FoodDrinkEurope: Economic Bulletin Q4 2012

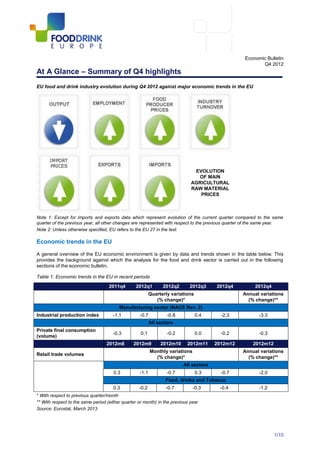

- 1. Economic Bulletin Q4 2012 At A Glance – Summary of Q4 highlights EU food and drink industry evolution during Q4 2012 against major economic trends in the EU EVOLUTION OF MAIN AGRICULTURAL RAW MATERIAL PRICES Note 1: Except for imports and exports data which represent evolution of the current quarter compared to the same quarter of the previous year, all other changes are represented with respect to the previous quarter of the same year. Note 2: Unless otherwise specified, EU refers to the EU 27 in the text. Economic trends in the EU A general overview of the EU economic environment is given by data and trends shown in the table below. This provides the background against which the analysis for the food and drink sector is carried out in the following sections of the economic bulletin. Table 1: Economic trends in the EU in recent periods 2011q4 2012q1 2012q2 2012q3 2012q4 2012q4 Quarterly variations Annual variations (% change)* (% change)** Manufacturing sector (NACE Rev. 2) Industrial production index -1.1 -0.7 -0.8 0.4 -2.3 -3.3 All sectors Private final consumption -0.3 0.1 -0.2 0.0 -0.2 -0.3 (volume) 2012m8 2012m9 2012m10 2012m11 2012m12 2012m12 Monthly variations Annual variations Retail trade volumes (% change)* (% change)** All sectors 0.3 -1.1 -0.7 0.3 -0.7 -2.0 Food, drinks and Tobacco 0.3 -0.2 -0.7 -0.3 -0.4 -1.2 * With respect to previous quarter/month ** With respect to the same period (either quarter or month) in the previous year Source: Eurostat, March 2013 1/10

- 2. The EU manufacturing industrial production index decreased (2.3%) in Q4 of 2012. In the same period, private consumption (volumes) registered a slight decrease compared to the previous quarter, i.e. -0.2%. The yearly comparison shows that the industrial production index decreased markedly in Q4 of 2012 compared to the same quarter of the previous year, i.e. by -3.3%. Private consumption also decreased compared to the change registered in the same quarter of 2011, but to a far lesser extent, i.e. -0.3%. The (all sectors) volume of retail trade decreased by 0.7% in December (compared to November 2012), while retail trade in food, drinks and tobacco decreased by 0.4%. Among the Member States for which data are available, total retail trade fell in twelve, rose in eight and remained stable in Finland. The largest decreases were registered in Romania (-3.2%), Spain (-2.2%) and Slovenia (-2.1%), and the highest increases in Luxembourg 1 and Poland (both +2.2%) and Estonia (+1.9%). FOOD AND DRINK INDUSTRY INDICATORS IN Q4 OF 2012 1. Food and drink industry output index decreased Food and drink industry output (production) in the EU fell by 0.36% in Q4 of 2012 compared to the previous quarter. This is in line with the negative trend experienced by the manufacturing production index in the same period (see the above section: Economic trends in the EU). Q4 of 2012 represented a quarter of mixed performances in terms of production at the Member State level. Austria (+1.36%), Czech Republic (+0.49%) and Sweden (+0.20%) reached positive production index growth rates, whereas Bulgaria (-2.84%), Spain (-1.35%) and Finland (-0.75%) remained on their negative trend of the previous quarter. The best performers whose production index growth rates even exceeded the positive growth rates of the previous quarter include Ireland (+7.31%), Estonia (+1.41%) and Germany (+0.72%). Table 2: Industry production index, quarterly growth 2012 Q3/2012 Q2 2012 Q4/2012 Q3 Member State (% change) (% change) EU27 0.52 -0.36 Austria -0.16 1.36 Belgium 1.36 0.42 Bulgaria -1.62 -2.84 Czech Republic -0.37 0.49 Denmark 2.60 -1.07 Estonia 0.96 1.41 Finland -1.47 -0.75 Germany 0.05 0.72 Greece 0.21 -3.20 Hungary 0.58 -3.27 Ireland 1.23 7.31 Italy 1.27 -2.31 Latvia 1.65 -1.63 Lithuania 4.11 0.30 Netherlands 0.32 -0.03 Poland 1.44 0.90 Portugal 1.88 0.18 Spain -0.74 -1.35 Sweden -2.47 0.20 United Kingdom 0.34 -2.95 Source: Eurostat, Short-Term Business Statistics, NACE Rev. 2, March 2013 1 Eurostat news release, Euro indicators, 21/2013. 2/10

