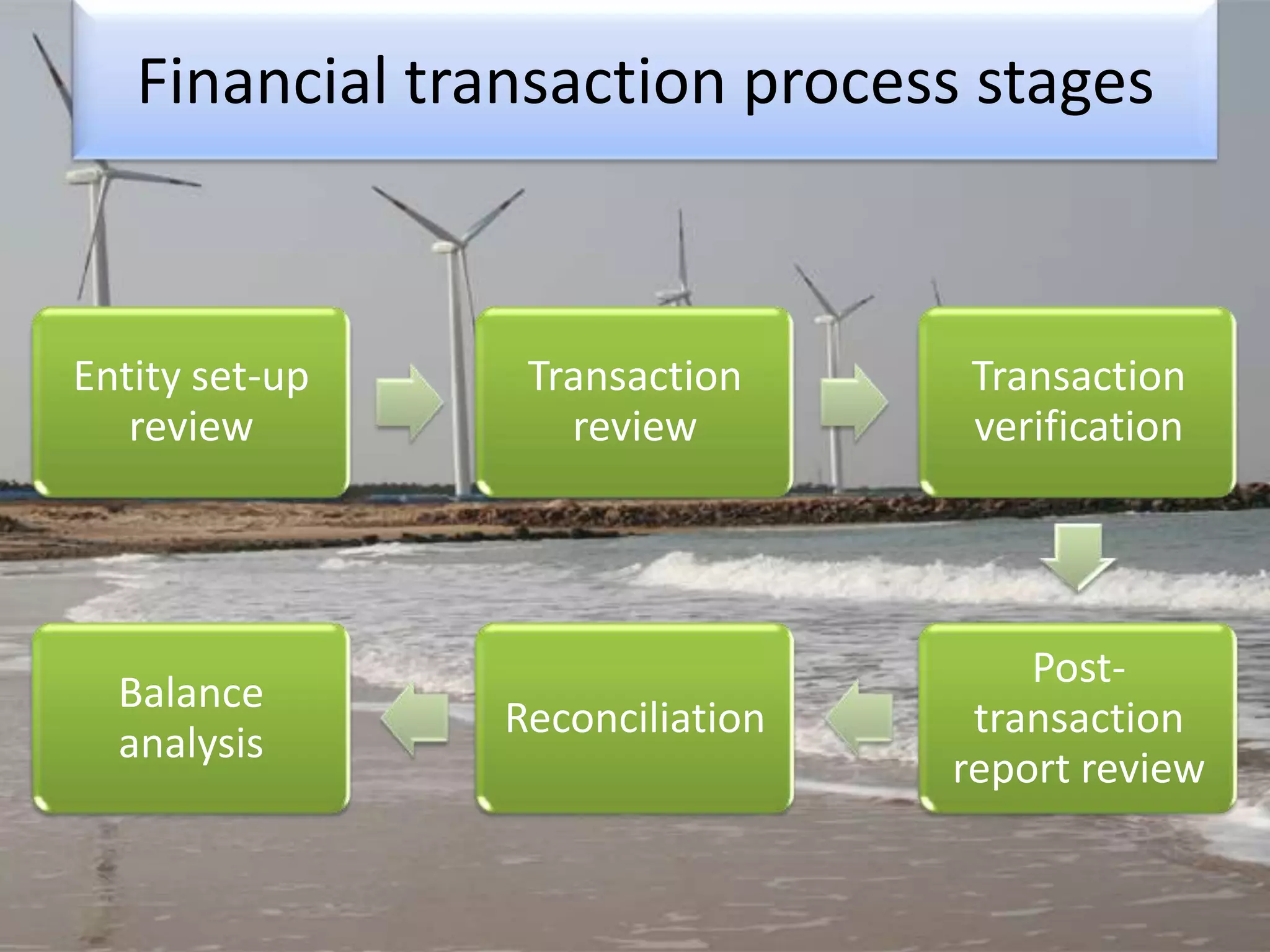

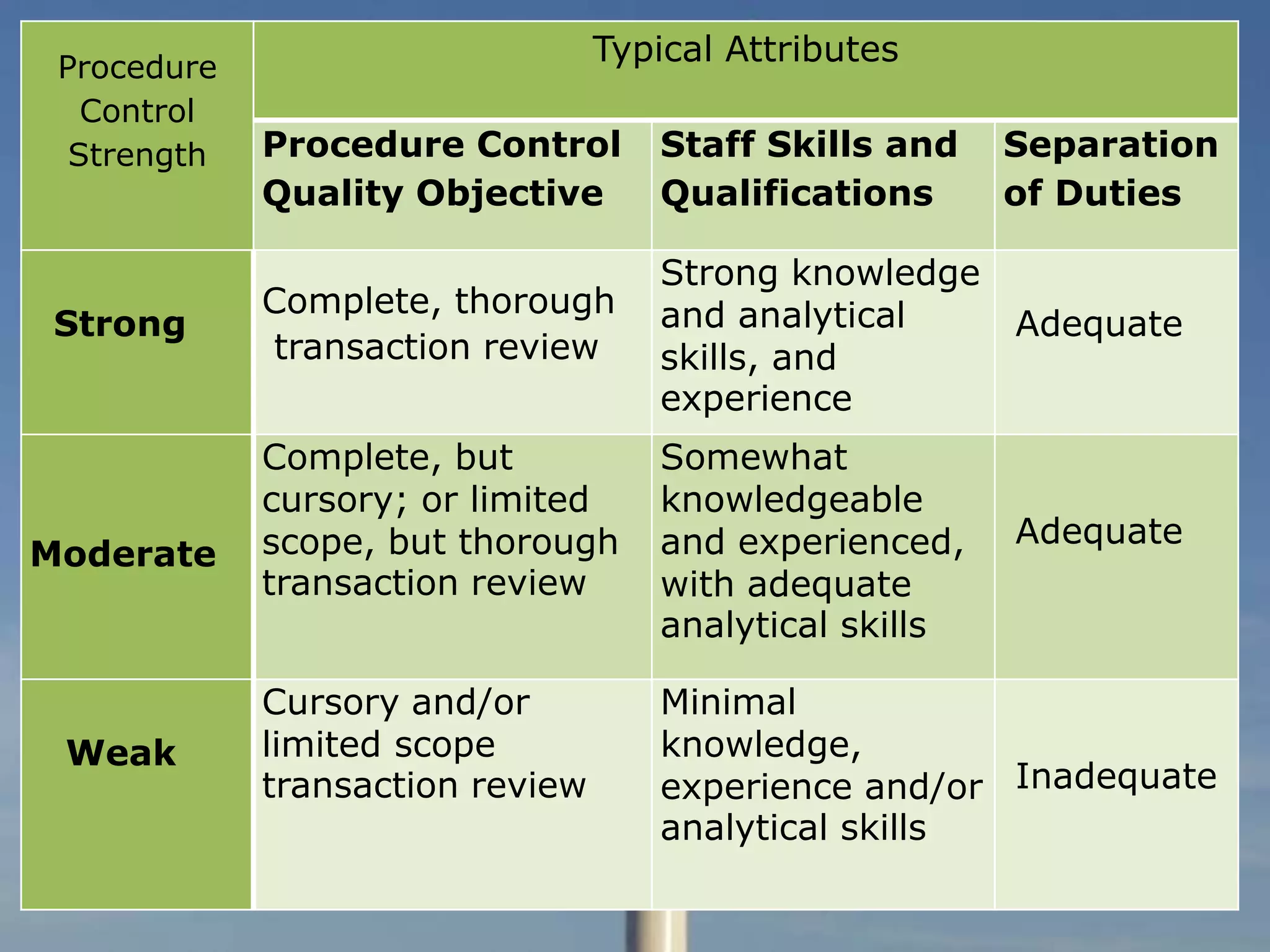

Controlling is an important managerial function that helps minimize errors by setting standards, measuring performance, and taking corrective actions. A financial transaction control procedure detects and prevents errors, misappropriations, and non-compliance in financial transactions. It ensures resources are effectively collected, used, and accounted for. The strength of a control procedure depends on its objectives, the skills of those performing it, and separation of duties within the process. Well-managed financial controls and processes ensure transactions comply with standards and are appropriately recorded in a timely manner.