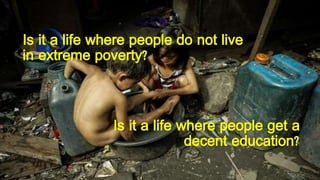

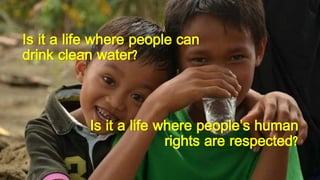

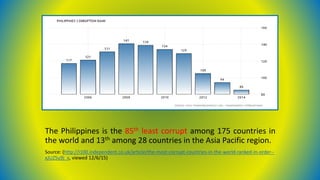

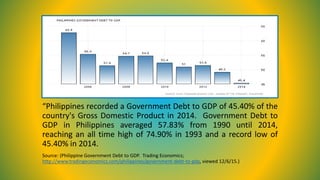

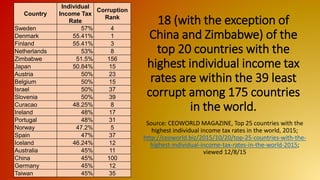

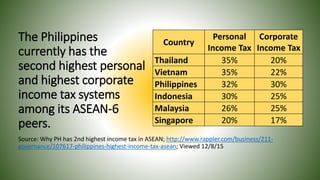

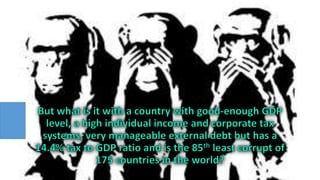

This document discusses development and sustainable development goals. It focuses on the Philippines, examining its levels of corruption, government debt, tax rates, and other economic indicators. It argues that for the Philippines to progress towards achieving the UN's 17 sustainable development goals, it will need to improve its taxation capacity, curb illicit financial flows, and strengthen governance and the rule of law. Addressing these issues would help the country mobilize domestic resources and contribute to achieving global development targets.

![Universality implies that all countries

will need to change, each with its own

approach, but each with a sense of the

global common good.

[Outcome document of the United Nations

Conference on Sustainable Development

(Rio+20), “The future we want”]](https://image.slidesharecdn.com/fddmooc-finalproject-mateoty-151209142739-lva1-app6891/85/Fddmooc-final-project-mateo-ty-32-320.jpg)