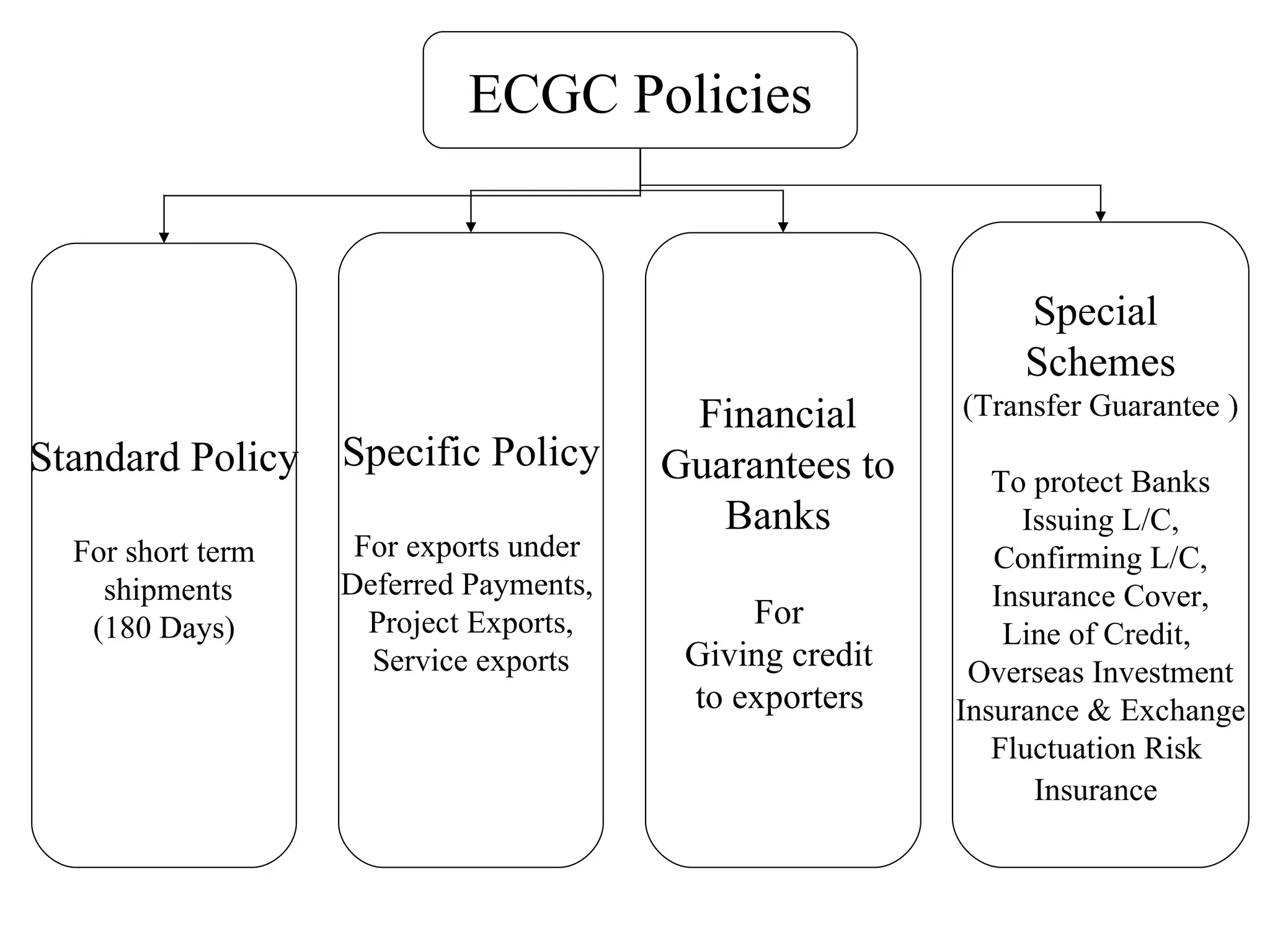

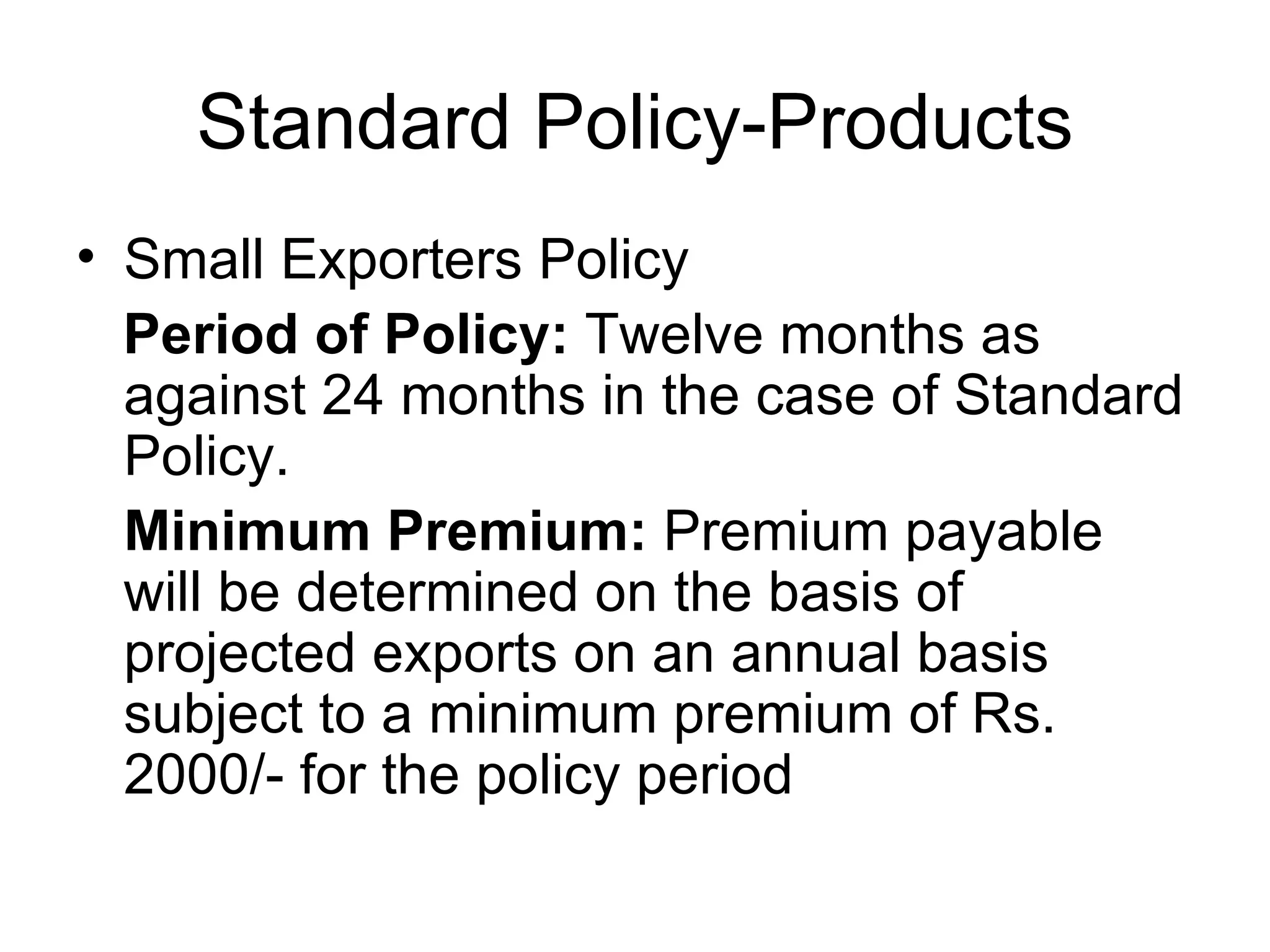

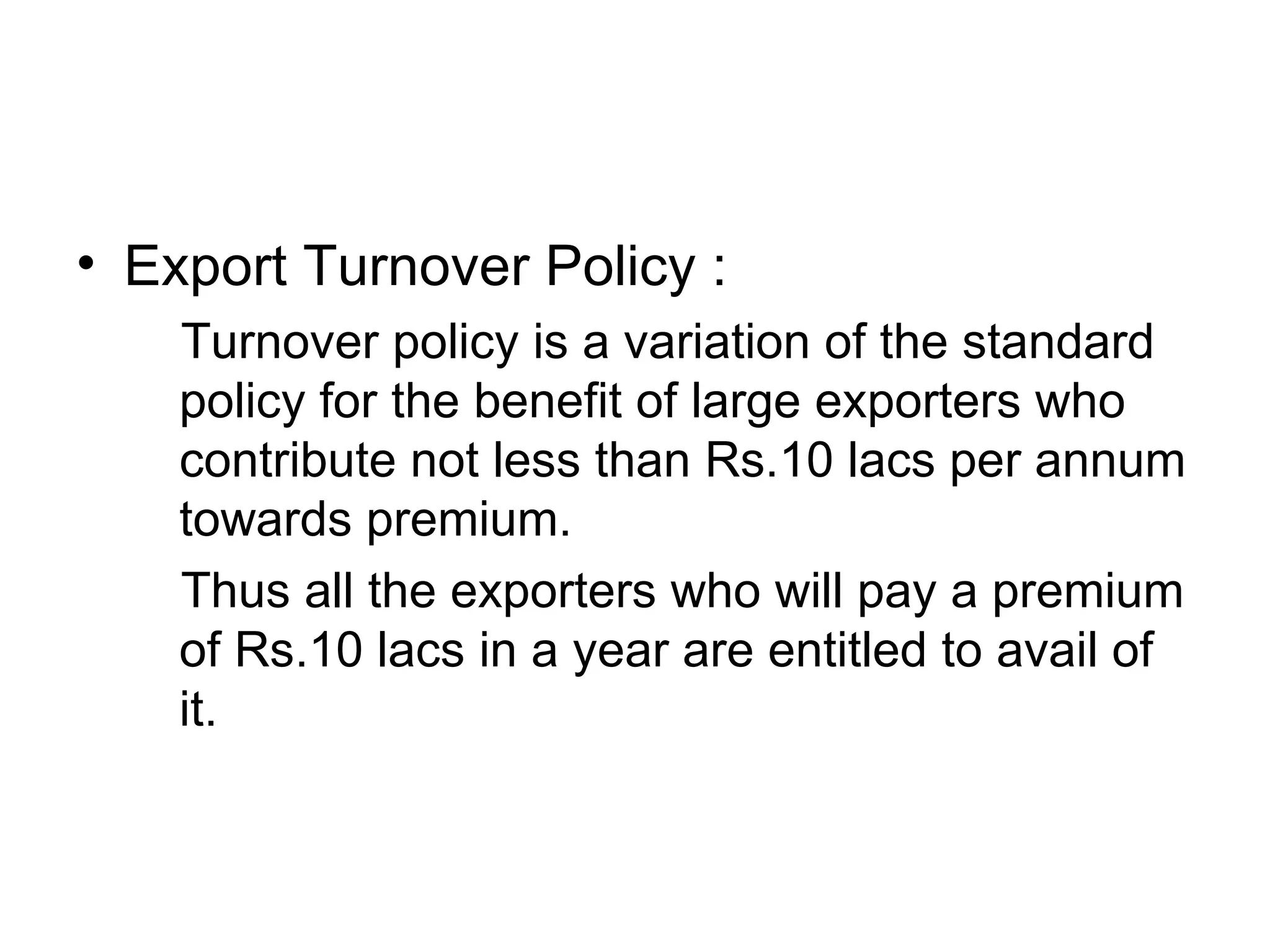

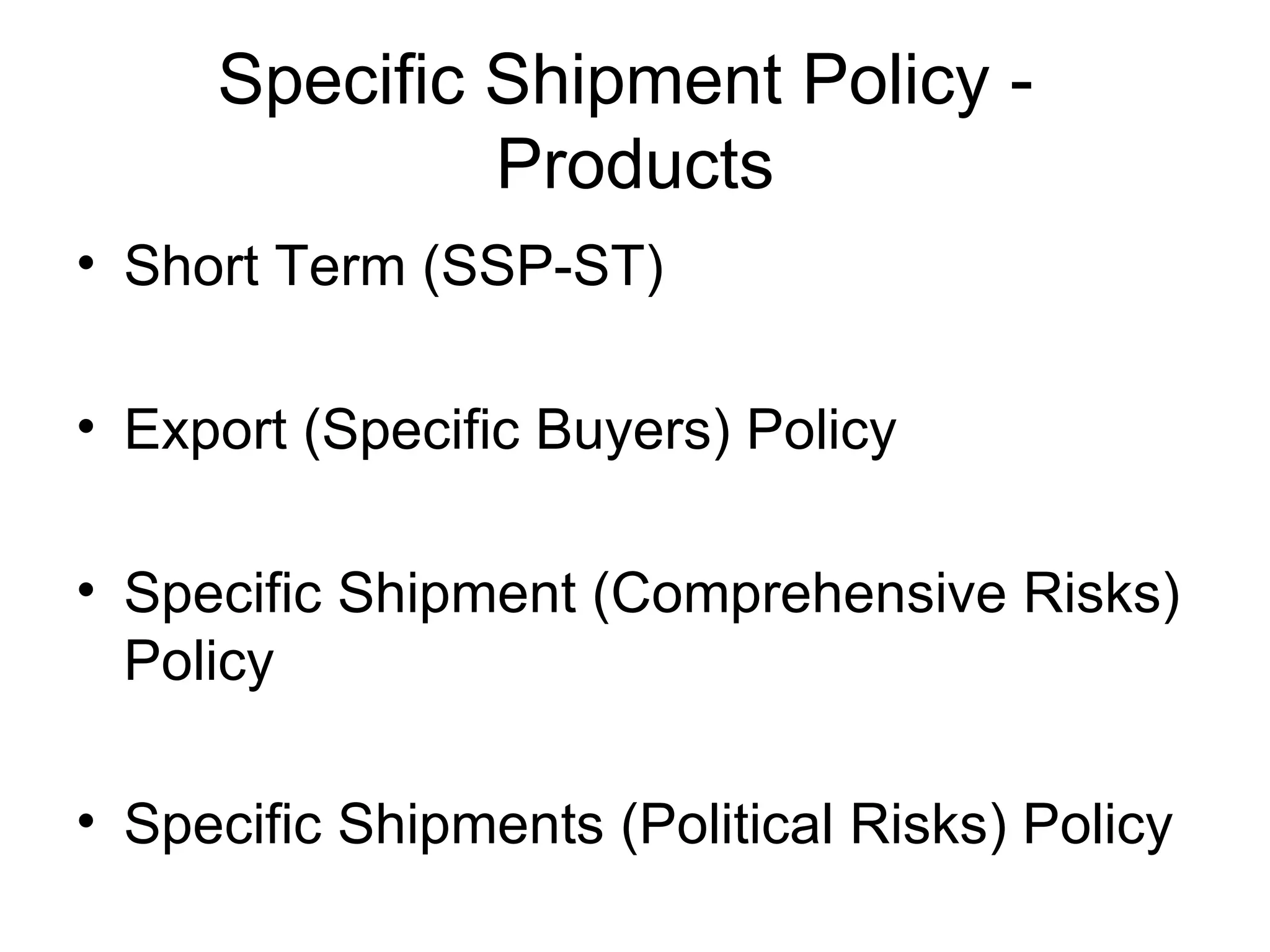

