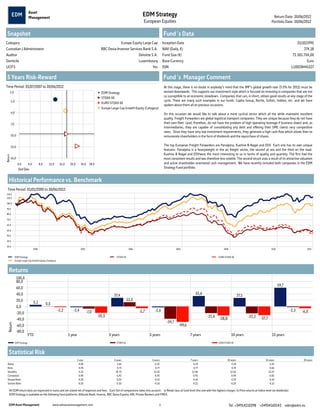

This document provides an overview and performance summary of the EDM Strategy European Equities Fund as of June 30, 2012. The fund manager comments that while global growth forecasts have been revised down, the fund focuses on companies not highly susceptible to economic slowdowns. Recent additions to the portfolio include the freight forwarders Panalpina and Kuehne & Nagel due to their quality and attractive valuations. Long-term performance charts show the fund outperforming benchmarks over various time periods.