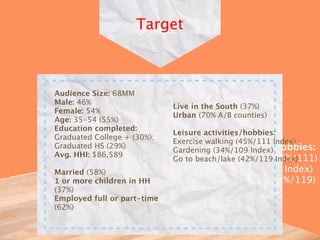

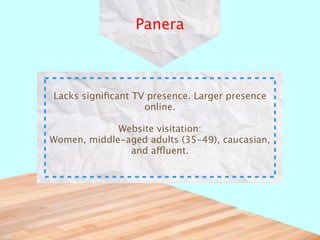

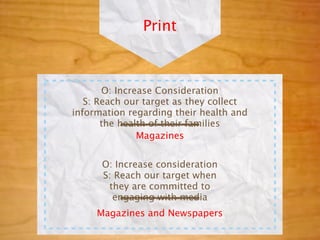

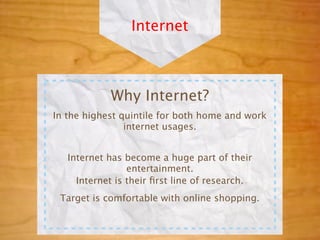

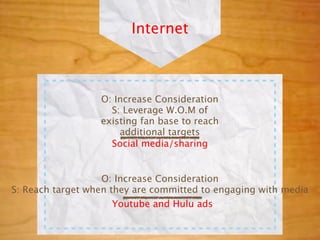

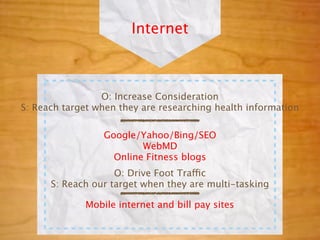

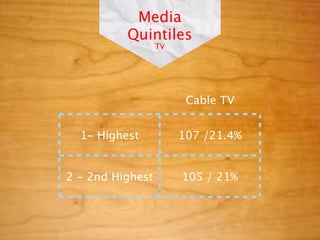

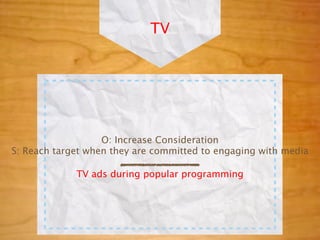

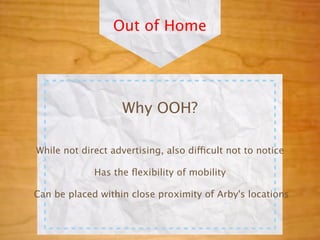

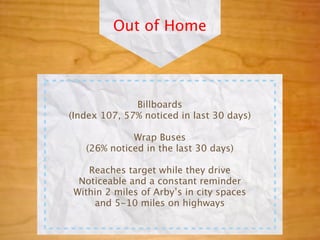

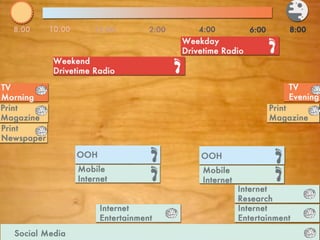

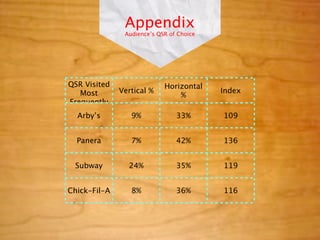

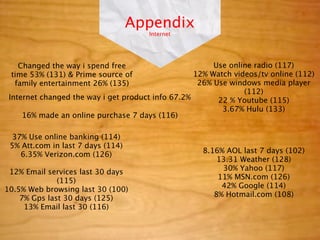

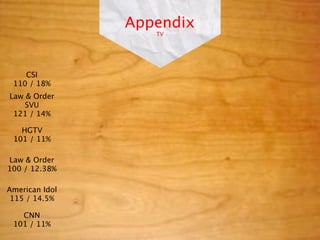

Arby's is developing a new branding initiative to grow its core audience and become more competitive. It is considering targeting an audience of 68 million adults aged 35-54 who value quality, health, and family. The document outlines strategies and tactics for reaching this target audience across various media channels, including TV, radio, print, internet, and out of home advertising. Key tactics include radio ads during weekday and weekend drive times, magazine ads in titles related to health and home, and video ads on YouTube and Hulu.

![Target

I try to eat healthier food these days [any

agree] AND

Fast food fits I don’t have I like the

my busy time to trend towards

OR OR

lifestyle (any prepare/eat healthier fast

agree) healthy meals food [any

AND I eat the foods I like regardless of

calories [any agree]](https://image.slidesharecdn.com/finalarbyskeynote-120507202702-phpapp01/85/Final-arby-s-keynote-4-320.jpg)