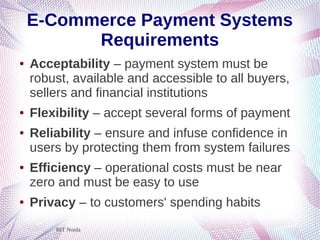

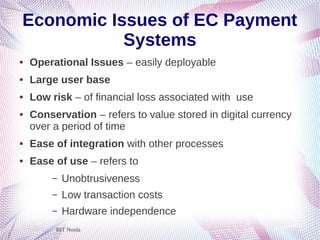

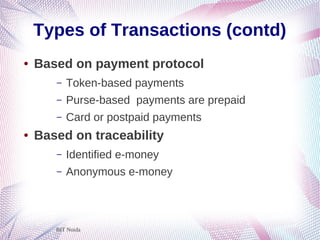

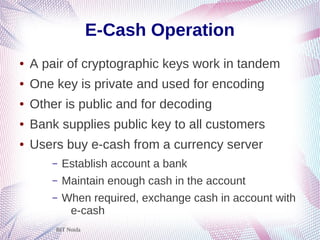

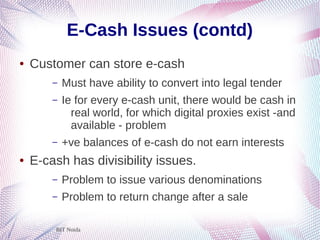

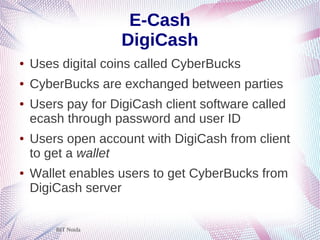

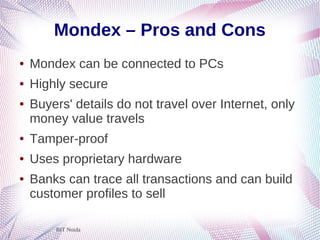

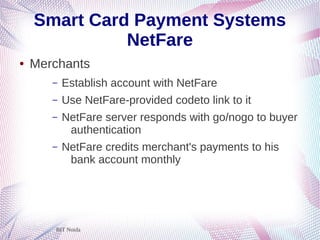

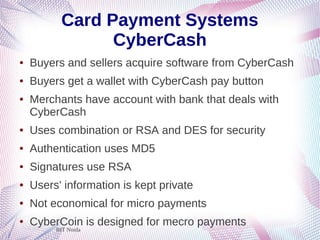

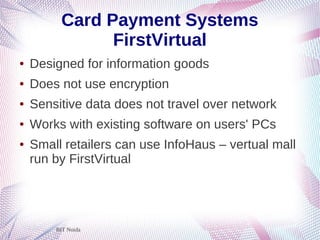

The document provides an overview of traditional and electronic payment systems. It discusses the evolution of money from barter to cash and various traditional methods like cash, checks, credit cards, and electronic fund transfers. It then covers requirements, types of e-commerce transactions, and issues with adapting traditional payment methods to the online context. The rest of the document summarizes various electronic payment systems like e-cash, smart cards, checks, and credit cards; outlining how they work, security measures, pros/cons and examples like DigiCash, Mondex, and CyberCash.