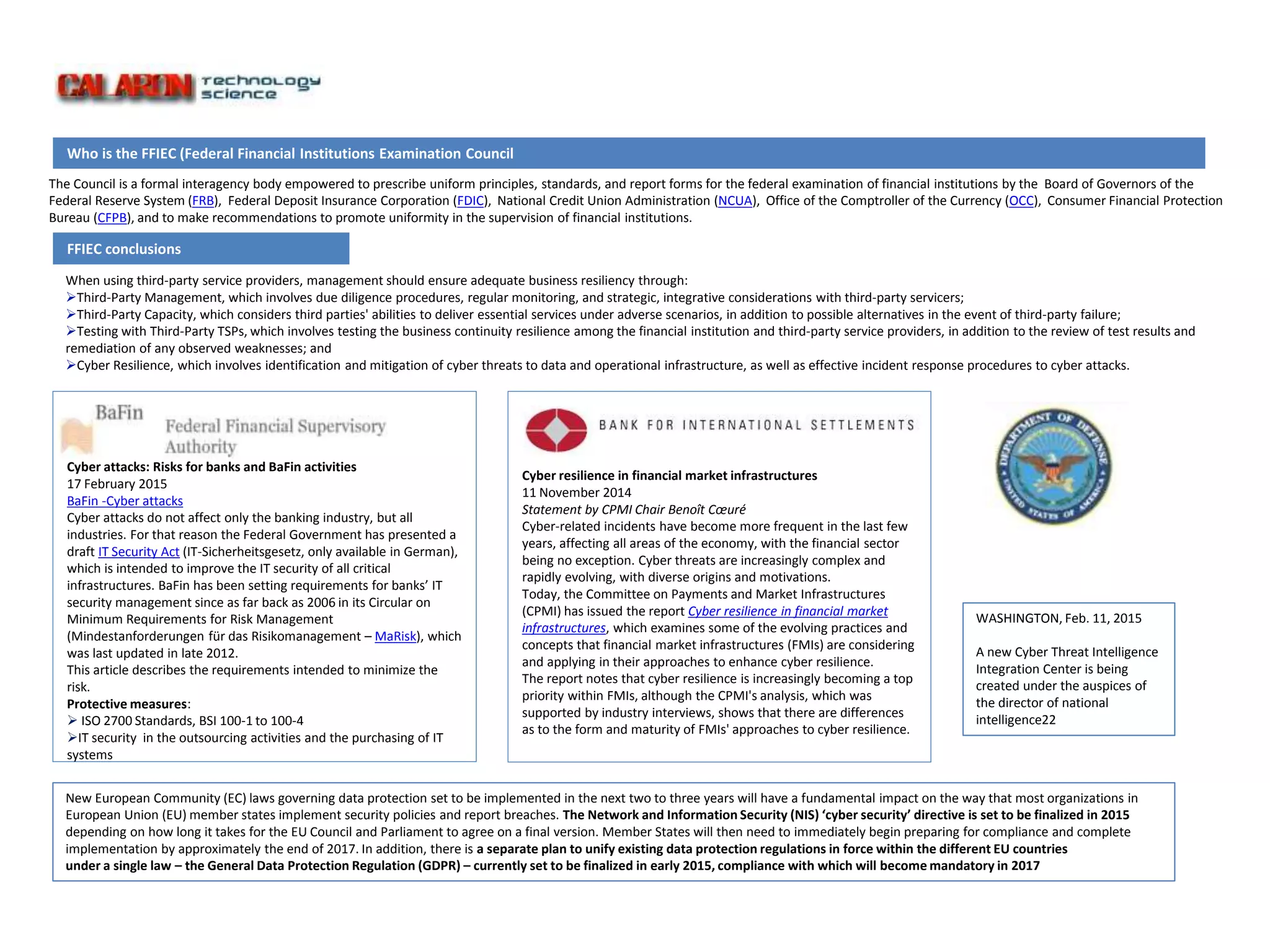

This document discusses the importance of cyber resilience for financial institutions when working with third-party service providers. It recommends that institutions implement: 1) third-party management procedures to oversee third parties, 2) ensure third parties can still deliver services during adverse scenarios, 3) test business continuity with third parties, and 4) identify and mitigate cyber threats. The FFIEC sets uniform standards and examines financial institutions, while the CPMI examines practices to enhance cyber resilience in financial market infrastructures.