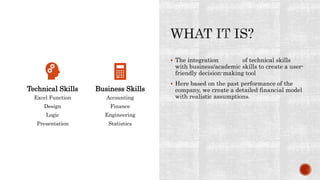

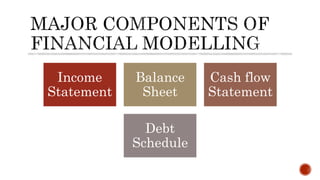

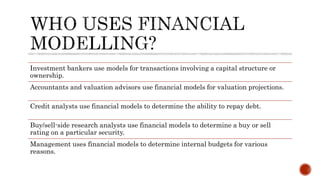

Financial modelling integrates technical skills like Excel with business skills like accounting and finance to create decision-making tools. Models are built using a company's past performance and realistic assumptions to forecast financial statements. Assumptions are key, decreasing uncertainty and gaining investor buy-in. The modelling process involves gathering historical data, calculating ratios and metrics, making informed growth and inventory assumptions, creating forecasts for income statements, balance sheets and cash flows, and valuing the company using discounted cash flows.