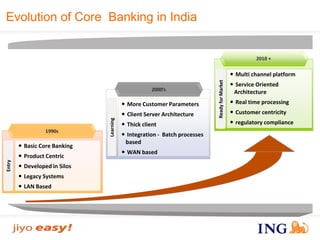

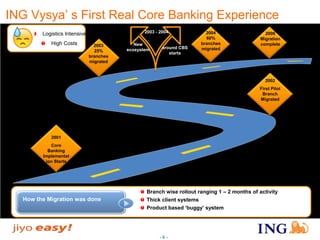

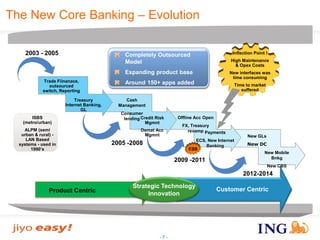

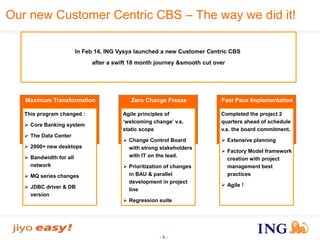

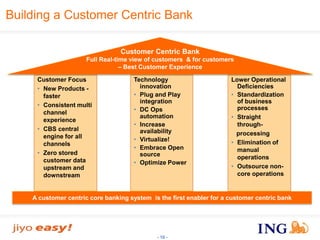

This document summarizes the evolution of core banking in India, using ING Vysya Bank as a case study. It describes how ING Vysya Bank migrated from legacy systems used in the 1990s to implementing a new core banking system between 2001-2006. The bank then transformed its core banking system again between 2012-2014 to create a new customer-centric system, completing the project ahead of schedule. The new system provides real-time access to customer information across channels to improve the customer experience.