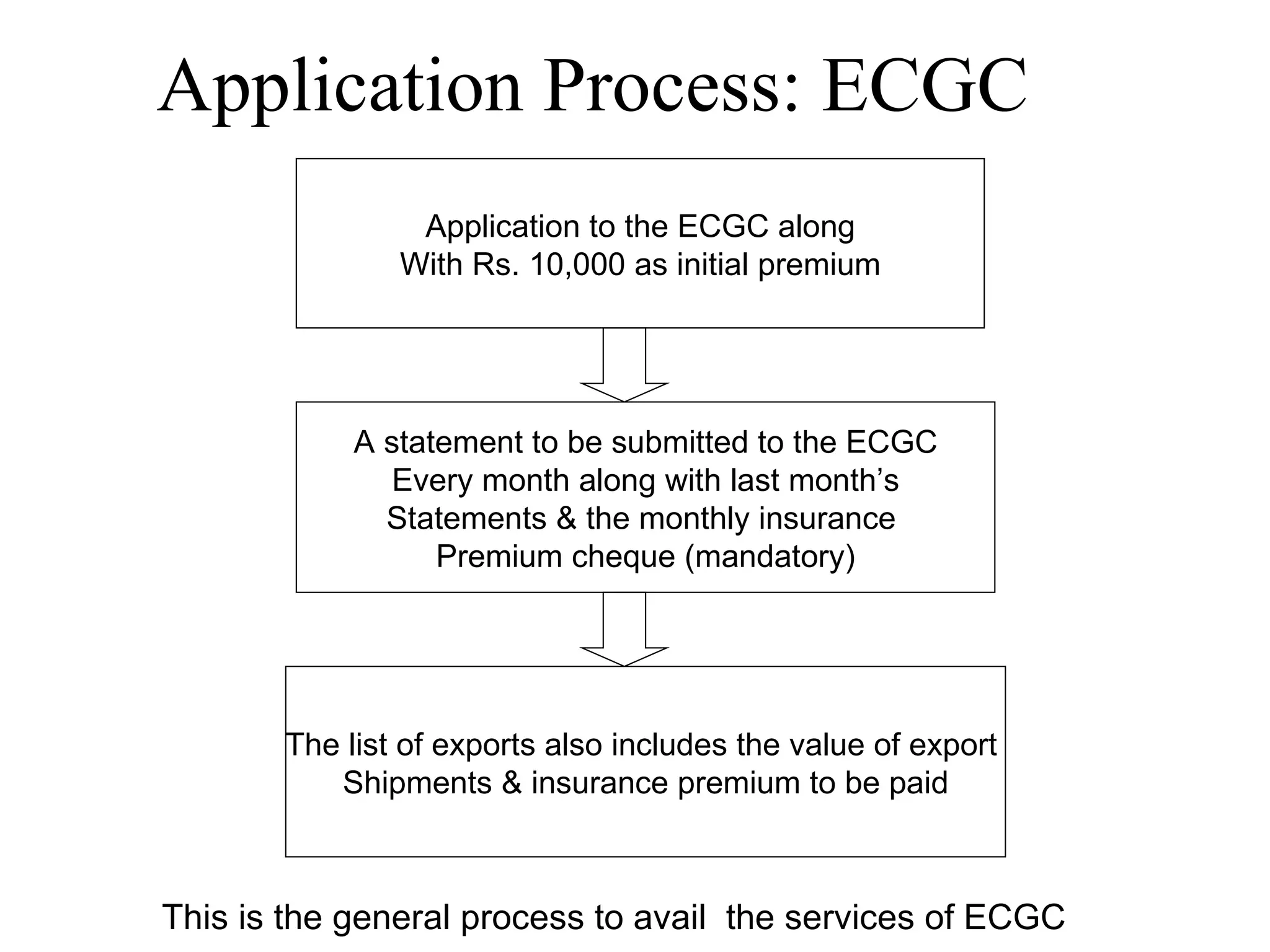

ECGC is India's export credit insurer that was established in 1957. It provides credit insurance and guarantees to Indian exporters against losses from payment defaults. ECGC offers various policies like specific, standard, and turnover policies that insure exporters against risks like foreign buyer default, political upheaval, and currency fluctuations. It also provides guarantees to banks to enable exporters to obtain better financing terms. To avail of ECGC's services, exporters must submit an application along with documents and pay initial and monthly premiums.