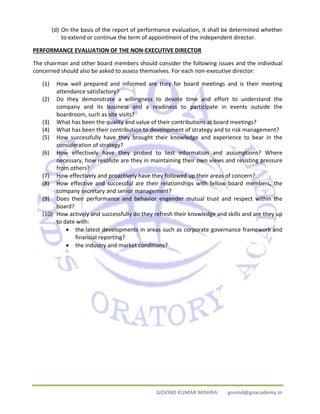

This document discusses ethics, governance, and sustainability. It covers several topics:

- Ethics is about determining right and wrong conduct based on moral principles. Corporate governance should strive for high ethical standards internally.

- There are different theories of ethics, including deontological (duty-based), teleological (outcome-based), utilitarianism (greatest good for greatest number), and virtue ethics.

- Business ethics is important for maintaining trust with stakeholders and society. Ethical businesses can prosper more in the long run.

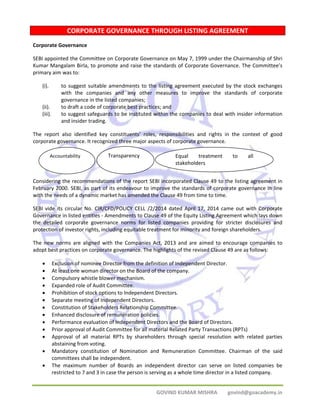

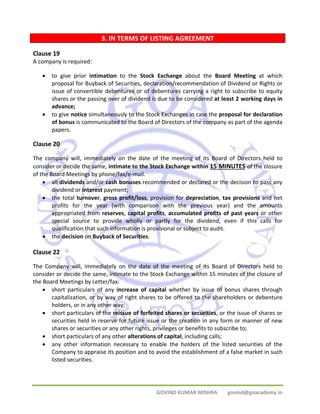

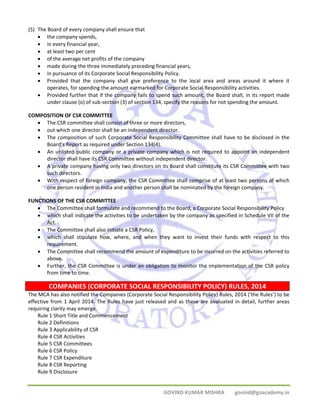

![• and that by reason of such change,

• it is likely that the affairs of the company [will be conducted in a manner prejudicial to

public interest or] in a manner prejudicial to the interests of the company;

GOVIND KUMAR MISHRA govind@goacademy.in

• may apply to the Tribunal for an order.

If Tribunal is of opinion that the affairs of the company are being conducted as aforesaid the

Tribunal may, with a view to bringing to an end or preventing the matters complained of, make

such order as it thinks fit.

The following persons have a right to apply under the above sections:

(i) in the case of a company having a share capital,

• not less than 100 members of the company or

• not less than 1/10 of the total number of its members,

• whichever is less, or

• any member or members holding not less than 1/10 of the issued share capital of

the company,

• provided that the applicant or applicants have paid all calls and other sums due on

their shares;

(ii) in the case of a company not having a share capital, not less than 1/5 of the total

number of its members.

The Central Government may, if in its opinion circumstances exist which make it just and

equitable so to do, authorise any member or members of the company to apply to the Tribunal

under section 397 or 398, notwithstanding the requirements of such number of members are not

fulfilled.

Pending the making by it of a final order the Tribunal may, on the application of any party to the

proceeding, make any interim order which it thinks fit for regulating the conduct of the

company's affairs, upon such terms and conditions as appear to it to be just and equitable.

WINDING UP

Shareholder has right to pass a special resolution, resolving that the company be wound up by

the Tribunal;

As per section 484, the circumstances in which company may be Wound‐Up Voluntarily are:

1. when the period, if any, fixed for the duration of the company by the articles has expired,

or the event, if any, has occurred, on the occurrence of which the articles provide that

the company is to be dissolved, and the shareholder in general meeting passes a

resolution requiring the company to be wound‐up voluntarily;

2. if the shareholder passes a special resolution that the company be wound‐up voluntarily.