- 3. 2. Evolution of main agricultural raw material prices The following shows a mixed picture for raw material prices: Oils and oil crops Grains Dairy Soybean Rape Cocoa Coffee Sugar Corn/ Soft WMP SMP Oil Bean Meal Seed Oil Palm Maize wheat oil Source: FoodDrinkEurope compilation Cocoa and coffee Quarterly developments: After having experienced positive growth of 9.3% in Q3 of 2012, cocoa prices decreased on average by 1.7% in Q4 of 2012. A similar negative trend was also experienced by coffee composite prices which fell by 9.6% in Q4 of 2012 against the 1% drop of the previous quarter. Year-on-year developments: The year-on-year comparison shows that, the New York cocoa market recorded a 0.71% decrease with respect to Q4 of 2011. However, coffee composite prices were significantly lower than their level in the same quarter of 2011, i.e. by 28.1%. Cocoa NY market price and coffee world price (monthly averages, current price, $/t) 6000 5000 4000 3000 2000 1000 0 Apr-07 Jul-07 Apr-08 Jul-08 Apr-09 Jul-09 Apr-10 Jul-10 Apr-11 Jul-11 Oct-11 Apr-12 Jul-12 Oct-07 Oct-08 Oct-09 Oct-10 Oct-12 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Cocoa price in $/t Coffee composite price in $/t Source: International Cocoa Organisation (ICCO) and International Coffee Organisation (ICO), March 2013 Sugar Quarterly developments: EU white sugar prices slightly increased (+2.0%) in Q4 of 2012. In the same quarter, U.S. market price continued to decrease, i.e. by 19.4% compared to Q3 of 2012. Year-on-year developments: On average, EU market price for white sugar was 12.4% higher in Q4 of 2012 than the same quarter of the previous year whereas the U.S. market price was 37.4% lower than the average in Q4 of 2011. In comparison, the world sugar price was 12.6% lower than the average of the same quarter of 2011. 3/10

- 4. White Sugar prices (monthly averages, current prices, €/t) 1200 1000 800 600 400 200 0 Jul Jul Jul Jan '10 Jul Jul Apr Apr Apr Apr Apr Apr Jan '08 Jan '09 Jan '11 Jan '12 Oct Oct Oct Oct Oct Oct July Jan '07 World price US market price Source: European Commission – Circa (Regulations (EC) No 562/2005 Article 6(1) and 479/2010 Article 2), United States Department of Agriculture, March 2013 Grains Corn maize prices Quarterly developments: Contrary to the positive trend of the previous two quarters, EU maize prices slightly decreased in Q4 of 2012 (compared to Q3 of 2012), i.e. by 0.9%. U.S. maize prices also decreased in the same period, i.e. by 7.1%, falling from the record price level of the previous quarter which experts claimed to be a result of drought and rising industrial demand. Year-on-year developments: On average, EU maize prices were 31.4% higher in Q4 of 2012 than the same quarter of the previous year. Similarly but to a lesser extent, U.S. maize prices were 24.0% higher in Q4 of 2012 than in the same quarter of the previous year. Corn/maize market prices (monthly averages, current prices, €/t) 300.00 250.00 200.00 150.00 100.00 50.00 Oct-08 Apr-07 Jul-07 Oct-07 Apr-08 Jul-08 Apr-09 Jul-09 Oct-09 Apr-10 Jul-10 Oct-10 Apr-11 Jul-11 Oct-11 Apr-12 Jul-12 Oct-12 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 DG Agri EU market price €/t FAO US market price €/t Source: FAO and European Commission (DG Agri), March 2013 4/10

