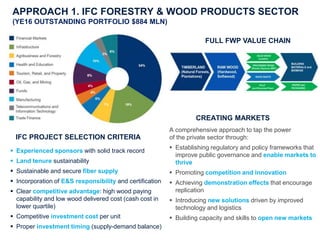

The document outlines the Integrated Solutions approach of the IFC, focusing on mobilizing capital for investment in sectors such as forestry, green bonds, and climate-smart projects. It emphasizes creating regulatory frameworks to enhance market performance, promoting competition and innovation, and investing in sustainable initiatives to support environmental and social governance. Key investment strategies include establishing robust project selection criteria, managing IFC's green bond program, and innovative financial instruments aimed at forest conservation and carbon credit markets.