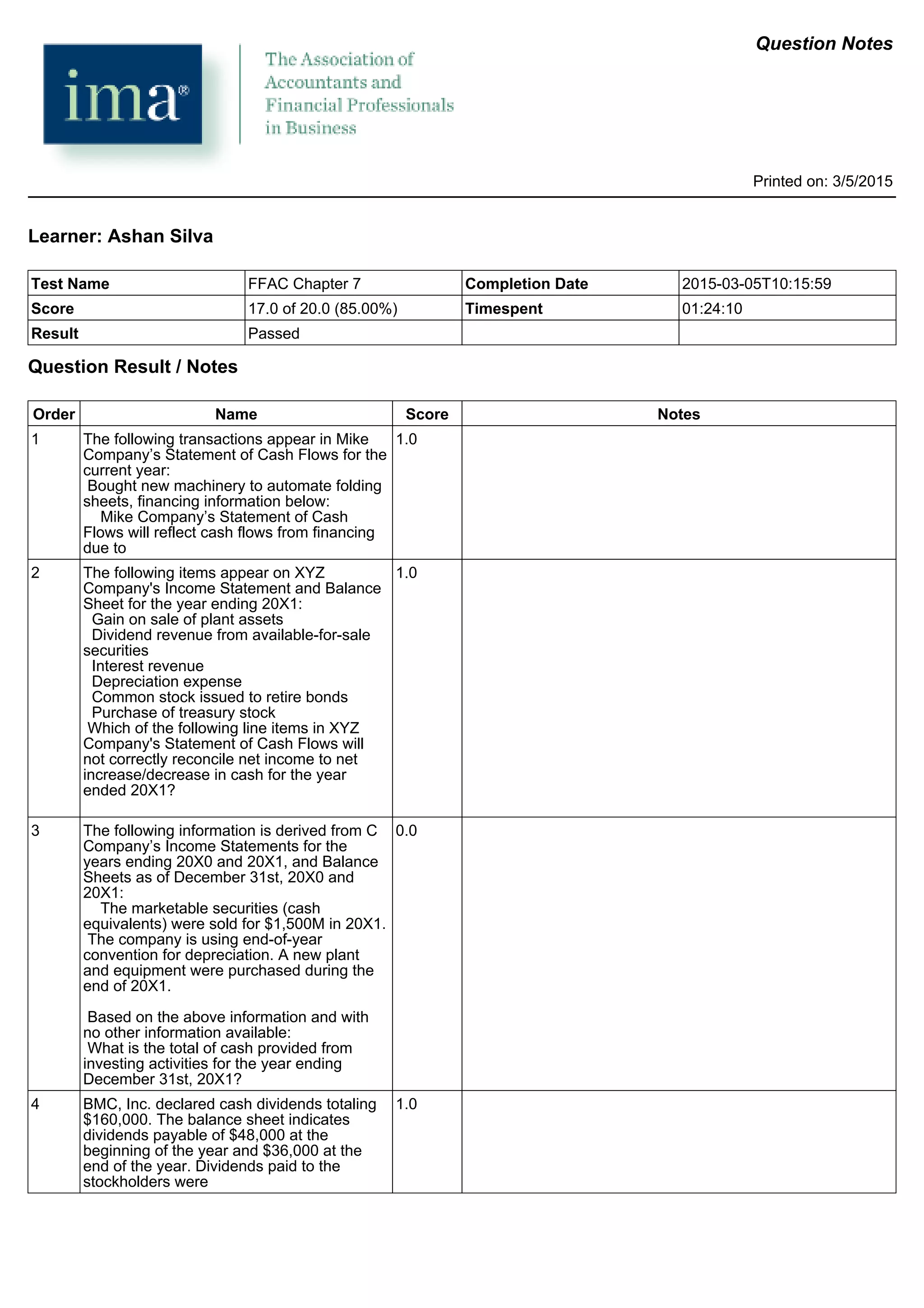

The document is a test completion report that provides details of Ashan Silva's completion of the FFAC Chapter 7 test, including a score of 17 out of 20 (85%), a time spent of 1 hour and 24 minutes, and a result of "Passed". It then lists the 20 questions on the test with the assigned score or result for each question.