FLIR

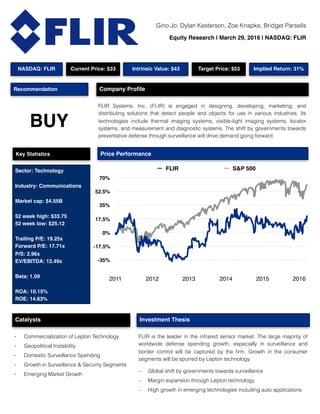

- 1. Key Statistics BUY Recommendation Sector: Technology Industry: Communications Market cap: $4.55B 52 week high: $33.75 52 week low: $25.12 Trailing P/E: 19.25x Forward P/E: 17.71x P/S: 2.96x EV/EBITDA: 12.49x Beta: 1.09 ROA: 10.15% ROE: 14.83% Investment ThesisCatalysts Current Price: $33 Intrinsic Value: $43 Target Price: $53 Implied Return: 31%NASDAQ: FLIR -35% -17.5% 0% 17.5% 35% 52.5% 70% 2011 2012 2013 2014 2015 2016 FLIR S&P 500 FLIR Systems, Inc. (FLIR) is engaged in designing, developing, marketing, and distributing solutions that detect people and objects for use in various industries. Its technologies include thermal imaging systems, visible-light imaging systems, locator systems, and measurement and diagnostic systems. The shift by governments towards preventative defense through surveillance will drive demand going forward. Company Profile FLIR is the leader in the infrared sensor market. The large majority of worldwide defense spending growth, especially in surveillance and border control will be captured by the firm. Growth in the consumer segments will be spurred by Lepton technology. - Global shift by governments towards surveillance - Margin expansion through Lepton technology - High growth in emerging technologies including auto applications - Commercialization of Lepton Technology - Geopolitical Instability - Domestic Surveillance Spending - Growth in Surveillance & Security Segments - Emerging Market Growth Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells Equity Research | March 29, 2016 | NASDAQ: FLIR Price Performance

- 2. Recommendation: BUY Investment Thesis Breakdown Increased Surveillance Budgets Margin Expansion FLIR is the worldwide leader in detection technology with a focus on infrared solutions. Its technology is used in surveillance, detection, and security applications by governments around the world. Due to the continued geopolitical instability around the world, coupled with the hesitation by governments to enter into war, many of the world’s governments are entering a state of Cold War-like surveillance in order to mitigate attacks. With the focus shifting from supplying missiles and armaments to the fortifying and surveillance of borders and other critical points, such as transportation hubs, FLIR will supply the majority of the large defense contractors supplying surveillance solutions to governments worldwide. The continued pressure from governments to curtail excessive defense spending should provide further compression of traditional defense outlets and drive the further focus towards preventative surveillance solutions. Thus, instead of spending money on resolving conflicts and responding to threats, governments will have a more active role in the prevention of said events in order to save lives and cut overall costs. Furthermore, the updating of current surveillance systems with state-of-the-art imaging technology will promote this effort, but also provide a wide opportunity for FLIR to capitalize on meeting this new demand. The expected upgrade cycle from governments in Europe and the Middle East will lead the growth in this segment. With the introduction of new technologies, FLIR has historically been able to expand margins as the majority of its revenues have been contract based. By having predictable revenues and the ability to expand margins by way of technological change, FLIR will observe continued gross margin growth. The Lepton thermal imaging core is the newest innovation in the long history of margin expanding inputs. Lepton will allow for continued margin expansion by making future products cheaper to mass produce. Additionally, this technology will lead FLIR to enter new emerging markets, which carry higher margins as they are at the forefront of technology. As demand for these markets remain on the higher end throughout our investment horizon, the margin expected should be higher, coupled with the natural expansion expected from Lepton technology. Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 2 International Terrorism Iranian Nuclear Weapons Cyberterrorism Biological Warfare Syrian Conflict North Korea Refugee Influx 52% 58% 58% 63% 73% 75% 79% American’s Top Threat Consensus

