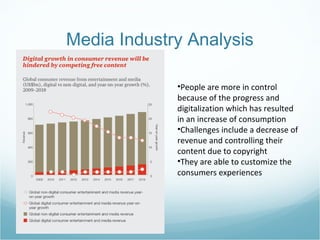

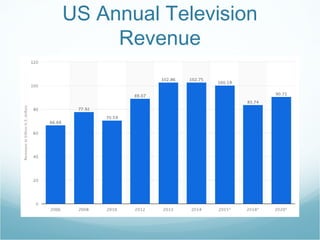

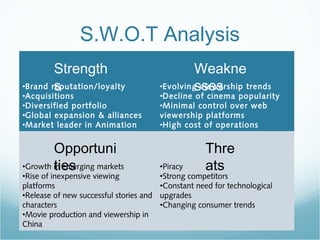

Disney is a leading international entertainment company focused on creating high-quality family content. It has five business segments: media networks, parks and resorts, studio entertainment, consumer products, and interactive media. Disney has seen great success through strategic priorities like innovative technology use and global expansion of its beloved brands. However, it faces challenges from evolving viewership trends and strong competitors in a dynamic media industry.