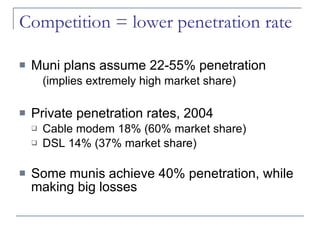

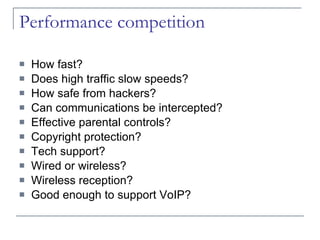

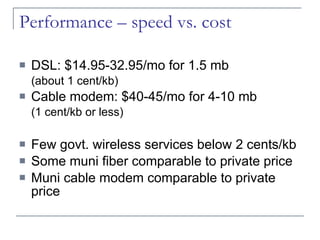

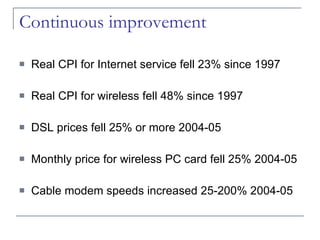

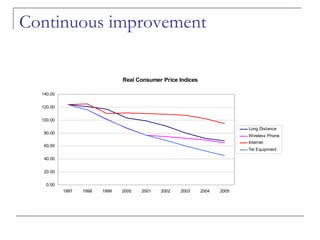

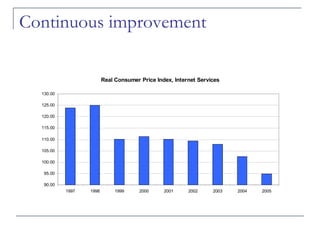

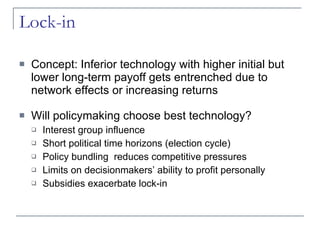

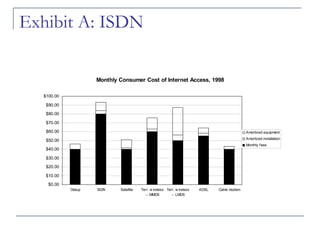

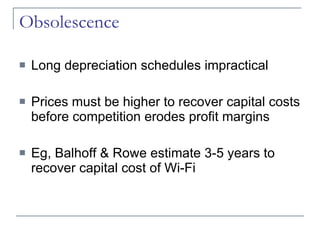

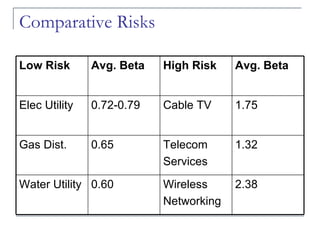

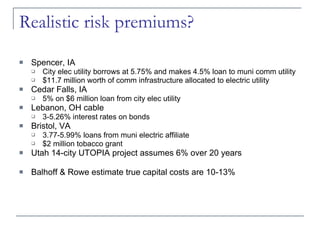

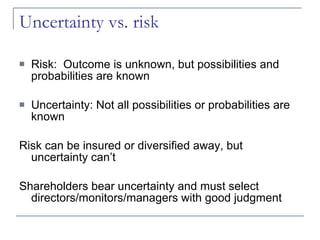

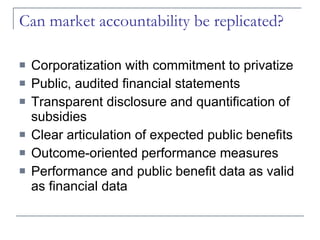

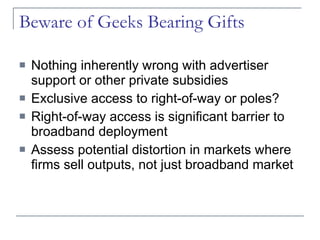

This document discusses some key challenges with government broadband initiatives compared to private sector competition in broadband markets. It notes that broadband technology and pricing are rapidly evolving, unlike traditional utilities. Government projects may face issues around continuous improvement, technological obsolescence, risk and uncertainty that private firms must deal with through competition. It also cautions that subsidies or regulations could potentially distort broadband markets or lock in inferior technologies.