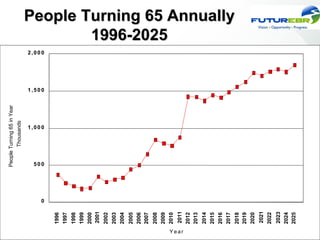

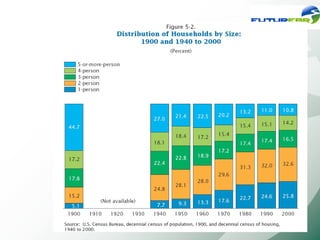

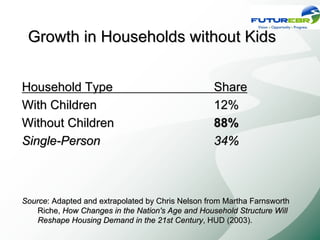

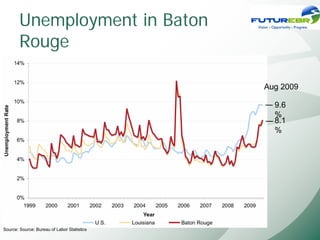

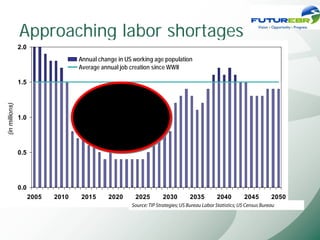

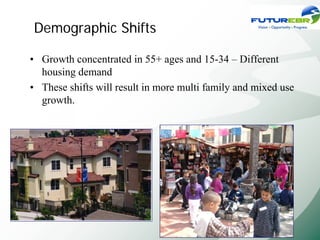

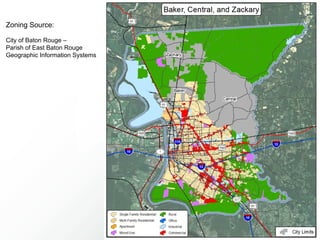

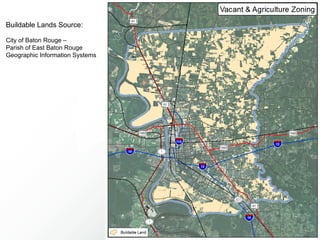

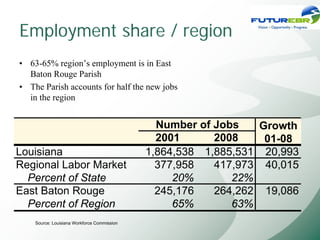

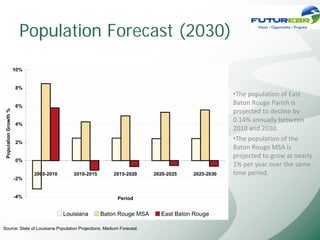

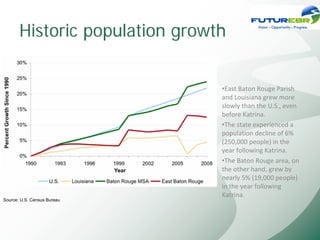

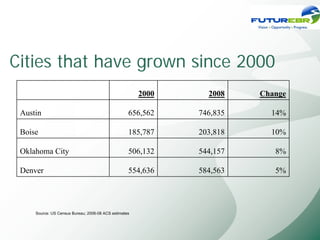

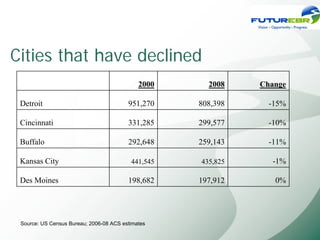

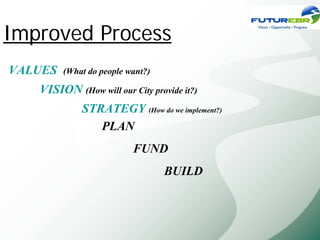

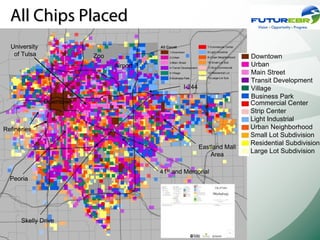

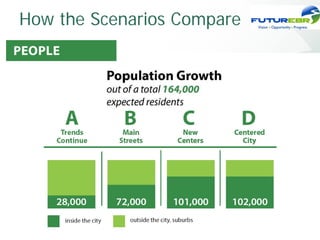

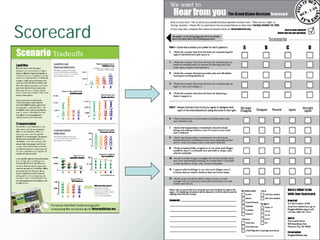

The document discusses demographic trends in the United States, including an aging population and increasing number of households without children. It also addresses trends in employment, income, crime rates, and population forecasts for Baton Rouge, Louisiana. Specifically, it notes that East Baton Rouge Parish's population is projected to decline slightly by 2030 while the Baton Rouge metro area grows. The document outlines different approaches to community planning, including traditional top-down models and more collaborative workshops that engage the public.