- 5. Soft wheat prices Quarterly developments: Similarly to the previous quarter trend but with a slower pace, EU maize prices continued to increase in Q4 of 2012 (compared to Q3 of the same year) i.e. by 6.6%. U.S. maize prices decreased during the same period i.e. by 2.3%. Year-on-year developments: On average, EU maize prices were 33.9% higher in Q4 of 2012 than the same quarter of the previous year. Similarly, U.S. soft wheat prices were 40.3% higher in Q3 of 2012 than in the same quarter of the previous year. Soft wheat market prices (monthly averages, current prices, €/t) 300.00 250.00 200.00 150.00 100.00 50.00 Oct-10 Apr-07 Jul-07 Oct-07 Apr-08 Jul-08 Oct-08 Apr-09 Jul-09 Oct-09 Apr-10 Jul-10 Apr-11 Jul-11 Oct-11 Apr-12 Jul-12 Oct-12 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 DG Agri EU market price €/t FAO US market price €/t Source: FAO and European Commission (DG Agri), March 2013 Dairy Skimmed Milk Powder (SMP) Quarterly developments: Similarly to the previous quarter trend but with a slower pace, EU SMP prices continued to increase in Q4 of 2012 (compared to Q3 of the same year) i.e. by 11.8%. Moreover, for the first time since Q3 of 2009, average EU prices in Q4 of 2012 were higher than world market prices. Year-on-year developments: The yearly comparison shows that, on average, EU SMP prices were 15.1% higher in Q4 of 2012 than the same period in 2011. 5/10

- 6. SMP (monthly averages, current prices, €/t) 4500 4000 Q4 2012 3500 Q3 2009 3000 2500 2000 1500 1000 500 0 Jul Jul Jul Jul Jul Jul Apr Apr Apr Apr Apr Apr Oct Oct Oct Oct Oct Oct Jan '07 Jan '08 Jan '09 Jan '10 Jan '11 Jan '12 FAO €/t World market price CLAL €/t EU market price CIRCA €/t EU market price R. 1234/07 €/t EU reference price Source: FAO, CLAL consultancy (discontinued after January 2011 to the benefit of the European Commission source), European Commission – Circa (Regulations (EC) No 562/2005 Article 6(1) and 479/2010 Article 2), March 2013 Whole Milk Powder (WMP) Quarterly developments: Generally higher than world market prices since Q3 of 2010, EU WMP average prices continued to increase in Q4 of 2012, i.e. by 9.6% from the previous quarter. Year-on-year developments: The yearly comparison shows that, on average, EU WMP prices remained fairly stable (- 0.1%) in Q4 of 2012 compared to the same quarter of 2011. WMP (monthly averages, current prices, €/t) 4000 3500 3000 2500 2000 1500 1000 Jan '08 Jul Jul Jul Jul Jul Sep Sep Sep Sep Sep Mar Jan '09 May Mar Jan '10 May Mar Jan '11 May Mar Jan '12 May Mar May Nov Nov Nov Nov Nov World market price CLAL €/t EU market price CIRCA €/t EU market price Source: FAO, CLAL consultancy (discontinued after January 2011 to the benefit of the European Commission source), European Commission – Circa (Regulations (EC) No 562/2005 Article 6(1) and 479/2010 Article 2), March 2013 6/10

