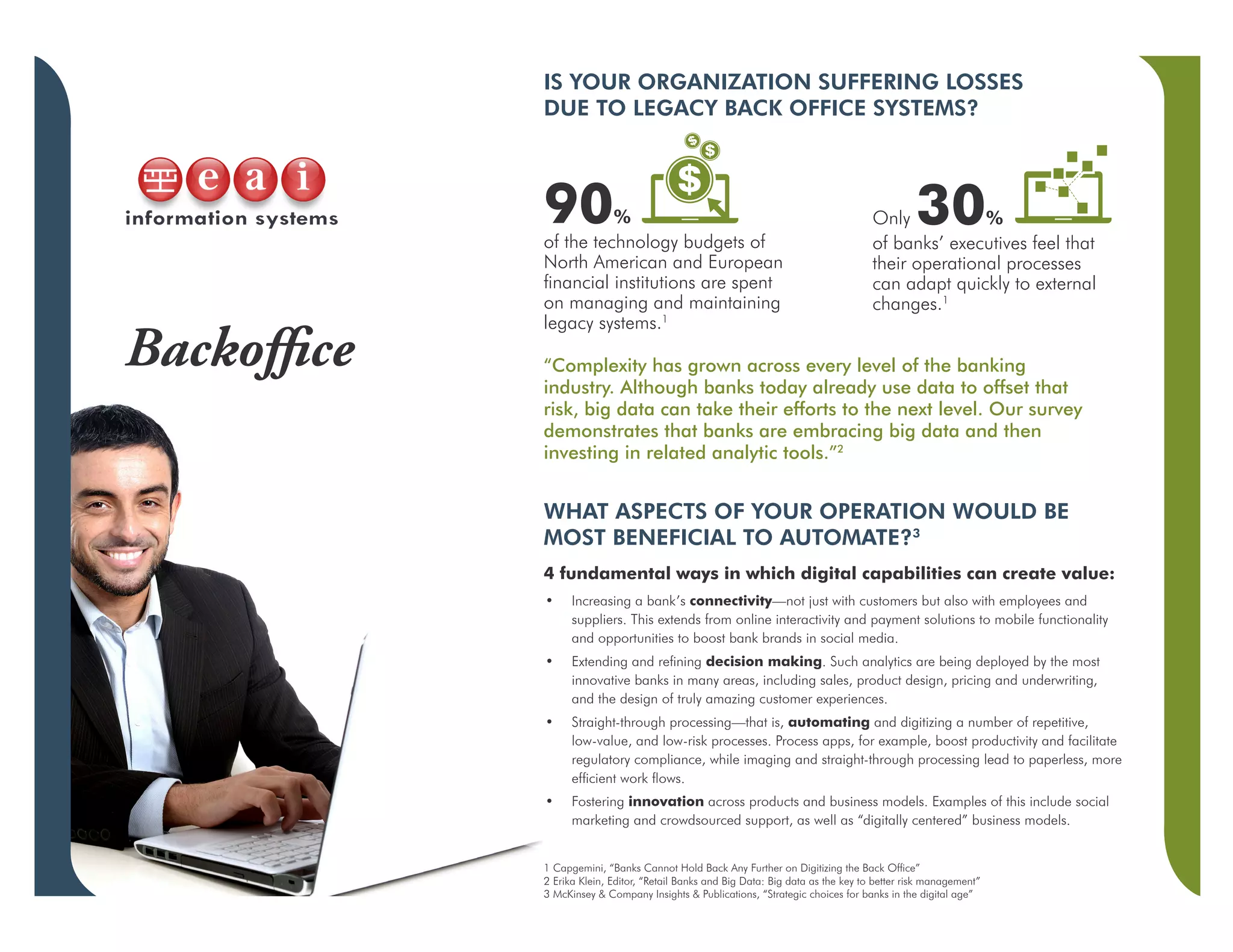

The document discusses the challenges faced by banks due to outdated legacy systems and emphasizes the importance of digital transformation in enhancing connectivity, decision-making, and operational efficiency. It highlights the critical role of big data and compliance in risk management, noting that many banking executives feel their data capabilities are lacking. Furthermore, it underscores the need for effective anti-money laundering programs and the automation of processes to improve transparency and efficiency within financial institutions.