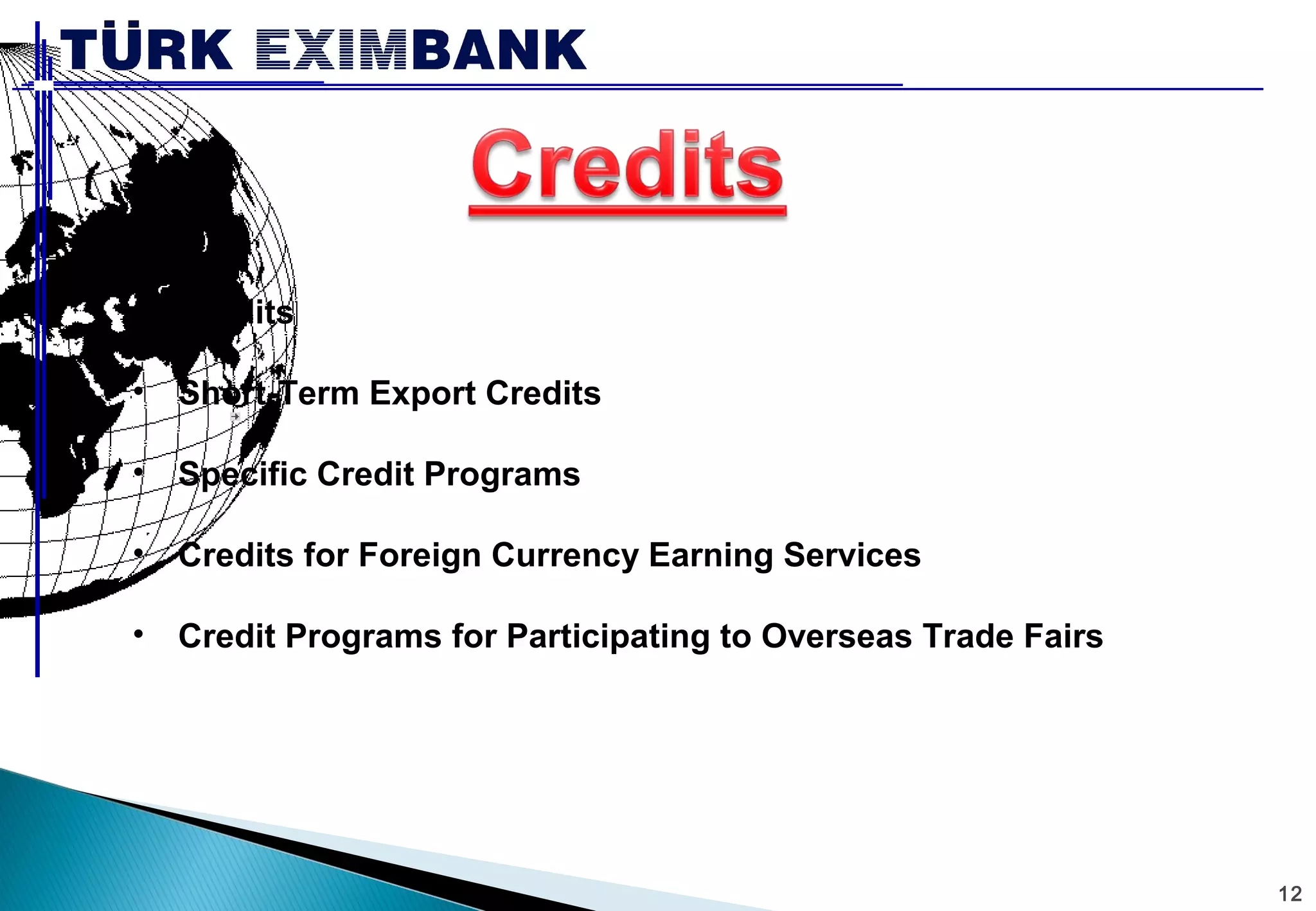

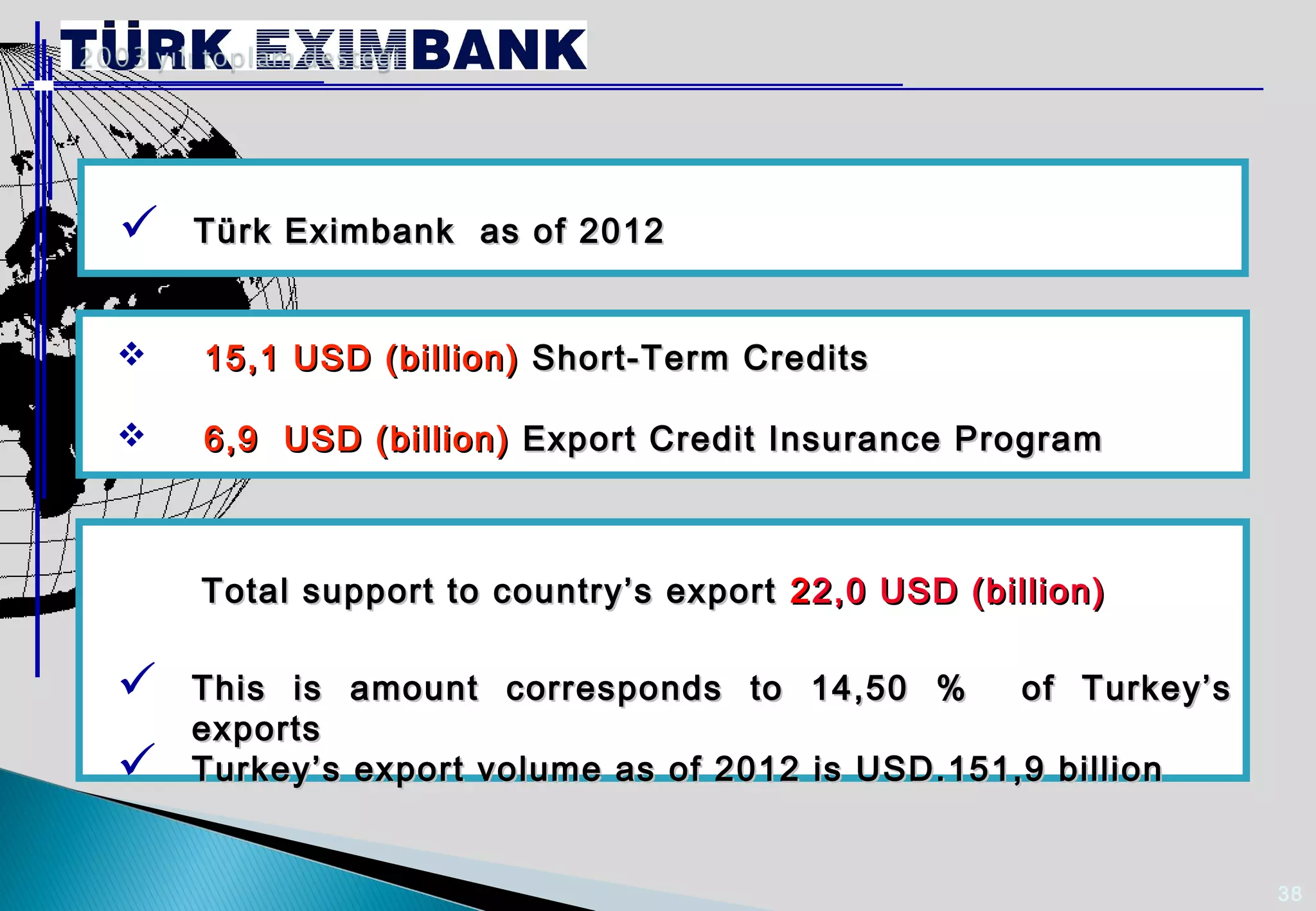

Türk Eximbank was established in 1987 by the Turkish government to support the country's export growth strategy. It provides various credit, guarantee, and insurance programs to Turkish exporters, contractors, investors, and companies earning foreign currency. These include short, medium, and long-term cash credits as well as non-cash programs. Türk Eximbank works closely with commercial banks in Turkey to encourage export financing. It aims to conform to international standards set by organizations like the OECD.