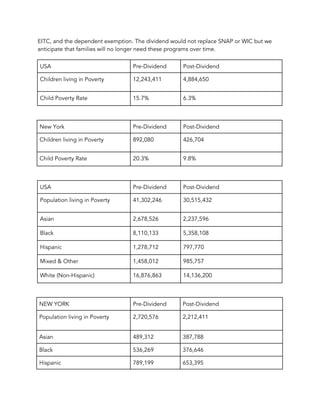

This document proposes policies to address child poverty and economic insecurity for families in the United States. It discusses high levels of child poverty and economic inequality compared to other developed nations. Specific policies proposed include universal health insurance for children, expanded access to affordable and high-quality child care and early education, paid family and medical leave, and providing families with direct cash benefits rather than only in-kind assistance. The goal is to improve economic opportunities and outcomes for children through investments that support families and level the playing field.