- 3. Recommendation: BUY Investment Thesis Continued Growth in Domestic Security Sector Worldwide Shift Towards Surveillance Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 3 Home security expenditure growth is expected to continue well into the future. Over the past 7 years, the household security industry has seen revenue growth in new home installations every year. Additionally, overall household security purchases have largely grown to accommodate the added demand brought on by instability. Security measures are being ramped up across the board, from airports and transportation hubs, to homes and apartments. FLIR’s sensors enhance the detection capabilities of home systems and provide an outlet for a switch to higher end technology. The connected home will drive growth in household products. Where firms like Nest and Phillips attempt to penetrate this new market with their thermostat and color LED lighting, FLIR provides homeowners with the technology to feel safer at home. Additionally, cities have began to install FLIR technology to ramp up community security efforts throughout the U.S., and the trend is expected to develop in European and Asian markets. Over the past 10 years, terrorism has caused around 130,000 fatalities worldwide. To combat the growing fear of attacks, governments are taking a more direct and active approach towards surveillance. As the continued instability in the Middle East drives anxiety in the West, a concentrated focus towards preventative security and surveillance will drive future demand for the firm. Solutions, including border security should see future funding as the current geopolitical environment points towards stricter entry requirements and tougher border security in order to mitigate foreign terrorism efforts. The Schengen Area, the world’s largest borderless territory will come under review following the events throughout Europe resulting from the widespread foreign refugee influx and the area’s ease of travel. The Schengen Area becoming securitized would result in a massive opportunity for FLIR to supply the necessary technology to surveil the area. Furthermore, the border control overhaul expected around Europe in securitized zones provides additional opportunities. 17,000M 18,250M 19,500M 20,750M 22,000M 3M 4M 5M 6M 7M 2009 2010 2011 2012 2013 2014 2015 Household Purchases Revenue U.S. Terrorism Deaths & Injuries 0 25 50 75 100 2004 2006 2008 2010 2012 2014 2016

- 4. Recommendation: BUY Markets Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 4 Surveillance Security OEM & Emerging Markets Detection The Surveillance segment develops products used to protect borders, conduct search and rescue missions, gather intelligence, and protect critical infrastructure by providing the capability to see over long distances, day or night, through adverse weather conditions, and from a variety of vehicle, man-portable, and fixed-installation platforms. Customers generally consist of United States and foreign government agencies, including civilian, military, paramilitary, and police forces, as well as defense contractors and aircraft manufacturers. The Security segment provides security solutions for home and small business monitoring, and enterprise and infrastructure security. The segment develops video security solutions for use in commercial, critical infrastructure, and home security. Solutions include thermal and digital cameras, and related video management software. Customers for the visible-spectrum solutions include high-end critical infrastructure users, and homeowners. Thermal security cameras are sold into the high-end critical infrastructure category. The OEM & Emerging Markets segment develops and manufactures thermal imaging camera cores and related components. A thermal camera core is an integrated camera system that includes the infrared sensor, related image processing electronics and an optical lens. The segment also includes high-potential products that do not have the scale to represent their own segment. Customers include makers of military aircraft and vehicles, automotive safety equipment, firefighting equipment, security cameras, hunting equipment, and unmanned aerial systems. FLIR sell its Mobile products to homeowners, outdoors people, and technology enthusiasts. The Detection segment develops and manufactures field-ready sensor instruments for the detection, identification, classification, and suppression of chemical, biological, radiological, nuclear, and explosive threats for military force protection, homeland security, and commercial applications. Solutions combine detection technologies into single hand-held instrument. Customers include federal, state, and local government; all branches of the U.S. military, foreign militaries, private sector businesses; and commercial ports. FLIR sells to agencies including the Departments of Homeland Security, Defense, and Energy, as well as the FBI and Secret Service.

- 5. Recommendation: BUY Competitive Advantage Competitor Analysis Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 5 - BAE Systems: Headquartered in London, provides defense, aerospace and security solutions operating in five segments: Electronic Systems, Cyber & Intelligence, Platforms & Services (US), P&S (UK) and P&S (International) - L-3 Communications: Engaged as a system contractor in aircraft modernization & maintenance, Command, Control, Communications, Intelligence, Surveillance and Reconnaissance systems, and governments - Danaher Corporation: Offers thermal imaging products and sensors that compete with FLIR’s products in its Test & Measurement segment - Raytheon: Develops integrated products, services and solutions in the sensing, control, and intelligence sectors Due to FLIR’s broad product reach and market reach, it operates in a highly concentrated industry. Many of its competitors operate in other industries, and thus may have a larger market capitalization than FLIR. However, based on our research and because FLIR has a focus for infrared and thermal imaging systems, it remains the highest quality primary global provider for infrared and thermal imaging systems and products. Commercial Operating Model: The business model that FLIR uses has a commercial approach, starting with its R&D, which is geared toward meeting the demands and wants of its end-users. Additionally, FLIR develops its products at high-volume levels with the ability to control multiple production inputs, driving low-cost production. Vertical Integration: FLIR has developed a competitive advantage through its vertical integration. Its ability to operate its processes completely internally, from the R&D, to its supply network, to its manufacturing process, rather than use external sourcing for these steps of the process provides significant cost advantages. While FLIR sees these benefits in its margins, it also benefits from its vertical integration with engineering advantages by designing products exactly towards the target market. Broad Product Mix: The firm has a broad product mix that has a variety of applications that can reach several markets and end-users. The ability for FLIR to reach a wide variety of end-users helps grow the top line and mitigate fluctuations of demand. Moreover, FLIR is constantly developing and improving its products with more applications to reach a wider end-market. Internally Funded Research and Development: Research and development is funded internally, allowing FLIR to have ownership of the development process and create products that are commercially viable. Additionally, FLIR has a large portfolio of patents allowing them to develop certain high demand technologies.

