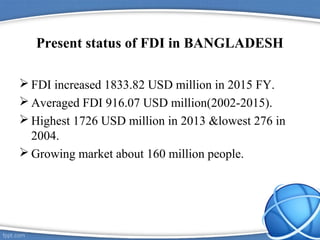

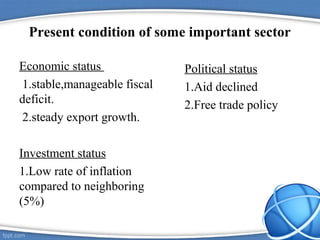

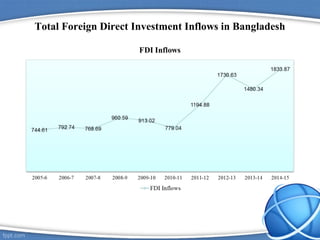

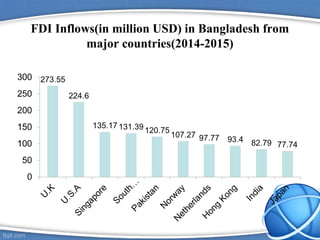

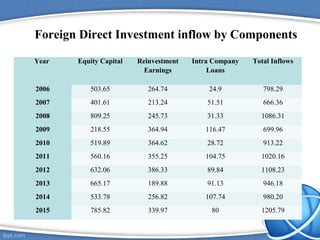

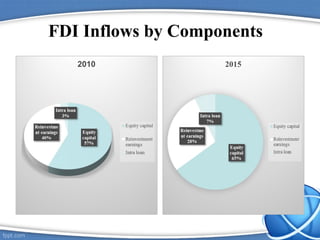

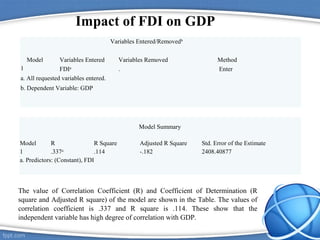

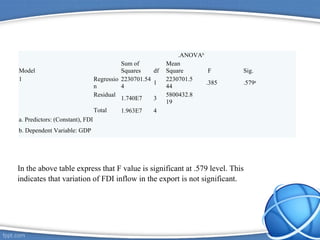

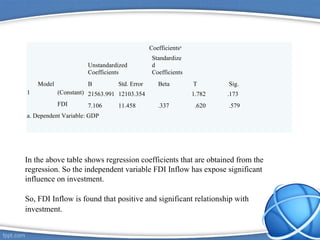

FDI refers to foreign direct investment, which occurs when a firm invests directly in facilities to produce or market a product in a foreign country. The presentation discusses FDI in Bangladesh, including factors that affect the country's FDI climate such as infrastructure, financial infrastructure, technological infrastructure, and international integration. It also examines variables related to FDI, including GDP, exports, and domestic investment as dependent variables, and FDI inflows as the independent variable. Regression analysis is used to show the impact of FDI inflows on GDP, finding a positive but not statistically significant relationship.