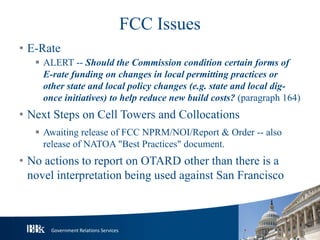

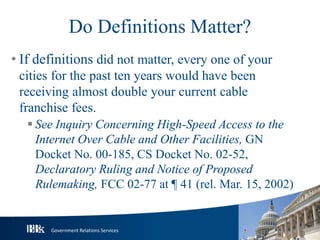

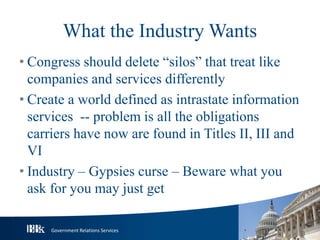

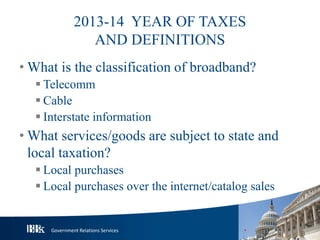

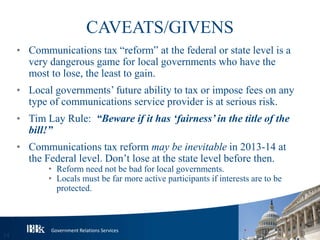

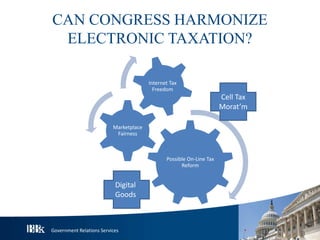

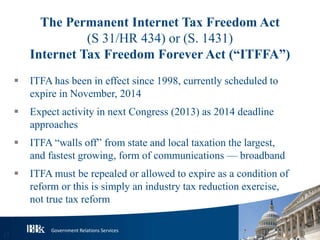

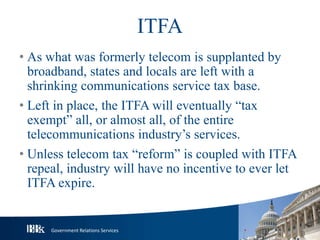

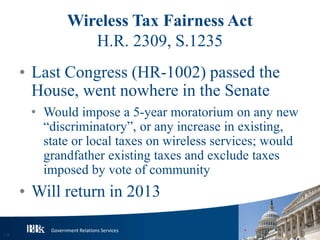

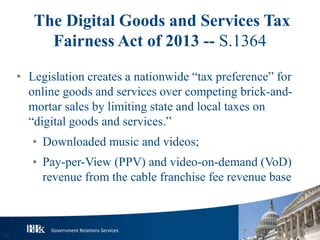

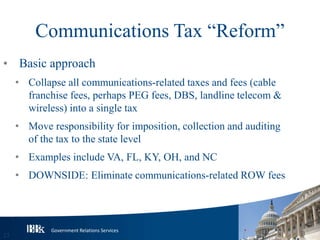

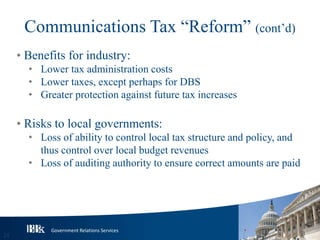

The document discusses the outlook for the FCC and key issues such as e-rate funding, net neutrality, and communications tax reform during the 2013-2014 period. It highlights the need for local governments to engage actively to protect their interests, especially regarding potential tax reforms that could diminish their revenue sources. Various legislative proposals regarding online taxation and wireless tax fairness are also mentioned, indicating significant changes in the taxation landscape for digital and telecommunications services.

![Government Relations Services

FCC Deadlines

September 3, 2013 RF Radiation Comments due

September 16, 2013

[WC Docket No. 13-184]

E-Rate Comments are due

October 16, 2013

[WC Docket No. 13-184]

E-Rate Reply Comments are due

November 1, 2013 RF Radiation Reply Comments due](https://image.slidesharecdn.com/bbkimlaconference2013-wheelerfcc-130927144124-phpapp01/85/The-Wheeler-Federal-Communications-Commission-2014-Outlook-on-Congress-and-the-FCC-8-320.jpg)