- 6. Industry Analysis Recommendation: BUY Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 6 Electronic Equipment & Instruments Industry FLIR operates in the infrared and thermal imaging segment of the electronic equipment and instruments industry, which currently has a total market value of around $3.3 billion and is expected to grow to over $5 billion by 2020. The industry is evolving to include more commercialized products, as there has been increased demand based on the variety of applications for infrared and thermal imaging and to mitigate the impact of possible stagnation in defense budgets worldwide. The commercial and household security markets depend largely on macroeconomic and disposable income to drive demand for security equipment. In the high margin household segment, we expect high growth driven by the smart home industry for advanced security systems, which will be spurred by growing per capita disposable income. The largest driver of this industry is federal funding for defense and homeland security, and carries political risk as budgets largely depend on the administration and congressional bias. In 2015, the U.S. government spent approximately $606 billion on defense, which was down from 2010 when the government spent the most on public defense in the last decade with approximately $760 billion in spending. While there is great uncertainty about the public defense budget, based on our research alongside the increased geopolitical risk and number of terror attacks throughout the world recently, we expect the U.S. government to spend around $616 billion in 2016 and roughly $600 billion through 2020. Furthermore, the Department of Homeland Security spent approximately $45.7 billion in 2015, and is expected to spend approximately $46.2 billion in 2016. Infrared and thermal imaging sensors and systems have several applications that are used by firefighters and law enforcement officers. Thus, local and state government spending for law enforcement departments and fire departments is an important driver of this industry. Department of Homeland Security Spending Inbillions $0 $18 $35 $53 $70 2000 2003 2006 2009 2012 2015 2018 Per Capita Disposable Income Forecast Inmillions $36,000 $38,000 $40,000 $42,000 $44,000 2011 2013 2015 2017 2019

- 7. Industry Analysis Continued Recommendation: BUY Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 7 Due to the nature of the product and the manufacturing business, the price of plastic and raw materials is an important determinant of costs within the industry. The price of plastic is correlated to the price of crude oil as oil products make up the primary materials used in the production of plastics. Thus, as oil rises, it is likely that the price of plastic will also rise. In 2015, the average price index for plastic was 233.3 and in 2016 is expected to rise to around 236, largely due to the expectations in the price of oil. Also, as the industry becomes more commercialized and brings more products that have consumer and business applications, the industry will begin to rely more heavily on corporate profit and spending, especially for industrial products, as well as consumer disposable income. Due to the macroeconomic headwinds and the expectations of increased interest rates over the intermediate term, the cost of capital could increase while corporate profits are expected to decrease slightly. In 2015, corporate profits were approximately $2,045 billion which was a 1.4% decrease from 2014. The 2015 per capita disposable income was $38,050 compared to 2014 per capita disposable income of $37,077. Moat The infrared and thermal imaging industry is highly competitive. The barriers to enter are high as companies that operate in this space compete for government contracts, pricing power, and cost efficiencies. The ability to obtain government contracts is based on the company’s ability to develop and manufacture products that are high quality and reliable at a low cost. Firms compete for pricing power and cost efficiencies, which can be obtained through vertical integration of processes, starting at the research and development through to the manufacturing phase. Prospective firms face significant barriers to entry as the industry requires a significant amount of investment capital and economies of scale to successfully compete. Investments include research and development, manufacturing and assembly facilities, equipment, and labor, as well as the ability to obtain affordable raw materials. FLIR’s focus on cost and production effectiveness has allowed the firm to provide a specialized product for the specific task needed in a shorter amount of time, at comparable to lower prices than its larger peers. Additionally, the firm’s margin growth has led to its continued success in asset utilization far exceeding the industry average. For a new entrant to effectively compete with FLIR, it would need to implement a cost structure that undercuts the most cost and production effective firm in the industry while providing premium products to compete with the only large firm strictly focused on infrared. Gross Margin Net Margin ROA 0 12.5 25 37.5 50 FLIR Industry

