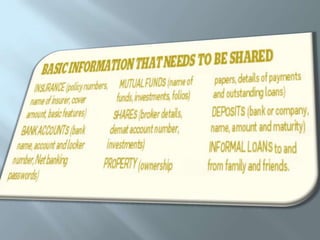

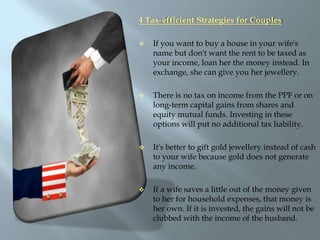

This document contains information about sharing financial decisions with a spouse. It discusses how investing in a spouse's name can help cut taxes. Specifically, it provides four tax-efficient strategies for couples, such as investing in tax-free investments like the Public Provident Fund or equity mutual funds to avoid additional tax liability. The document also discusses how gifting gold jewelry instead of cash to a spouse does not generate any taxable income.