Financial Analysis

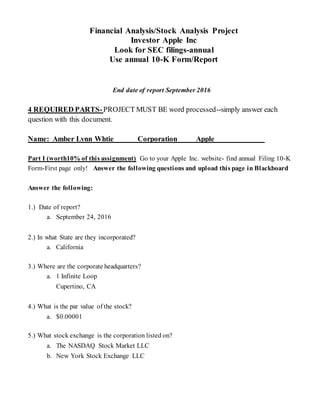

- 1. Financial Analysis/Stock Analysis Project Investor Apple Inc Look for SEC filings-annual Use annual 10-K Form/Report End date of report September 2016 4 REQUIRED PARTS-PROJECT MUST BE word processed--simply answer each question with this document. Name:_Amber Lynn Whtie____ Corporation_____Apple _____________ Part I (worth10% of this assignment) Go to your Apple Inc. website- find annual Filing 10-K Form-First page only! Answer the following questions and upload this page in Blackboard Answer the following: 1.) Date of report? a. September 24, 2016 2.) In what State are they incorporated? a. California 3.) Where are the corporate headquarters? a. 1 Infinite Loop Cupertino, CA 4.) What is the par value of the stock? a. $0.00001 5.) What stock exchange is the corporation listed on? a. The NASDAQ Stock Market LLC b. New York Stock Exchange LLC

- 2. Name: Amber White_________________Corporation_________________________ Part 2 (worth20% of this assignment) List the amounts from the proper Financial Statements; Use the financial statements with the corporations annual report. Then compute the percentage change (increase or decrease) in the following items from the preceding year to the current year. (Use the table format below with columns for “Last Year” “Current Years and “% Change)- Submit this page to your instructor via Blackboard with your name and corporationon it. September 2015 September 2016 From the Balance Sheet (In Thousands) Last Year Current Year % Change Total Current Assets $89,378.00 $106,869.00 20% Total Non-Current Assets $200,967.00 $214,817.00 7% Total Current Liabilities $80,610.00 $79,006.00 -2% Total Non-Current Liabilities $90,380.00 $114,431.00 27% From the Income Statement (In Thousands) Last Year Current Year % Change Total Revenues $233,715.00 $215,639.00 -8% Total Cost of Sales $140,089.00 $131,376.00 -6% Total Expenses $22,396.00 $24,239.00 8% Interest Expense $514.00 $1,316.00 2% Earnings per Common Share $9.28 $8.35 -10% From the Statement of Cash Flows (In Thousands) Last Year Current Year % Change Net Cash Inflow(Outflow) from Operating Activities $81,266.00 $65,824.00 -19% Net Cash Inflow(Outflow) from Investing Activities ($56,274.00) ($45,977.00) 18% Net Cash Inflow(Outflow) from Financing Activities ($17,716.00) ($20,483.00) -16% Net increase (Decrease) in cash during the year $7,276.00 ($636.00) -108%

- 3. Name: Amber Lynn White_________Corporation________________________________ Part 3 (worth 30% ofthis assignment): Using the corporation’s annual financial statements Answer the following questions related to the company and include the page number in parentheses(*) from where you located the answer in the Annual Report. Submit to your instructor via Blackboard with your name and corporation filled in. a) How does the company describe its primary business? a. "The company designs, manufactures and markets mobile communication and media devices, personal computers and portable digital music players, and sells a variety of related software,services, accessories,networking solutions and third-party digital content and applications" (p. 1 of Annual Report for Apple Inc. 2016 Form 10-K) b) How many stores are located in the United States? a. 270 stores in the U.S. (http://www.apple.com/retail/storelist/). "As of September 24, 2016 , the Company owned 7.1 million square feet and leased 22.3 million square feet of building space,primarily in the U.S. Additionally, the Company owned a total of 2,583 acres of land primarily in the U.S." (p. 16 of Annual Report) c) List their most popular product lines a. iPhone is the most popular, proceeded by iPad and Mac. (p. 68 of Annual Report) d) What method of depreciation is used by the company? a. Straight-Line Depreciation (p.48 of Annual Report) e) What inventory method is used to state the value of the company's inventory? a. Apple uses the FIFO method of inventory (p. 48 of Annual Report) f) What is the largest source of cash from financing activities? a. The company's largest source of cash from financing activities is from the issuance of common stock. (p. 43 of Annual Report) f) What is the largest use of cash from investing activities? a. The company's largest use of cash from investing activities is for the purchases of marketable securities. (p. 43 of Annual Report) g) What is the gross margin percentage? a. The gross margin percentage for 2016 is 39.1% (p. 26 of Annual Report) h) How many shares are they authorized to sell? a. They are authorized to sell 12,600,000,000 (p. 41 of Annual Report) i) How many shares are issued? a. There are 5,336,166,000 issued (p. 41 of Annual Report) j) What is the company's "effective tax rate" this recent year? a. The company's effective tax rate of 2016 was 25.6% (p. 56 of Annual Report) k) What major lawsuits are facing the company? a. Infringement of Intellectual Property Rights (p. 17 of Annual Report) l) What Accounting firm serves as the company's Independent Auditor? a. Earnst & Young LLP,Independent Registered Public Accounting Firm (p.71 of Annual Report)

