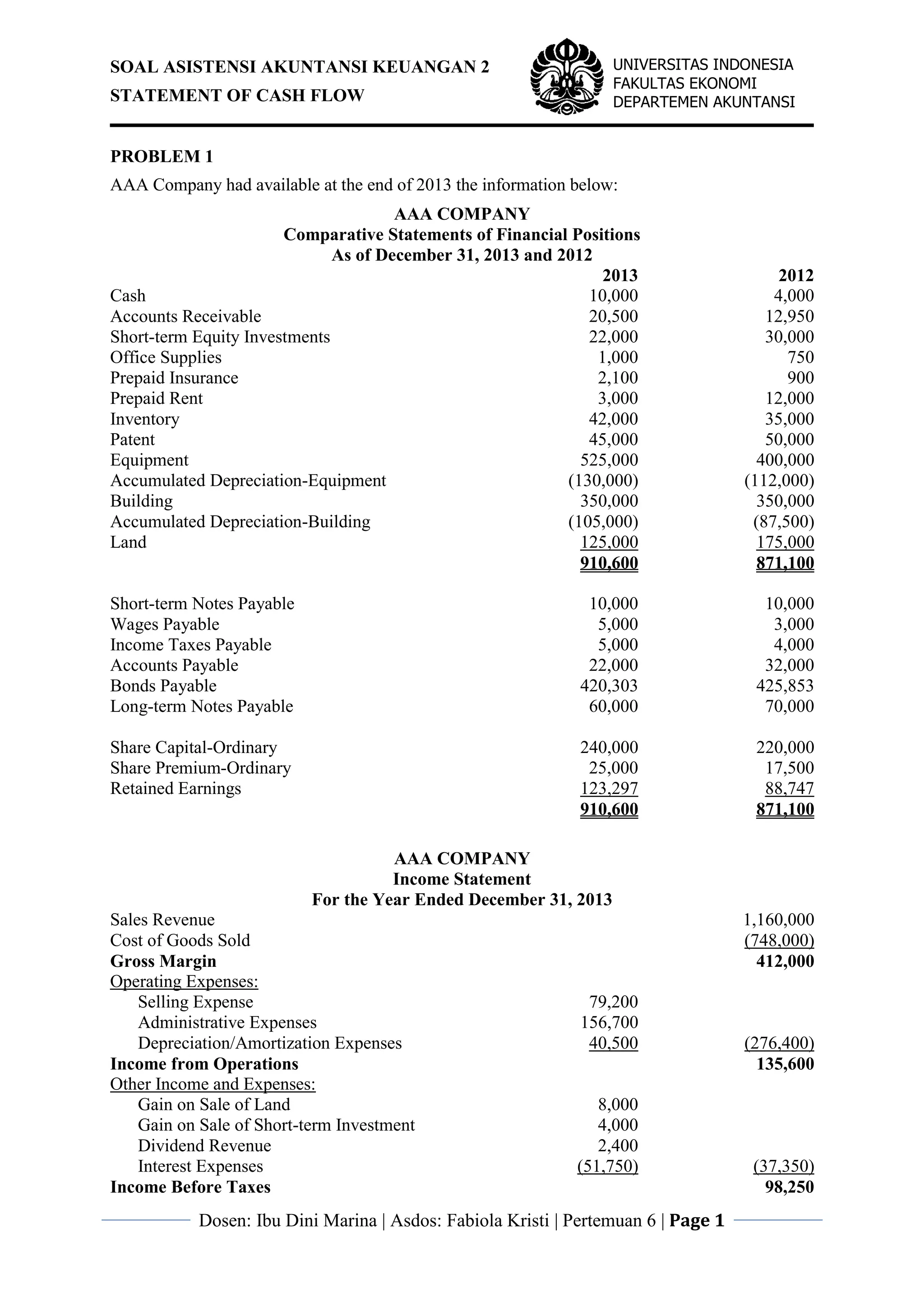

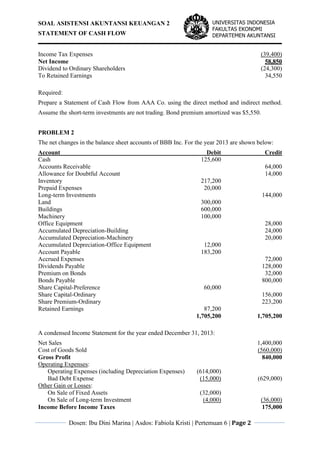

The document provides financial information for AAA Company and BBB Inc. including comparative balance sheets, income statements, and notes. It asks to prepare statements of cash flows for both companies using direct and indirect methods. For AAA Company, additional information includes bond premium amortization. For BBB Inc., additional information provides details on various cash flow transactions for the year.