Under Section 397 read with Section 399, shareholder may apply for winding up of company in

case of oppression and mismanagement.](https://image.slidesharecdn.com/ethics-141105085309-conversion-gate01/85/Ethics-Governance-and-Sustainability-96-320.jpg)

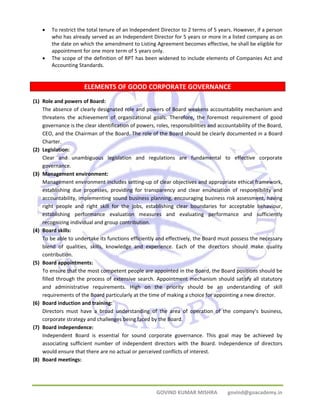

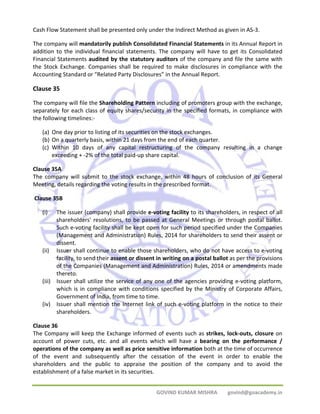

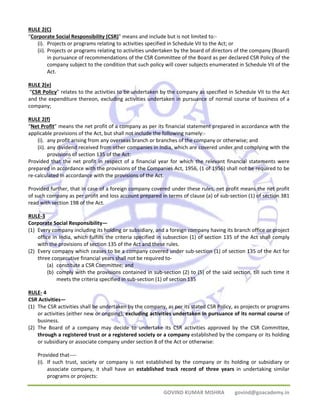

![(3) Non‐executive directors: Secretarial Audit will provide comfort to the Non‐executive Directors that

appropriate mechanisms and processes are in place to ensure compliance with laws applicable to the

company, thus mitigating any risk from a regulatory or governance perspective; so that the Directors not in‐charge

of the day‐to‐day management of the company are not likely to be exposed to penal or other

GOVIND KUMAR MISHRA govind@goacademy.in

liability on account of non‐compliance with law.

(4) Government authorities / regulators: Being a pro‐active measure, Secretarial Audit facilitates reducing the

burden of the law‐enforcement authorities and promotes governance and the level of compliance.

(5) Investors: Secretarial Audit will inform the investors whether the company is conducting its affairs within

the applicable legal framework.

(6) Other Stakeholders: Financial Institutions, Banks, Creditors and Consumers are enabled to measure the law

abiding nature of Company management.

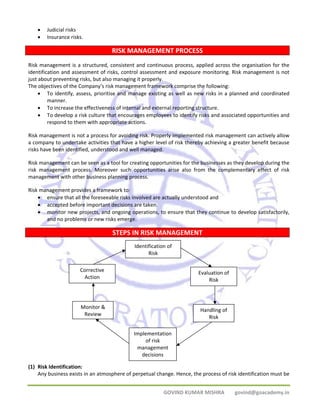

ROLE OF COMPANY SECRETARY IN RISK MANAGEMENT

¾ As a top level officer and board confidante, a Company Secretary can pay a role in ensuring that a sound

Enterprise wide Risk Management [ERM] which is effective throughout the company is in place.

¾ The board of directors may have a risk management sub‐committee assisted by a Risk Management Officer.

¾ As an officer responsible for coordination and communication for effective corporate functioning and

governance, a Company Secretary shall ensure that there is an Integrated Framework on which a strong

system of internal control is built.

¾ Such a Framework will become a model for discussing and evaluating risk management efforts in the

organization. Risk and control consciousness should spread throughout the organization.

¾ A Company Secretary can ensure that this happens so that the risk factor will come into consideration at

the every stage of formulation of a strategy.

¾ It will also create awareness about inter‐relationships of risks across business units and at every level of the

organization.

¾ A Company Secretary can ensure that the following questions are effectively addressed at the board level:

• What is the organization’s risk management philosophy?

• Is that philosophy clearly understood by all personnel?

• What are the relationships among ERM, performance, and value?

• How is ERM integrated within organizational initiatives?

• What is the desired risk culture of the organization and at what point has its risk appetite been set?

• What strategic objectives have been set for the organization and what strategies have been or will be

implemented to achieve those objectives?

• What related operational objectives have been set to add and preserve value?

• What internal and external factors and events might positively or negatively impact the organization’s

ability to implement its strategies and achieve its objectives?

• What is the organization’s level of risk tolerance?

• Is the chosen risk response appropriate for and in line with the risk tolerance level?

• Are appropriate control activities (i.e., approvals, authorizations, verifications, reconciliations, reviews

of operating performance, security of assets, segregation of duties) in place at every level throughout

the organization?

• Is communication effective — from the top down, across, and from the bottom up the organization?

• How effective is the process currently in place for exchanging information with external parties?

