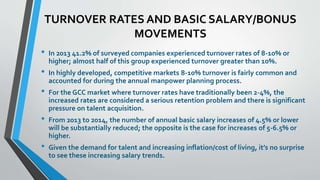

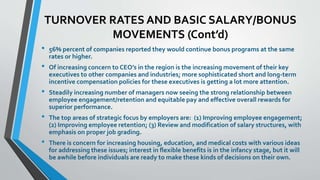

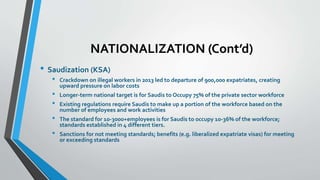

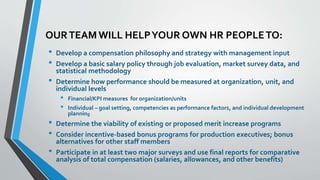

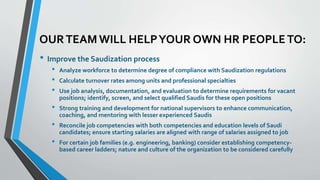

The document discusses compensation challenges facing companies in the KSA/GCC region, highlighting issues such as rising turnover rates and the need for competitive pay policies to attract and retain talent. It emphasizes the importance of aligning compensation strategies with nationalization goals, and creating flexible total compensation packages for enhanced employee engagement and performance management. The text also provides insights into popular trends and challenges in devising effective compensation policies tailored to local labor markets.