- 8. Recommendation: BUY Catalysts The FLIR Lepton is the world’s smallest infrared sensor available as an OEM product. It packs a resolution of 80 × 60 pixels into a camera body that is smaller than a dime. This revolutionary camera core is poised to make thermal imaging available to a new generation of mobile and handheld devices, as well as small fixed-mount camera systems. This technology has allowed FLIR to reduce the cost of a camera from over $5,000 to around $250. This allows them to enter new markets and distribution channels as the technology becomes more affordable for commercial use. FLIR’s continued efforts into innovative technologies have allowed them to be first to market in many new high growth sectors through various automotive and mobile phone applications. These new technologies will remain on the higher end during our investment horizon, allowing FLIR to charge premium pricing that will drive margin expansion. Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 8 Geopolitical Instability FLIR’s surveillance segment benefits greatly from geopolitical tensions as governments ramp up surveillance of borders and the monitoring of large metropolitan areas following geopolitical instability domestically and worldwide. The recent instability resulting from the Syrian civil war and the subsequent threat from ISIL has resulted in Europe’s worst refugee crisis since World War II. Germany, who has pledged to accept the vast majority of refugees has come under pressure in recent months from threats of terrorists entering the country through refugee channels. Frontex, the European Union’s border patrol agency will receive €332 million up from €143 million last year. Much of the added budget will go towards border and internal surveillance. Lepton Technology Approved Asylum Applications 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 Germany Sweden Italy France Holland U.K.

- 9. Recommendation: BUY Catalysts Continued Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 9 FLIR’s security segment poses the largest opportunity over our investment horizon as international markets further their demand for commercial and retail security products. A large demand driver has been international airports worldwide adopting stricter security protocols and demanding premium security products. Historically, FLIR has supplied foreign markets through its Lorex brand which is mainly composed of bundle cameras that had little to no infrared capabilities. Going forward, the upgrade cycle from international markets towards higher end products that include full infrared capabilities will drive demand globally. Again, this is possible by FLIR’s commitment to innovation and cost savings throughout its product lines. Growing Security Expenditure FLIR is the premium supplier to fringe OEMs that drive technological innovation in the infrared industry. One of the most successful segments has been automobile infrared integration. The firm has been active in developing relationships with high end manufacturers in order to build a steady backlog of demand for its products. Beginning in 2006 with BMW, FLIR has expanded its high end automobile OEM partnerships to include Mercedes, Audi, and Cadillac. FLIR technology is available only on the highest end models as an add-on. Another high growth opportunity is the mobile accessories segment. With the implementation of Lepton technology, FLIR has been able to cram the infrared capabilities of a $5,000+ commercial device into a mobile accessory for around $250. Emerging Segment Growth Wireless Speakers Smart Thermostat Smart Home Security Domestic Robots Smart CO Detectors Smart Lighting 6% 6% 8% 9% 11% 17% U.S. Homes With Smart Technology

- 10. Recommendation: BUY Risks & Mitigants Speed of Technology Dependence on Defense Budgets Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 10 A large portion of revenues are dependent on U.S. government defense spending. Accounting for roughly 20% of revenues, the Department of Defenses’ appropriations drive demand for FLIR. However, FLIR has moved away from strictly supplying the government and has diversified its product portfolio to mitigate the risk of a sharp decrease in defense spending. International Exposure Approximately 47% of FLIR’s sales come from overseas, providing exposure to the various risks brought on by the slowing markets of Europe and Asia. However, the opportunities available in these markets exceed the risk. By being the premier supplier of surveillance technology to Middle Eastern and European governments, FLIR will continue to see growth throughout the tumultuous markets it may face. Macroeconomic Environnent The performance of the security industry is closely tied to the health of the economy. If the economy goes into a recession, per capita disposable income decreases, and the unemployment rate increases, less Americans will be able to afford expensive security systems and high-end visualization solutions. However, FLIR is continually working to manage its sales mix to include more commercial clients in order to lock in as many long-term contracts as possible. FLIR is at the forefront of detection technologies, and in order to maintain its strong market presence, it will need to remain innovative to be competitive in the future. The firm has historically allocated roughly 8-10% of annual revenue to R&D and plans to keep this positive relationship well into the future. Military Firefighting Traffic Diagnostic Tools Mobile Maritime Man-Portable Hunting Boating

