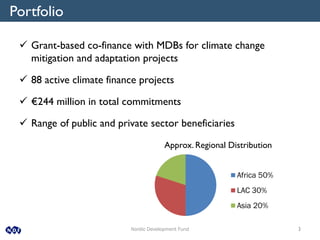

The Nordic Development Fund is owned by five Nordic countries and focuses exclusively on climate change and development projects in low and lower-middle income countries. It has total assets of 880 million and provides grant-based co-financing for 88 active climate finance projects totaling €244 million. Under its new 2016 strategy, the Fund will focus on catalyzing private sector investment, supporting climate innovation, and piloting high-risk climate interventions through grant and blended financing.