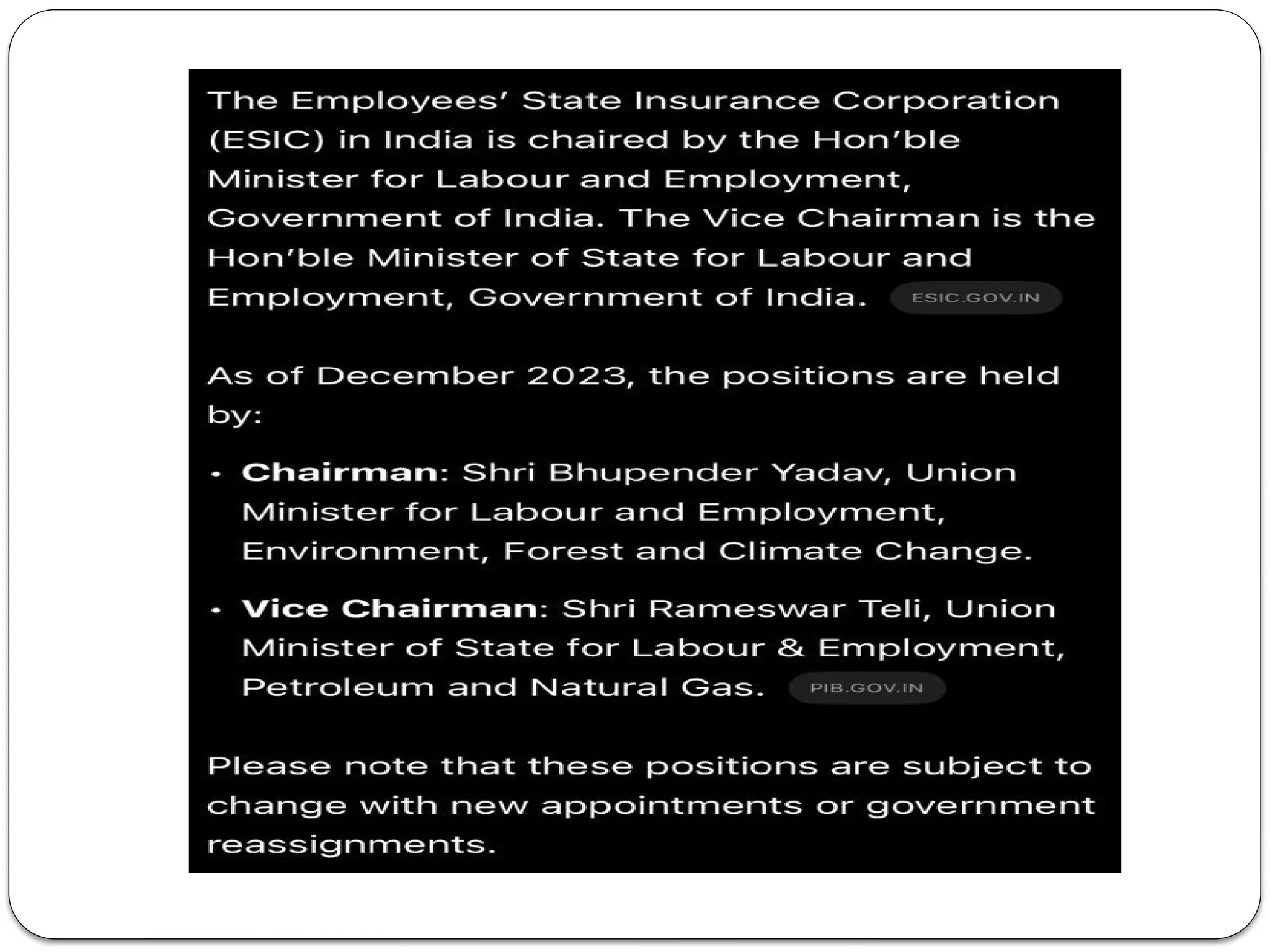

The Employees' State Insurance Act (ESI Act) of 1948, with subsequent amendments, provides social security and health insurance benefits to industrial employees in India, covering various establishments. It offers medical, sickness, maternity, and disablement benefits financed by contributions from employers and employees, with extensive medical facilities supported by a network of dispensaries and hospitals. Additionally, the Rajiv Gandhi Shramik Kalyan Yojna provides unemployment allowances for ESI-covered employees who involuntarily lose their jobs.