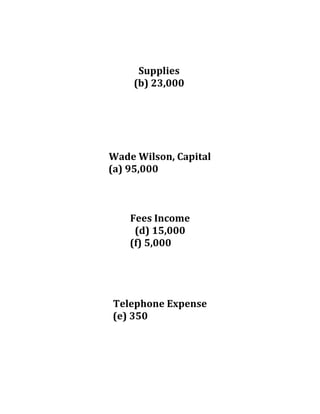

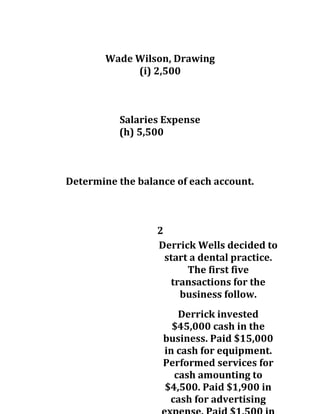

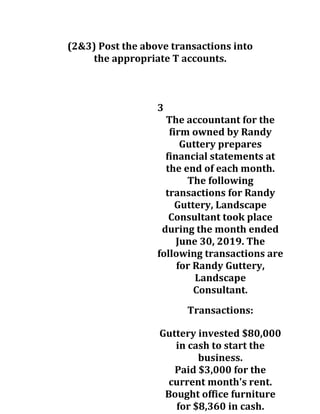

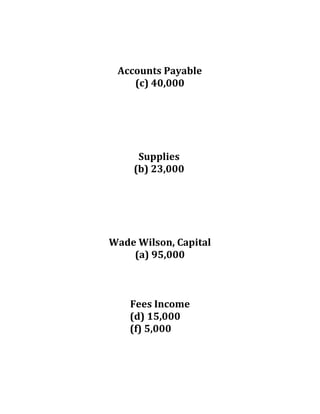

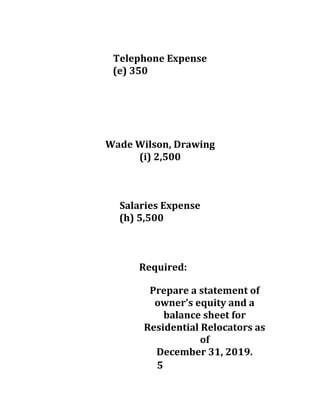

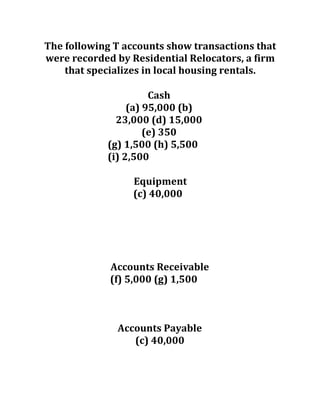

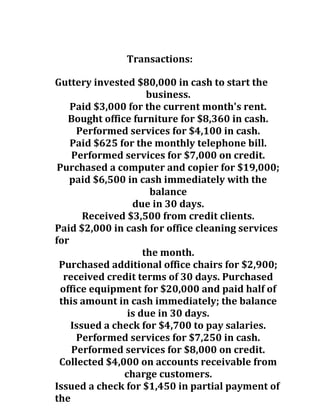

The document outlines various accounting practice assignments for students in ACC 290, focusing on transactions recorded by businesses such as Residential Relocators and Randy Guttery, a landscape consultant. It includes tasks such as preparing T-accounts, trial balances, financial statements, and analysis of changes in owner's equity. The assignments aim to enhance understanding of accounting principles and practices through practical application.