• What is the process for assessing the presence and performance quality of all eight ERM components

over time?](https://image.slidesharecdn.com/ethics-141105085309-conversion-gate01/85/Ethics-Governance-and-Sustainability-117-320.jpg)

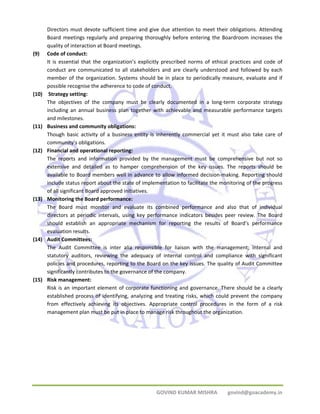

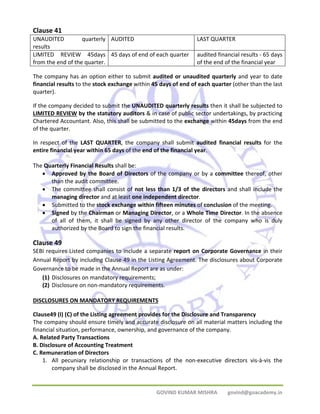

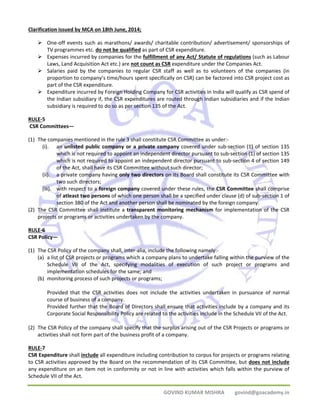

![On 29th Mar. 1985 the Government of India enacted a legislation, called The Bhopal Gas Disaster (Processing of

Claims) Act providing the Government of India to have the exclusive right to represent Indian plaintiffs as in

India and also elsewhere in connection with the tragedy.

The case moved to the Indian Courts, starting in the Bhopal High Court, till it finally reached the Supreme Court,

Finally in, 1989, the Supreme Court of India came out with a over all settlement of claims and awarded U.S.

$470 million to the Government of India on behalf of all Bhopal victims in full and final settlement of all the

past, present and future claims arising from the disaster.

HAZARDOUS OR INHERENTLY DANGEROUS INDUSTRY

What is the measure of liability of an enterprise which is engaged in a hazardous or inherently dangerous

industry, if by reason of an accident occurring in such industry, persons die or is injured? Does the rule in

Rylands v. Fletcher apply or is there any other principal on which the liability can be determined. This question

was debated in M.C. Mehta v. Union of India, AIR 1987 SC 1086 commonly called OLEUM GAS LEAK CASE.

This case came to the limelight after it originated in a writ petition filed in the Supreme Court by the

environmentalist and lawyer M.C. Mehta, as a public interest litigation. [M.C. Mehta and another (Petitioners)

v. Union of India and others (Respondents) and Shriram Foods & Fertiliser Industries (Petitioners) v. Union of

India (Respondents) AIR 1987 SC 965]

The petition raised some seminal questions:

¾ concerning the Arts.21 and 32 of the Constitution,

¾ the principles and norms for determining the liability of large enterprises engaged in manufacture and

GOVIND KUMAR MISHRA govind@goacademy.in

sale of hazardous products,

¾ the basis on which damage in case of such liability should be quantified and

¾ whether such large enterprises should be allowed to continue to function in thickly populated areas

¾ and if they are permitted so to function, what measures must be taken for the purpose of reducing to a

minimum the hazard to the workmen and the community living in the neighbourhood.

On December 4,1985 a major leakage of oleum gas took place from one of the units of Shriram and this leakage

affected a large number of people, both amongst the workmen and the public. The Delhi Administration issued

two orders, on the behest of Public Health and Policy, to cease carrying on any further operation and to remove

such chemical and gases from the said place.

The Inspector of Factories and the Assistant Commissioner (Factories) issued separate orders on December 7

and 24, 1985 shutting down both plants. Aggrieved, Shriram filed a writ petition challenging the two

prohibitory orders issued under the Factories Act of 1948 and sought interim permission to reopen the caustic

chlorine plant.

The Supreme Court after examining the reports of the various committees held that pending consideration of

the issue whether the caustic chlorine plant should be directed to be shifted and relocated at some other place,

subject to certain stringent conditions which were specified.

The Court said that it is not possible to adopt a policy of not having any chemical or other hazardous industries

merely because they pose hazard or risk to the community. If such a policy were adopted, it would mean the

end of all progress and development.

Such industries, even if hazardous have to be set up since they are essential for the economic development and

advancement of well being of the people. We can only hope to reduce the element of hazard or risk to the

community by taking all necessary steps for locating such industries in a manner which would pose least risk or

danger to the community and maximizing safety requirements in such industries.](https://image.slidesharecdn.com/ethics-141105085309-conversion-gate01/85/Ethics-Governance-and-Sustainability-195-320.jpg)