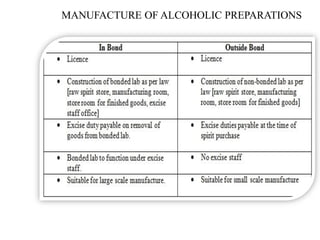

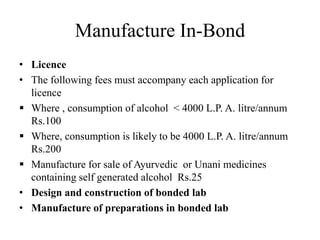

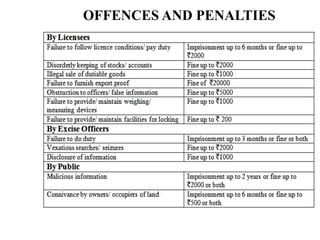

This document outlines India's Excise Duties Act of 1955 and rules regarding the manufacture and transport of alcoholic preparations for medicinal purposes. It discusses licensing requirements for bonded and non-bonded manufacturing facilities, duty rates on alcoholic preparations based on alcohol content, warehousing procedures, import and export rules, inspection powers of excise officers, and penalties for non-compliance. The overall purpose of the Act is to regulate the alcohol industry to protect public health and safety while enabling production of medicines containing alcohol.