- 7. Oils and oil crops Quarterly developments: In Q4 of 2012 oils and oils crops prices experienced a general decrease. The decrease in prices was most pronounced for Palm oil and Soybeans with a price decline of 18.5% and 10.1%, respectively. Moreover, after having significantly increased during the previous quarter, prices of Soybean meal (+29.3%) started to decrease in Q4 of 2012, i.e. by 6.9%. Year-on-year developments: The yearly comparison shows that in Q4 of 2012 only Soybean meal, Soybeans and Rapeseed prices were significantly higher than in the same quarter of 2011: by 64.6%, 23.7% and 4.7% respectively. On the contrary Palm oil, Rape oil and Soybean oil were 21.0%, 5.8% and 4.6% lower in Q4 of 2012 than the same period of the previous year. Oils and oilcrop prices (monthly averages, current prices $/t) 1800 1600 1400 1200 1000 800 600 400 200 0 Apr-09 Apr-07 Jul-07 Oct-07 Apr-08 Jul-08 Oct-08 Jul-09 Oct-09 Apr-10 Jul-10 Oct-10 Apr-11 Jul-11 Oct-11 Apr-12 Jul-12 Oct-12 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 World Bank Soybean oil $/t World Bank Soybeans $/t World Bank Soybean meal $/t World Bank Palm oil $/t Source: World Bank and FAO, March 2013 3. Price developments in the food supply chain Consumer prices (1.34%), producer prices (1.31%) and inflation (0.83%) all grew on average in Q4 of 2012. EU27: Price developments in the food supply chain 145.0 140.0 135.0 130.0 125.0 120.0 115.0 110.0 105.0 100.0 2007M04 2011M04 2007M01 2007M07 2007M10 2008M01 2008M04 2008M07 2008M10 2009M01 2009M04 2009M07 2009M10 2010M01 2010M04 2010M07 2010M10 2011M01 2011M07 2011M10 2012M01 2012M04 2012M07 2012M10 Agricultural Commodity Price Producer Price Source: Eurostat (Food supply chain monitor), March 2013 7/10

- 8. 4. Slight increase in employment index in the EU food and drink industry After having experienced a slight decrease in Q2 and Q3, the labour input index for the food and drink industry increased (+0.28%) in Q4 of 2012. This is contrary to the performance shown by the (total) manufacturing sector whose employment index decreased by 0.31% in the same period. When looking at the industry breakdown, the food sector employment index increased by 0.1%, whereas the beverages industry employment index increased by 1.02% in comparison with the previous quarter. Labour input index (2010=100) : food and drink industry trends compared to total manufacturing 110 105 100 95 90 85 80 2010Q1 2010Q2 2010Q3 2010Q4 2011Q1 2011Q2 2011Q3 2011Q4 2012Q1 2012Q2 2012Q3 2012Q4 Manufacturing Manufacture of food products Manufacture of beverages Source: Eurostat (SBS), Nace Rev. 2, seasonally adjusted data, March 2013. 5. Food and drink industry turnover continued to increase The food and drink industry’s turnover index increased by 0.88% in Q4 of 2012 compared to the previous quarter. EU27: Turnover index (2010 = 100) 115.00 110.00 105.00 100.00 95.00 90.00 2012Q1 2007Q1 2007Q2 2007Q3 2007Q4 2008Q1 2008Q2 2008Q3 2008Q4 2009Q1 2009Q2 2009Q3 2009Q4 2010Q1 2010Q2 2010Q3 2010Q4 2011Q1 2011Q2 2011Q3 2011Q4 2012Q2 2012Q3 2012Q4 Manufacture of food products and beverages Source: Eurostat (SBS), seasonally adjusted data, March 2013 8/10

