fine and penalties as per Value Added Tax, 2052 Nepal.pdf

•

0 likes•25 views

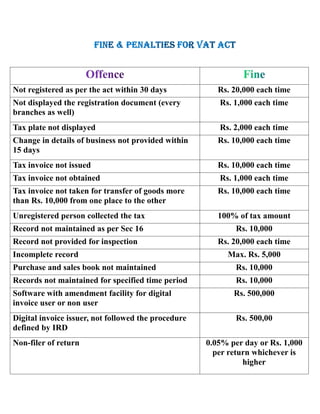

VAT fines and penalties as per Value Added Tax, 2052.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Similar to fine and penalties as per Value Added Tax, 2052 Nepal.pdf

Similar to fine and penalties as per Value Added Tax, 2052 Nepal.pdf (20)

Final gst vth unit payments of tax interest penalty and tdd&tcs

Final gst vth unit payments of tax interest penalty and tdd&tcs

#Comprehensive Guide on TDS Under GST# By SN Panigrahi

#Comprehensive Guide on TDS Under GST# By SN Panigrahi

(52)levy of exemption from tax ppt hari master piece

(52)levy of exemption from tax ppt hari master piece

taxstructureofpakistan22-110113191019-phpapp01.pdf

taxstructureofpakistan22-110113191019-phpapp01.pdf

Recently uploaded

INFO PEMESANAN [ 085176963835 ] Jual Obat Aborsi Cytotec Pasuruan, Obat Aborsi Pasuruan, jual aborsi obat cytotec di pasuruan, jawa timur, jual aborsi cytotec di pasuruan, jawa timur, harga obat cytotec di pasuruan, jawa timur, apotik yang jual cytotec di pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, jual obat gastrul di pasuruan, jawa timur, obat aborsi pasuruan, jawa timur, jual cytotec asli pasuruan, jawa timur, harga obat aborsi di pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, alamat jual obat aborsi di pasuruan, jawa timur, harga obat cytotec, jual obat aborsi cytotec asli di pasuruan, jawa timur makassar palembang batam pekanbaru sulawesi utara, tempat jual obat aborsi di pasuruan, jawa timur, obat aborsi di pasuruan, jawa timur, apotik yang menjual obat aborsi di pasuruan, jawa timur, jual obat cytotec di pasuruan, jawa timur, harga obat gastrul di apotik pasuruan, jawa timur jual gastrul, alamat jual obat cytotec di pasuruan, jawa timur, harga gastrul per biji, harga obat aborsi di pasuruan, jawa timur, klinik jual obat aborsi di pasuruan, jawa timur, bidan jual obat aborsi di pasuruan, jawa timur, klinik obat aborsi ilegal di pasuruan, jawa timur, klinik jual obat aborsi kandungan pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, obat aborsi pasuruan, jawa timur, klinik jual obat aborsi kandungan pasuruan, jawa timur, jual gastrul di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, klinik obat aborsi di pasuruan, jawa timur, obat aborsi, apotik yang jual bebas cytotec di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, harga obat gastrul di apotik, jual obat cytotec, obat aborsi, klinik obat aborsi cytotec pasuruan, jawa timur, jual cytotec asli pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, alamat jual obat cytotec di pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, jual obat aborsi cytotec penggugur kandungan di pasuruan, jawa timur, harga cytotec, jual gastrul di pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, harga cytotec di apotik k24, toko obat aborsi cytotec asli pasuruan, jawa timur, jual obat aborsi cytotec penggugur kandungan di pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, alamat jual obat cytotec di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, obat aborsi, jual gastrul di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, jual obat aborsi cytotec penggugur kandungan di pasuruan, jawa timur, harga cytotec, jual gastrul di pasuruan, jawa timur, cytotec asliObat Aborsi Pasuruan 0851\7696\3835 Jual Obat Cytotec Di Pasuruan

Obat Aborsi Pasuruan 0851\7696\3835 Jual Obat Cytotec Di PasuruanObat Aborsi Jakarta Wa 085176963835 Apotek Jual Obat Cytotec Di Jakarta

Income statement definition

An income statement is a financial statement that reports a company's financial performance over a specific accounting period. It is one of the three important financial statements used for reporting a company’s financial performance, the other two being the balance sheet and the cash flow statement. The income statement focuses on the revenue, and expenses reported by a company during a particular period. It provides valuable insights into a company’s operations, the efficiency of its management, underperforming sectors, and its performance relative to industry peers.

The income statement is also known as the profit and loss (P&L) statement or the statement of revenue and expense. It starts with the details of sales and then works down to compute net income and eventually earnings per share (EPS). The income statement does not differentiate between cash and non-cash receipts (sales in cash vs. sales on credit) or cash vs. non-cash payments/disbursements (purchases in cash vs. purchases on credit).

Key income statement items

Revenue is the total amount of money a company earns from its operations, usually from the sale of goods or services. For example, a car manufacturer’s revenue would be the total amount of money it earns from selling cars.

Cost of Goods Sold (COGS) represents the direct costs associated with producing or delivering the goods or services sold by a company. In the auto industry, COGS would include the cost of raw materials, labor, and other expenses directly related to manufacturing vehicles.

