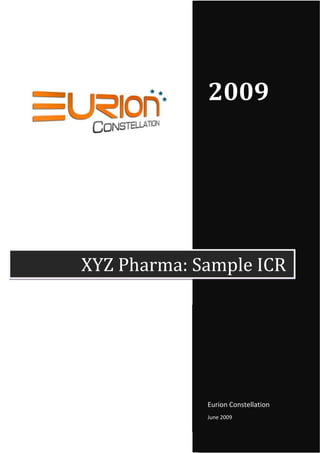

XYZ Pharma reported losses in 2009 due to increased costs from acquisitions and stiff competition lowering prices. While acquisitions boosted sales, costs grew faster. Higher debt also pressures margins. XYZ faces risks from competition and rising costs. However, opportunities exist in the growing Indian pharmaceutical industry and contract R&D. Recent acquisitions in regulated foreign drug markets may help diversify geographically.

![Valuation

[This section covers the valuation done, the fundamental

bases of assumptions, and logics, thereof.]

Downside Risks

XYZ is a leveraged company, with Debt Equity ratio of

2.14, 2.51, and 2.53 for FY 2008, FY 2007, and FY 2006,

Debt Equity Ratio respectively. Higher debt is putting pressure on its

margins, and considering its net losses in the most recent

reported year, this leverage poses a higher downside risk.

Foreign Currency Convertible Bonds of XYZ, raised in

November, 2005, stood at Rs/$ at March 31, 2008. These

Foreign Currency

bonds have a much higher conversion price than the

Convertible Bonds

current stock price. If these convertible notes are held till

maturity, in November, 2010, they will become

redeemable at 145.2% of their face value.

The company is facing stiff competition from foreign as

well as, domestic players. With the entry of Chinese

players in the market, the prices of Ciprofloxacin and

Competition

Ranitidine have fallen considerably, which form the major

chunk of its bulk segment.

Increasing cost of fuel, raw materials, and other inputs

are further, narrowing the company’s margins in the short

Rising costs term. Rising cost pose a significantly higher threat to a

smaller, yet leveraged player like XYZ.

Advantages

India is increasingly becoming an outsourcing hub for

Active Pharmaceuticals Ingredient's (APIs), which is a core

Domestic Industry domain of XYZ. The per capita medical spending in India

Growth remains amongst the lowest in the world, opening up a

large untapped market. Rising income levels are further

expected to help this industry grow.

Commercial R&D on contract basis is an upcoming area

and is expected to be another business driver for XYZ in

Contract R&D

the medium to long term.

To deal with the increasing competition from countries

Strategic initiatives like China, XYZ has directed its focus on US and UK

markets. Its recent acquisitions in the booming, generic

Eurion Constellation | Sample Initial Coverage Report 4](https://image.slidesharecdn.com/eurion-sampleicr-100221064029-phpapp01/85/Eurion-Sample-ICR-4-320.jpg)

![drugs section of these regulated markets is likely to

provide it with front end sales capabilities with wider

international reach and will help in geographical risk

diversification.

Financial Overview

[This section, broadly, covers the historical performance,

as well as, expectations about future revenues and

profitability.]

Mergers and Acquisitions made during the financial

year

In August 2008, XYZ Pharma Ltd aquired UK based ABC, a

marketing and distribution company dealing in generic

drugs. This acquisition will give XYZ Pharma, a wider sales

and marketing capability in the UK markets. The highly

regulated UK generic drugs market is one of the largest

XYZ targets the large and most potential markets in the world. XYZ’s strategic

and highly lucrative rationale behind the deal was to utilize the established

generic drugs market in track record of a profitable company like ABC for gaining

UK entry into UK’s generic drugs market and achieving cost

advantage by keeping Indian as the production base for

ABC’s licensed drugs. ABC has 47 acquired licenses and 36

pending licenses for generic drugs across Europe. It is a

profitable company with considerable regulatory know-

how and a proven track record for acquiring MHRA

approvals. This is further expected to help XYZ Pharma in

launching its pipeline products in UK. The value of the

deal was estimated to be Rs/$ (EUR mn) and was funded

by a combination of cash and new debt.

Stock Performance

[Explanations and details]

Eurion Constellation | Sample Initial Coverage Report 5](https://image.slidesharecdn.com/eurion-sampleicr-100221064029-phpapp01/85/Eurion-Sample-ICR-5-320.jpg)

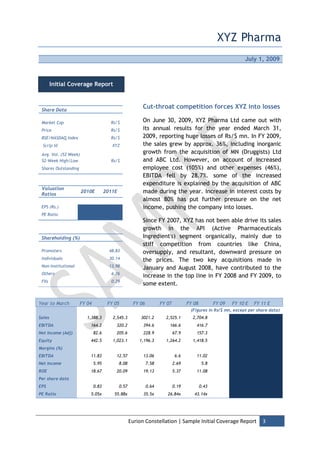

![25000

22720

20000

18550

15000

10000

5000 4930 4140

0

Mar/06 Mar/07 Mar/08 Mar/09

Value of Rs 1,000 invested SENSEX

Company Background

Headquartered in Mumbai (India), XYZ Pharma Ltd. is a

pharmaceuticals company with backward integration from

manufacturing Active Pharmaceuticals Ingredient's (APIs)

up to the level of biopharmaceutical formulations. It

Profile: A company, well mainly deals in the prescription drugs and is the second

integrated along the largest manufacturer of Ciprofloxacin and Ranitidine in

industry value chain India. In addition, it is engaged in commercial R&D

activities. It began as a wholly-owned subsidiary of GM

Laboratories Ltd. in 2001 and started operating as GM

Laboratories Ltd, an independent entity after being

divested in 2003. XYZ Pharma was formed by a merger

between GM Laboratories and TS Pharmaceuticals Ltd. in

2005.

In January 2008, XYZ acquired HX Group Ltd, a UK based

Strategy: Expecting to manufacturer of licensed drugs and wholesale marketer

derive over 50% of the of over-the-counter pharmaceutical products. The deal

global revenues from was done through XYZ Pharma (UK) Ltd., a subsidiary of

Western markets XYZ Pharma Ltd. HX Group is the parent company of

druggist MN Ltd, which owns manufacturing license for 38

products. MN is a zero debt company with well

established market for its product portfolio.

Management [This part tells about key management personnel.]

Eurion Constellation | Sample Initial Coverage Report 6](https://image.slidesharecdn.com/eurion-sampleicr-100221064029-phpapp01/85/Eurion-Sample-ICR-6-320.jpg)

![Financial Performance: [This part presents a brief overview of the ‘last’

H1 2008 results reported results.]

Industry Overview [This portion covers industrial overview and outlook in

brief.]

Eurion Constellation | Sample Initial Coverage Report 7](https://image.slidesharecdn.com/eurion-sampleicr-100221064029-phpapp01/85/Eurion-Sample-ICR-7-320.jpg)