Korea Eximbank has extensive experience financing oil and gas projects globally and in Iran. It has provided over $11 billion for projects in the Middle East including $625 million for South Pars Phase 9 and 10 in Iran. The bank utilizes framework agreements and provides loans, guarantees, and financial advisory services to support sectors like oil and gas, infrastructure, and healthcare. It has worked with other export credit agencies on large projects and aims to be a total financial solutions provider for Korea-Iran economic partnerships.

![KEXIM: Total Financial Solution Provider

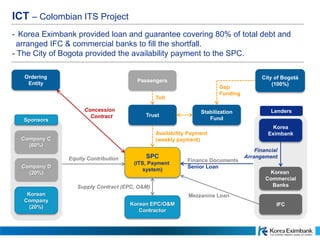

Korea Eximbank’s support for diverse industrial projects ranges from loans and

guarantees to financial advisory/arrangement services and equity investment.

Project

Company

Off-taker

Loan

Sponsors

(Korean)

[Sponsors]

Sponsors

Equity

Investment

Korea Eximbank

Guarantee

Loan

Financial Advisory Service

Financial

Arrangement

Other ECAs, MDBs

[Lenders]

EPC Contractor

Loan

O&M Contractor

Guarantee

Equity Investment

Commercial Banks

Fund

Fund Investment](https://image.slidesharecdn.com/eximbankfinancingprocess-180202070845/85/Exim-bank-financing-process-20-320.jpg)