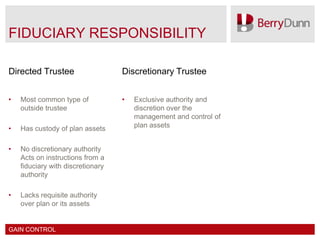

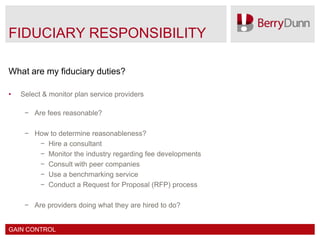

This document discusses fiduciary responsibilities for retirement plans. It defines what it means to be a fiduciary, including acting solely in participants' interests, prudently, following plan documents, diversifying investments, and paying reasonable expenses. Fiduciaries must select and monitor service providers and investments prudently. Failure to do so can result in legal and financial liability. The document provides tips for fiduciaries to protect themselves such as obtaining insurance and properly documenting their processes.