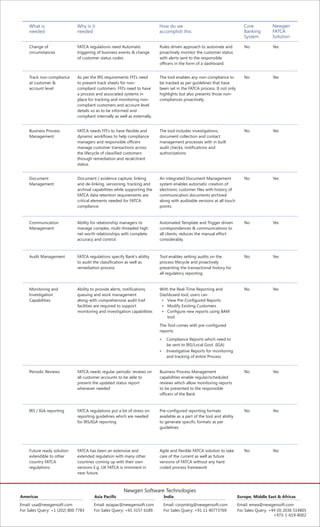

The document outlines the necessary steps for enterprises to achieve compliance with FATCA regulations, emphasizing the need for meticulous planning and specialized roles. It discusses various components of a FATCA-compliant framework, including data capture, review processes, monitoring, and audit management, alongside the flexible adaptability of systems to accommodate future regulatory changes. A robust information management system is highlighted as essential for ensuring compliance while maintaining operational efficiency.