- 11. Andrew Teich — President and CEO Teich has been CEO since May 2013. Previously, he served as a director for Sensata Technologies Inc. His career in the thermal imaging industry spans over 30 years. He obtained a B.S. from Arizona State University and is an alumnus of Harvard Business School. Recommendation: BUY Management Team Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 11 Tom Surran — COO Surran has been Senior VP and COO for FLIR since January 2014. He has held positions at TDK Corporation, Headway Technologies, Inc., and Everex Systems, Inc. He received his B.S. from Xavier University and an MBA from the University of Chicago. Shane Harrison — SVP, Corporate Development & Strategy Harrison has been with FLIR since 2010 after being a VP at Lehman Brothers in their Global Technology Investment Banking Group. He also was an Analyst at Goodrich Aerospace and an Auditor at Deloitte & Touche. He achieved a B.S. from the University of Oregon and an MBA from UCLA Anderson School of Management. Amit Singhi — CFO Singhi is the firm’s CFO and has been the Senior VP of Finance. Previously, he worked on the finance team for Ford Motor Company. His MBA and M.S. in Electrical Engineering Systems are from the Indian Institute of Technology.

- 12. We conducted a sensitivity analysis on the EV/EBITDA multiple that drives this model to account for both adverse and favorable scenarios that FLIR could face through 2020, such as demand fluctuations in its Surveillance segment. Over the past 6 years, FLIR’s EV/EBITDA multiple has been well above 14 times. This poses a significant upside as the multiple regresses to a higher historical average. Recommendation: BUY Valuation Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 12 EV/EBITDA Model We utilized multiple valuation methods to arrive at a target price for 2020. Our first model is an EV/EBITDA multiple model. FLIR is currently trading at an EV/EBITDA multiple much lower than its three-year historical average. Its three-year historical average EV/ EBITDA multiple is 13.4 times. We have the multiple expanding over our investment horizon due to the increase in surveillance demanded by European and Asian countries, high demand for commercial applications, and higher than expected demand for its emerging market offerings including mobile and automobile applications. At 18.2 times EBITDA in 2020, FLIR will have a market cap of roughly $6.5 billion and an equity value per share of $50.93.

- 13. A sensitivity analysis was conducted on the multiple in order to account for a variety of scenarios the firm could face through 2020. Over the past 5 years, FLIR’s P/E multiple has remained within an average range of around 20. Our estimates of EPS coupled with multiple expansion provide a comfortable value proposition. We used multiple valuation methods to arrive at a target price for 2020. Using three different P/E multiple models, we gauged the probable returns for FLIR over our five-year investment horizon. FLIR’s P/E is currently approximately 19, while its three-year average is roughly 26.7. This presents us with an opportunity to buy and is why we recommend using a P/E expansion model. We expect the multiple to regress back up as a result of more surveillance spending as well as high growth in segments such as Surveillance and OEM & Emerging Markets. - In a bull case with expectations for a higher multiple, we expect a 2020 price target of $53.58. - Assuming a constant multiple and base case earnings growth, we expect a price target of $46.22. - FLIR offers a favorable risk-reward investment, with a bear case price target of $43.96. Recommendation: BUY P/E Model Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 13

- 14. We conducted a scenario analysis on our free cash flow to equity model to account for changes in discount rates and terminal values. Even in our bear case scenario, FLIR is 26.7% undervalued. Recommendation: BUY Free Cash Flow to Equity Model Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 14 We used a free cash flow to equity model to value what FLIR is worth today, deriving a terminal value of $53.58 from our P/E model. The model implies the stock is roughly 31% undervalued in our base case scenario. The model has implied assumptions based on our expectations of the firm, its competitors, and the industry landscape: - Top line growth will increase as we observe: a global shift by governments towards surveillance complementing traditional defense, high growth in emerging technologies including mobile and automobile applications, and growth in the Security segment. - Bottom line growth is driven by margin expansion by the wide commercialization of Lepton technology. - Using a 60-month regression, we arrived at a beta of 1.11. In the long term, stocks regress towards a beta of 1, therefore, we adjusted beta slightly to 1.09 to accommodate future changes for an appropriate discount rate.

- 15. Recommendation: BUY Appendices Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 15

- 16. Recommendation: BUY Appendices Continued Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 16

- 17. Recommendation: BUY Appendices Continued Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 17

- 18. Recommendation: BUY Appendices Continued Equity Research | March 29, 2016 | NASDAQ: FLIR Analysts: Gino Jo, Dylan Kesterson, Zoe Knapke, Bridget Parsells 18