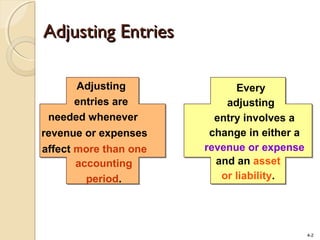

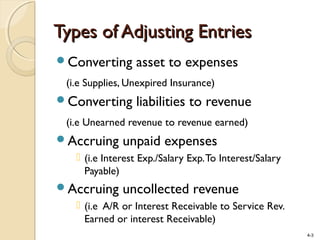

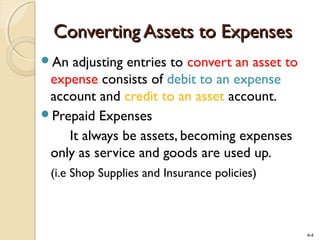

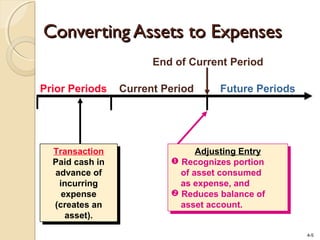

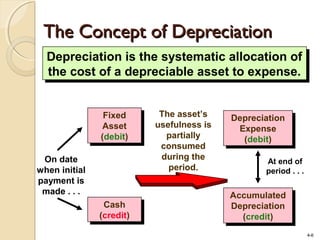

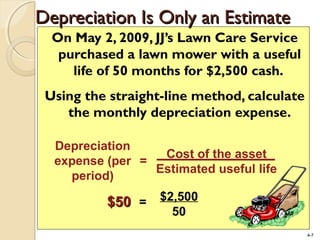

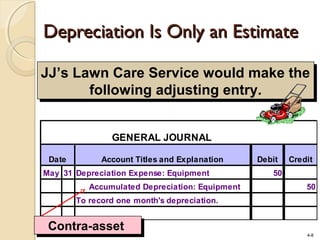

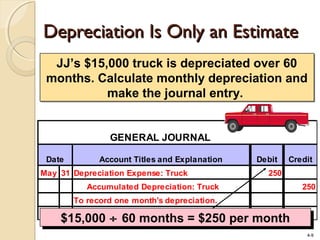

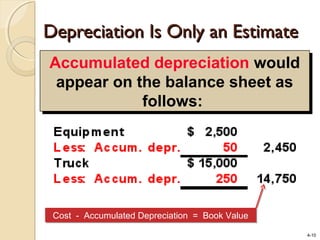

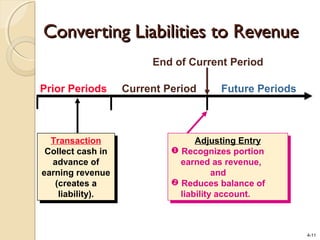

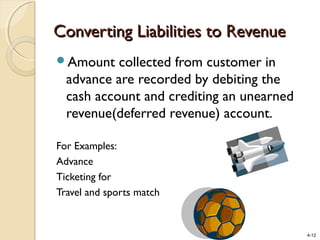

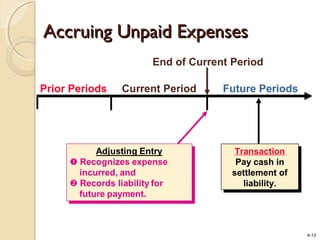

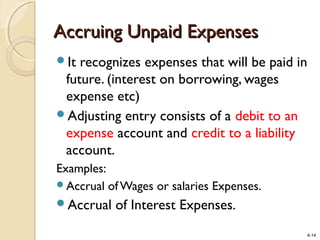

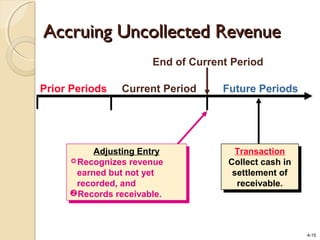

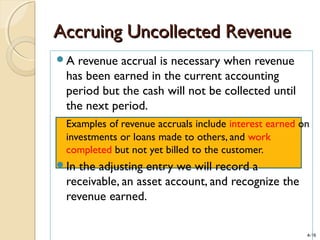

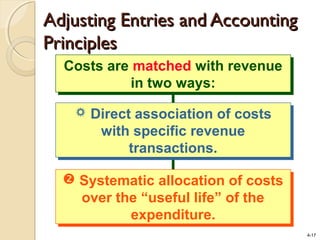

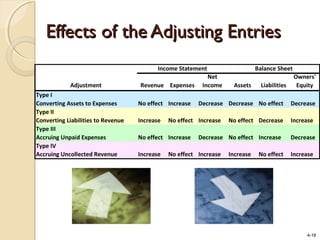

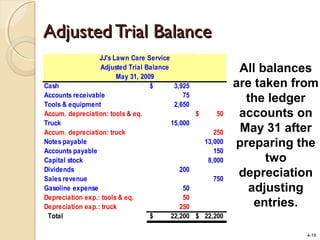

This document discusses adjusting entries in accounting. It explains that adjusting entries are needed when revenue or expenses affect more than one accounting period. There are four main types of adjusting entries: 1) converting assets to expenses, 2) converting liabilities to revenue, 3) accruing unpaid expenses, and 4) accruing uncollected revenue. The document provides examples of each type of adjusting entry and explains how they affect the financial statements. It also discusses key accounting concepts like accruals, deferrals, and depreciation expense.