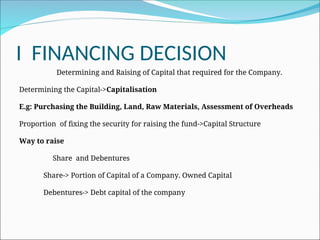

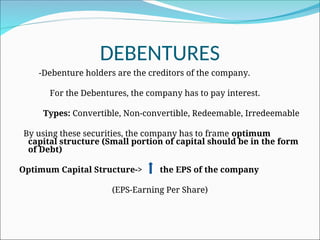

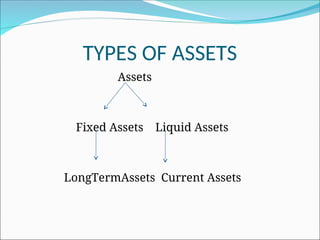

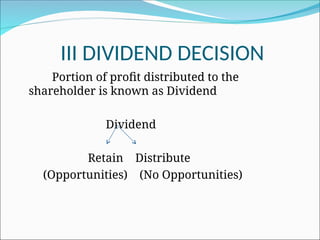

The document outlines the three main functions of business finance: financing decisions, investment decisions, and dividend decisions. It details various forms of capital such as equity and debentures, and discusses the importance of capital budgeting and working capital in investment strategies. Additionally, it addresses dividend distribution to shareholders and suggests assessing a blue-chip company's capital structure for its impact on earnings per share (EPS).