- 9. 6. Imported food prices increased in Q4 of 2012 Imported food prices registered a slight increase in Q4 of 2012, up to 0.49% from the previous quarter. Food and drink import price index (2010 = 100) 115.00 110.00 105.00 100.00 95.00 90.00 85.00 80.00 2010Q2 2007Q1 2007Q2 2007Q3 2007Q4 2008Q1 2008Q2 2008Q3 2008Q4 2009Q1 2009Q2 2009Q3 2009Q4 2010Q1 2010Q3 2010Q4 2011Q1 2011Q2 2011Q3 2011Q4 2012Q1 2012Q2 2012Q3 2012Q4 Euro area Source: Eurostat (SBS), March 2013 Exchange rates In Q4 of 2012, the euro has appreciated against most major non-EU currencies in an environment of low volatility. The table below gives details for the euro appreciation against the currencies of major trading partners. Table 3: Evolution of quarterly average exchange rates Q4 2012/ Q3 2012 1 EUR= 2012 Q3 2012 Q4 % Australian Dollar 1.20 1.25 3.73 Canadian Dollar 1.24 1.29 3.24 Brazilian Real 2.54 2.67 5.17 Swiss Franc 1.20 1.21 0.37 Chinese Yuan Renminbi 7.94 8.10 2.05 Japanese Yen 98.30 105.12 6.94 New Zealand Dollar 1.55 1.58 1.87 United States Dollar 1.25 1.30 3.72 Pound Sterling 0.79 0.81 2.0 Source: ECB, bilateral exchange rates, March 2013 9/10

- 10. 7. Trade: Both imports and exports increased in Q4 of 2012 year-on-year The EU trade balance in food and drink products continued to improve during the Q4 of 2012 compared to the same period of 2011. The export surplus amounted to nearly €6.5 billion, which marks an increase of €1.5 billion year-on-year. Imports Q4 of 2012 Exports Q4 of 2012 Total food and drink imports amounted to 17.1 Total food and drink exports amounted to €23.6 billion, i.e. 3.5% more compared to the previous billion, i.e. 9.6% more compared to the same period year. However, a real import increase in terms of of 2011. Similar to Q3 of 2012, the value of exported quantity and value was observed for only a limited drinks increased proportionately more than export of group of alcoholic and soft drinks, and grain mill and other foodstuffs. Nonetheless, the year-on-year export starch products. For a number of foodstuffs, the import growth registered for fish products, oils and fats and growth in terms of value was linked to the price factor, spirits was also very positive (+30.2%, 21%, 20% while the imported quantity was in fact lower than a respectively) and matched with a similar trend in terms year ago. Finally, some products registered a real of exported quantities. Finally, other food and drink import reduction both in terms of volume and value, products contributed also to the growth in export value, e.g. dairy (-11.8% in value and -13.4% in volume), fruit despite witnessing a double-digit volume reduction. A and vegetables (-7% in value and -14.4% in volume), single-digit volume reduction was registered for wines, and less significantly, spirits and cider. beer and meat products. Trade balance in € million Q4 2011 2012 Total of Food and Drink 4,996 6,482 Meat products 1,059 1,306 Fish and sea food products -3,339 -2,959 Processed fruit and vegetables -853 -591 Oils and fats -2,694 -3,171 Dairy products 2,081 2,124 Grain mill and starch products 347 311 Bakery & farinaceous products 699 814 Other food products 2,130 2,310 Prepared animal feed 508 586 Drinks 4,983 5,714 FoodDrinkEurope - represents the European food and drink industry - the leading industrial sector and major EU employer and exporter. FoodDrinkEurope’s role is to represent the food and drink industry’s interests, at the level of both European and international institutions. FoodDrinkEurope’s membership consists of 24 national federations and 3 observers, 25 European sector associations and 18 major food and drink companies. For further information, please contact: Lisa McCooey, Communications Director / Deputy Director General. Tel: + 32 2 508 10 24 - l.mccooey@fooddrinkeurope.eu 10/10