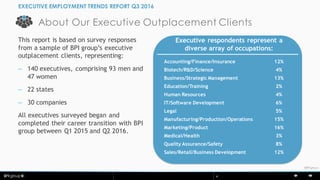

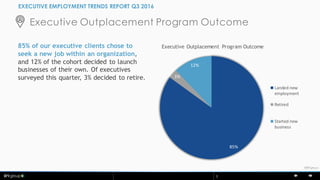

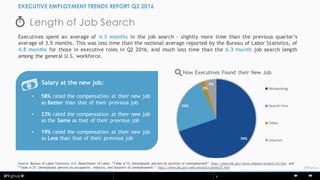

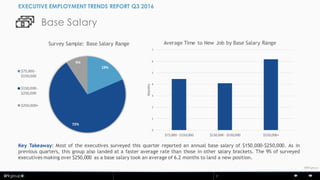

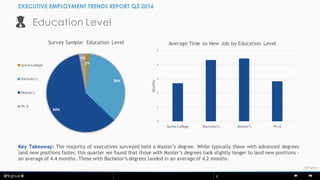

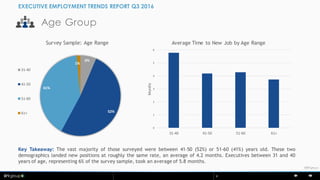

The executive employment trends report by BPI Group analyzes the job search experiences of executives to improve their outplacement services, highlighting that clients found new positions in an average of 4.3 months, significantly less than national averages. The report shows that 85% of clients pursued new jobs, with many reporting improved compensation packages at their new roles. Key factors influencing job search length included salary level, education, and age, with most survey respondents holding master's degrees and aged between 41-60.

![© BPI10

©BPIgroup

About Executive Outplacement Services

EXECUTIVE EMPLOYMENT TRENDS REPORT Q3 2016

BPI group offers a local boutique touch with a global network of resources

to ensure long-term career success for our executive outplacement clients.

In addition to job search coaching, clients may also choose to focus on

entrepreneurial ventures, preparing for retirement, or other work

alternatives.

Each client works with a personal career coach to develop a customized,

winning services plan, helping them to:

• Focus on developing the next step in their career, leveraging assessment

tools and professional consulting to establish short and long-term career

direction.

• Learn how to effectively job search and thrive in the new world of

work.

• Search for the next opportunity, be it a new job, a business acquisition

or start-up, or a part-time career.

• Connect to high-quality job opportunities, through technology, a team

of job developers, social networks, in-person networking events,

personal introductions, and direct placement activities.

• Succeed in their new role, by developing a 90-day onboarding plan.

Interested in learning more?

Call +1.800.323.0206.

My coach provided a sounding board, someone I could vent to,

support, compassion, and most importantly, sound, pragmatic

suggestions and solutions...[my coach] is simply the best.

- Gary, landed as Chief Executive Officer

at an energy service solutions company

A weekly session with my coach was a great shot in the arm, as

he provided me with useful guidance, support, and an

opportunity to laugh while reminding me that I’m on the right

track…I couldn’t be more pleased with the professional and

personal support I received from BPI group. I felt very fortunate

when I compared notes with colleagues of mine who did not work

with BPI group.

- Matthew, landed as Vice President of Marketing

with a manufacturing holding company](https://image.slidesharecdn.com/executiveemploymenttrendsq32016-160812170144/85/Executive-Employment-Trends-Report-Q3-2016-10-320.jpg)