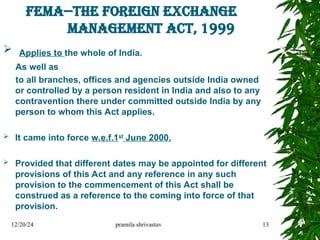

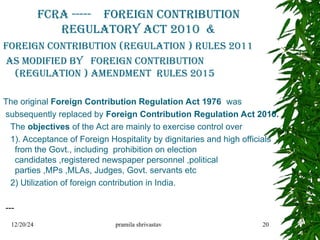

The document discusses cross-border transactions, detailing their types such as financing, trading, and shared services, and the regulations governing exchange control. It outlines the evolution of related laws in India, specifically the Foreign Exchange Management Act (FEMA) and the Prevention of Money Laundering Act (PMLA), highlighting their objectives and distinctions from previous legislation. Additionally, it emphasizes the implications of these laws on foreign contributions and the enforcement actions taken against violations.

![THE BLACK MONEY ACT - EXEMPT

THE BLACK MONEY (UNDISCLOSED FOREIGN INCOME

AND ASSETS) AND IMPOSITION OF TAX ACT, 2015

NO. 22 OF 2015 [26th May, 2015.]

An Act to make provisions to deal with the problem of the Black money

that is undisclosed foreign income and assets, the procedure for dealing

with such income and assets and to provide for imposition of tax on any

undisclosed foreign income and asset held outside India and for matters

connected therewith or incidental thereto.

THE RULES FRAMED UNDER THE NEW LAW PROVIDE FOR

EXEMPTION FROM PROSECUTION UNDER FEMA TO THOSE

DISCLOSING THEIR ASSETS.

RBI on 30TH

SEPTEMBER said no action under FEMA will be taken against

declarations under one-time black money compliance window, which ends on

Wednesday.

In a communication to banks, the Reserve Bank said: "No proceedings shall lie

under the Foreign Exchange Management Act, 1999 (FEMA) against the

declarant with respect to an asset held abroad for which taxes and penalties

under the provisions of Black Money Act have been paid." RBI has already

notified the Foreign Exchange Management Regulations, 2015, in this regard.

12/20/24 pramila shrivastav 30](https://image.slidesharecdn.com/13-241220093357-35c7b0fc/85/13-NJA-PRESENTATION-ppt-cross-border-transaction-30-320.jpg)