Gross Profit is calculated by subtracting the COGS from the revenue.

Selling, General, and Administrative (SG&A) expenses represents the costs associated with a company's non-production activities, such as sales, marketing, and administrative functions. In the auto industry, SG&A expenses would include salaries of sales personnel, advertising expenses, rent for office spaces, and other costs related to running the business.

Depreciation & Amortization: Depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life. Amortization, on the other hand, is the process of spreading out the cost of an intangible asset over its useful life. In the auto industry, depreciation and amortization expenses would include the depreciation of manufacturing equipment, vehicles, and amortization of patents or trademarks.

Interest Expenses represents the costs associated with borrowing money or using credit facilities. Interest expenses are incurred when a company has outstanding debt or loans. In the auto industry, interest expenses would include interest paid on loans used to finance manufacturing facilities or purchase equipment.

This PowerPoint presentation is only a small preview of our Toolkits. For more details, visit www.domontconsulting.comCreating an Income Statement with Forecasts: A Simple Guide and Free Excel Te...

Creating an Income Statement with Forecasts: A Simple Guide and Free Excel Te...Aurelien Domont, MBA

Recently uploaded (20)

00971508021841 حبوب الإجهاض في دبي | أبوظبي | الشارقة | السطوة |❇ ❈ ((

00971508021841 حبوب الإجهاض في دبي | أبوظبي | الشارقة | السطوة |❇ ❈ ((

Understanding Financial Accounting 3rd Canadian Edition by Christopher D. Bur...

Exploring-Pipe-Flanges-Applications-Types-and-Benefits.pptx

Exploring-Pipe-Flanges-Applications-Types-and-Benefits.pptx

Top^Clinic ^%[+27785538335__Safe*Women's clinic//Abortion Pills In Harare

Top^Clinic ^%[+27785538335__Safe*Women's clinic//Abortion Pills In Harare

South Africa's 10 Most Influential CIOs to Watch.pdf

South Africa's 10 Most Influential CIOs to Watch.pdf

NewBase 17 May 2024 Energy News issue - 1725 by Khaled Al Awadi_compresse...

NewBase 17 May 2024 Energy News issue - 1725 by Khaled Al Awadi_compresse...

Abortion pills in Muscut<Oman(+27737758557) Cytotec available.inn Kuwait City.

Abortion pills in Muscut<Oman(+27737758557) Cytotec available.inn Kuwait City.

Obat Aborsi Pasuruan 0851\7696\3835 Jual Obat Cytotec Di Pasuruan

Obat Aborsi Pasuruan 0851\7696\3835 Jual Obat Cytotec Di Pasuruan

Presentation4 (2) survey responses clearly labelled

Presentation4 (2) survey responses clearly labelled

The Art of Decision-Making: Navigating Complexity and Uncertainty

The Art of Decision-Making: Navigating Complexity and Uncertainty

Pay after result spell caster (,$+27834335081)@ bring back lost lover same da...

Pay after result spell caster (,$+27834335081)@ bring back lost lover same da...

Goal Presentation_NEW EMPLOYEE_NETAPS FOUNDATION.pptx

Goal Presentation_NEW EMPLOYEE_NETAPS FOUNDATION.pptx

Creating an Income Statement with Forecasts: A Simple Guide and Free Excel Te...

Creating an Income Statement with Forecasts: A Simple Guide and Free Excel Te...

fine and penalties as per Value Added Tax, 2052 Nepal.pdf

- 1. Not registered as per the act within 30 days Rs. 20,000 each time Not displayed the registration document (every branches as well) Rs. 1,000 each time Tax plate not displayed Rs. 2,000 each time Change in details of business not provided within 15 days Rs. 10,000 each time Tax invoice not issued Rs. 10,000 each time Tax invoice not obtained Rs. 1,000 each time Tax invoice not taken for transfer of goods more than Rs. 10,000 from one place to the other Rs. 10,000 each time Unregistered person collected the tax 100% of tax amount Record not maintained as per Sec 16 Rs. 10,000 Record not provided for inspection Rs. 20,000 each time Incomplete record Max. Rs. 5,000 Purchase and sales book not maintained Rs. 10,000 Records not maintained for specified time period Rs. 10,000 Software with amendment facility for digital invoice user or non user Rs. 500,000 Digital invoice issuer, not followed the procedure defined by IRD Rs. 500,00 Non-filer of return 0.05% per day or Rs. 1,000 per return whichever is higher

- 2. Hassel in investigation to Officer Rs. 5,000 each time Under-invoicing Rs. 2,000 for each invoice or 100% of tax or 6 months jail or both (Whichever is higher) Non-compliance of this act Rs. 1,000 each time Evasion of tax Upto 25% of tax Overstocking (Income to be recognized and valuation at market price) Upto 50% of tax Invoice only without actual sale 50% of invoice or 6 months jail or both Non-registration by the person needed to registered 50% of tax False record or fake invoice 100% of tax or 6 months jail or both Evasion of tax through fraud 100% of tax or 6 months jail or both Activity conducted under suspension for 7 days each time due to offence mentioned above conducted for 2 or more than 2 times 100% of tax or 6 months jail or both Inducer 50% of lesser tax Tax non payment 10% fine and 15% interest