- 4. Name: Amber Lynn White__________Corporation____________________________ Part 4: (Worth 40% of this assignment) Investment Decision/Advice: Prepare a statement of your decision to invest or not to invest in the company's stock based on your interpretationof the company's long-term growthprospects. A yes or no answer is not sufficient. Please use quantitative analysis from Chapter 13, 14 and 15 to support your conclusions. (For example 3 years trend analysis, 3 years current ratio, 3 years debt ratio, 3 years of stock price trends including EPS and P/E ratio) Please Note: to get full credit for this assignment please show all computations. Submit to your instructor via Blackboard withyour name and corporationfilledin. 1.) 3 years trend analysis (All dollar amounts for 1. Are in Thousands) For net sales 2016 2015 2014 Total Net Sales for all Countries: $215,639.00 233,715.00 182,795.00 Percentage Change= ((current year being evaluate- Amount of base year)/Amount of base year) *100 Amount of Change Percentage of change 2016 215639-182795= (32844/182795)*100= $32,844 18% 2015 233715-182795= (50920/182795)*100= $50,920 27% *Base year 2014 182795-182795= (0/182795)*100= $0 0% For net income 2016 2015 2014 Total Net Income: $45,687.00 $53,394.00 $39,510.00 Amount of Change Percentage Change 2016 (45687-39510)= (6177/39510)*100= $6,177.00 16% 2015 (53394-39510)= (13884/39510)*100= $13,884.00 35% *Base Year 2014 (39510-39510) = (0/39510)*100 $0 0% _____________________________________________________________________

- 5. 2. 3 years current ratio Current Assets Current Liabilities Current Ratio= (Current Assets/ Current Liabilities) 2016 $106,869.00 $79,006.00 1.35 2015 $89,378.00 $80,610.00 1.11 2014 $68,531.00 $63,448.00 1.08 __________________________________________________________________________ 3. 3 years debt ratio (Total Assets and Total Liabilities are inThousands) Total Assets Total Liabilities Debt Ratio=(Total Liabilities/Total Assets) 2016 $321,686.00 $193,437.00 0.60 2015 $290,345.00 $170,990.00 0.59 2014 $231,839.00 $120,292.00 0.52 4. 3 years stock price trends Market Price Per Share Trend % = (Period Amount/Base Period Amount)*100 2016 99.25 111% 2015 124.24 139% *Base2014 89.39 100% _____________________________________________________________________________ 5. 3 years EPS Earnings Per Share= (Net Income-Preferred Dividends)/Weighted average number of common shares outstanding Net Inc. (In Thousands) Preferred Div. WANCSO (In Thousands) EPS 2016 $45,687.00 0 5,470.82 8.35 2015 $53,394.00 0 5,753.42 9.28 2014 $39,510.00 0 6,085.57 6.49 6. 3 years P/E ratio= Market Price Per Share of Common Stock/Earnings Per Share Market $ per share of Common Stock Earnings per share P/E Ratio 2016 99.25 8.35 11.89 2015 124.24 9.28 13.39 2014 89.39 6.49 13.77

- 6. Please make your recommendation whether to buy this stock or not based on the long term growth aspects, based on the information you just provided and any other information you may have researched. Submit to your instructor via Blackboard with calculations shown. All of the analysis' provided above, show the company's position is generally trending to the positive. Though the comparison between this year and last year seems to have taken a small dip by some of the analysis, overall the company's health seems to be improving since 2014. The dip in numbers may be attributed more to the lack of new products, lack of interest in new products, or the technology field's volatile nature. The percentage change between the three years of net income and net sales shows the percentage has decreased slightly from last year to this year. The SEC Filings address a potential reason for this on p. 9. The market in which Apple competes is extremely competitive, and they cannot be certain new products from year to year will be more popular than the previous years'. Due to this fact, it seems there's a possibility the new products introduced over the last year were not as well received as in 2015. This could change, and the company strives to assess a new product before bringing it to the market. The stock price trend analysis, P/E analysis, and Earnings Per Share computations all also showed a slight decrease since last year, and more significant different between 2014&2015, and 2014&2016. This was also addressed in the Annual Report on p. 15. The company's industry has had extreme fluctuation over the last year in the market, but this does not affect the operation of the company, which continues to grow successfully. "If the Company fails to meet expectations related to future growth, profitability, dividends, share repurchases or other market expectations, its stock price may decline significantly, which could have a material adverse impact on investor confidence and employee retention" (Ernst & Young LLP, 2016) . This explanation would make any reader leery of the technology department. Anyone looking at this report could see that investing in this company would pose a risk that

- 7. cannot be certain, due to all of the variables of the technology department and the actual products brought to the market by Apple Inc. The three year debt and current ratio computations suggest the company is overall improving with managing their debt and assets. These ratios provide more insight into the company's business management progress, whereas the computations including market prices are less likely to be significantly controlled by the company. Overall, my suggestion would be to purchase stock in this company. It appears the company has specific goals it will attempt to achieve within the next year, and the stock price is the lowest it's been in three years, so there is room for your investment potential to be high. Apple Inc. is a strong competitor in the technology field, and is rivaled by few. This company has hit a small dip, which means an investor may buy stock at a lower price, and watch the stock rise after holiday shopping commences, and the company introduces new products this year. Resources Ernst & Young LLP. (2016). UNITED STATES SECURITIES AND EXCHANGE COMMISSON. SEC Annual Filing, San Jose.