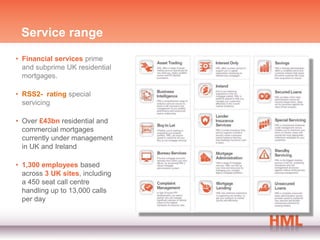

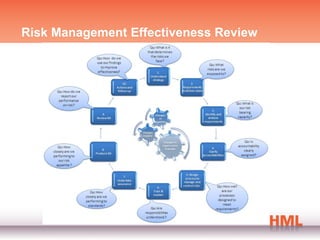

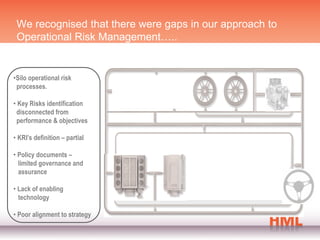

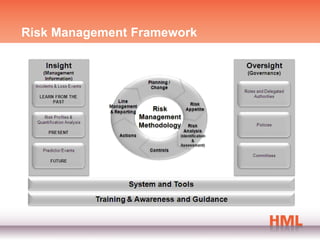

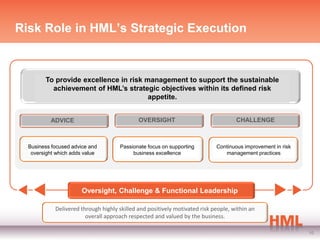

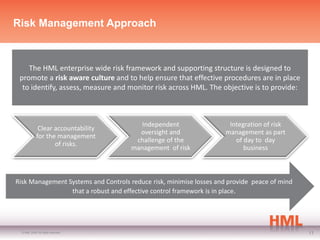

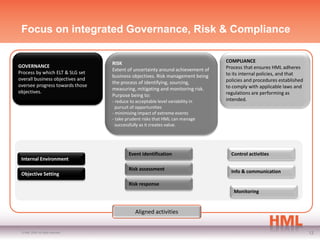

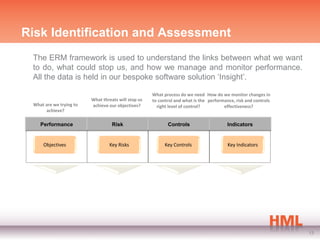

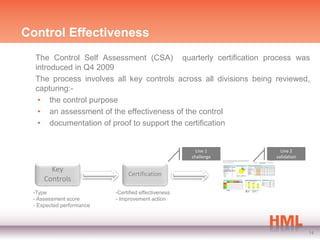

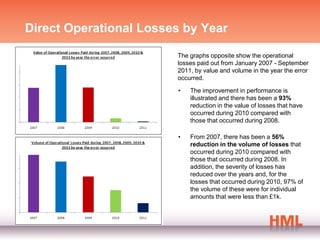

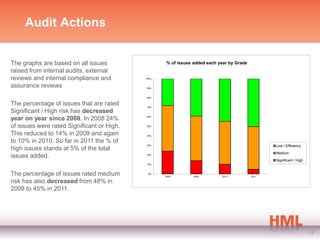

The document outlines HML's transformation in operational risk management, highlighting the effectiveness of its risk management framework and addressing gaps in past approaches. It shows a significant reduction in operational losses and an improvement in risk compliance, supported by a structured process and technology integration. The overall goal is to align risk management with business strategy to achieve sustainable objectives while minimizing potential threats.