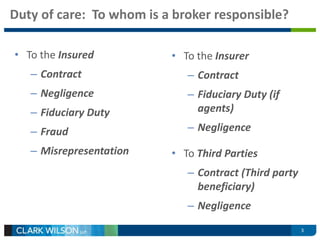

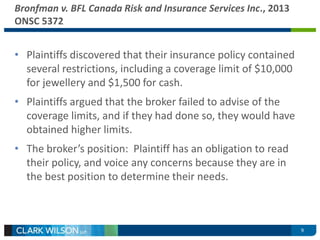

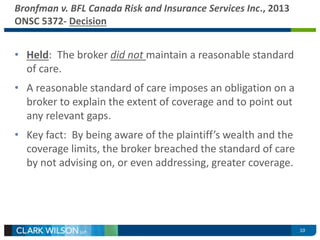

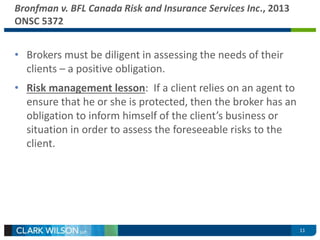

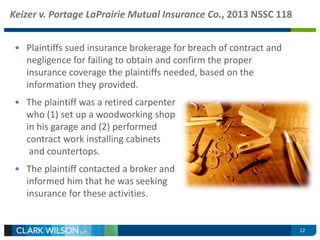

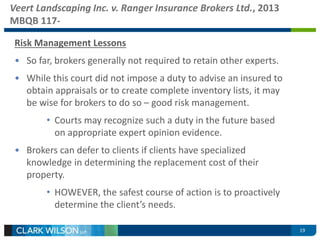

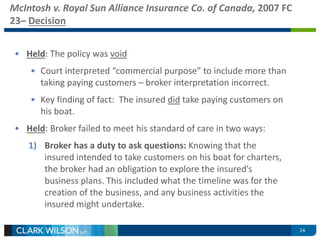

This document summarizes a presentation on brokers' errors and omissions exposure. It discusses the duty of care brokers have and to whom - the insured, insurer, and third parties. Case law examples illustrate that courts increasingly hold brokers to a high standard of care, requiring them to proactively inquire about client needs, point out coverage gaps, ensure adequate coverage is in place, and review coverage at renewal. However, to be liable for a loss, a broker's breach of their duty of care must have actually caused the loss. The presentation emphasizes brokers should proactively advise clients, inquire about their situations, review policies, and ensure proper insurance is in place.