides and concludes by arguing that operational efficiencies and customer benefits should ultimately matter most, and liberalization could fuel further economic growth, as seen in other sectors.