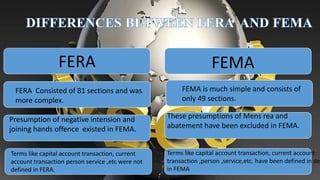

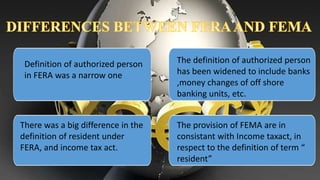

The document discusses India's foreign exchange market and the regulations governing it. The Reserve Bank of India regulates the market under the Foreign Exchange Management Act of 1999 (FEMA), which replaced the older Foreign Exchange Regulation Act (FERA). FEMA aims to make offenses civil rather than criminal and simplifies regulations. Authorized dealers like exporters, importers, corporations, and non-residents participate in the market. FEMA's objectives include facilitating trade and payments, maintaining an orderly exchange market, and regulating foreign capital and payments in India.