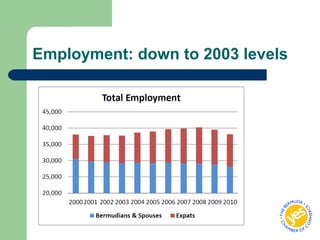

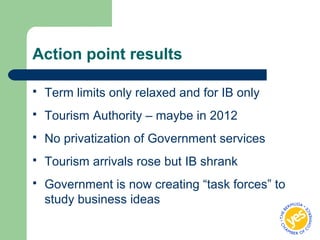

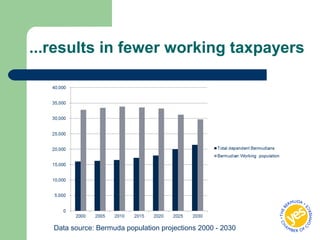

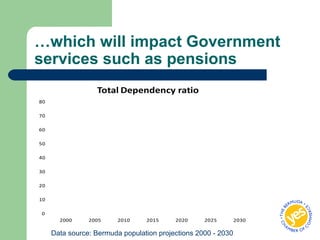

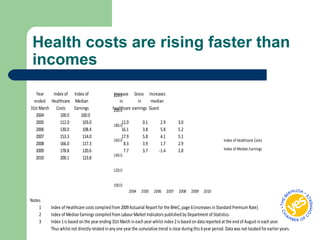

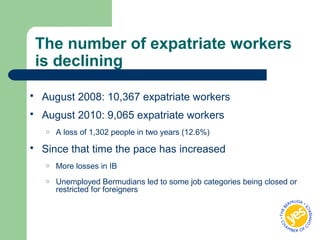

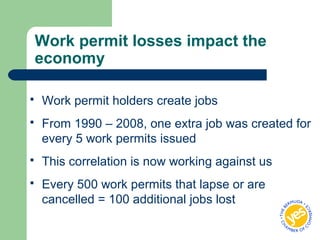

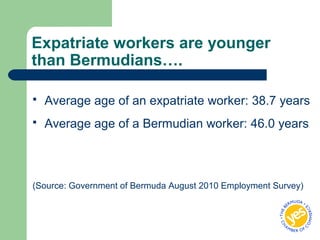

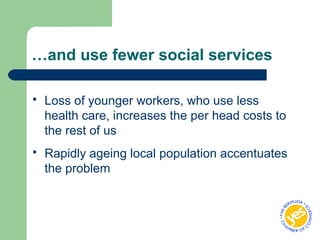

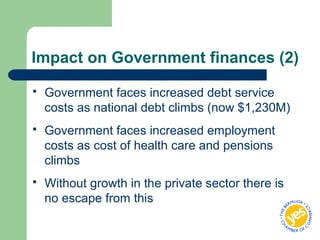

The document summarizes the state of Bermuda's economy, which has been in decline since 2008. The two main pillars of Bermuda's economy - international business and tourism - have been shrinking. As a result, employment and real estate sales are down, while government debt and health care costs are up. The aging population also threatens to increase costs and reduce the number of taxpayers. The document calls for examining policies from the 1950s-60s to determine if they still promote economic progress, and outlines several agenda items for 2012, including infrastructure projects, gambling, real estate rules, and privatizing government services to address Bermuda's economic challenges.